Labour market signals and inflation rise

Regular pay excluding bonuses rose 4.5% year-on-year. With wage growth cooling and December’s CPI print at 3.4%, slightly above expectations, the Bank of England faces a delicate balancing act. If inflation stabilizes or slows in the coming months, it may strengthen the case for a continued policy pause, keeping rates on hold until there is clearer evidence of sustained disinflation.

UK consumer price inflation rose to 3.4%.

Unemployment rate held steady at 5.1%.

Private-sector wages slowed to 3.6%.

BoE holds rates steady until there is clearer evidence of sustained disinflation.

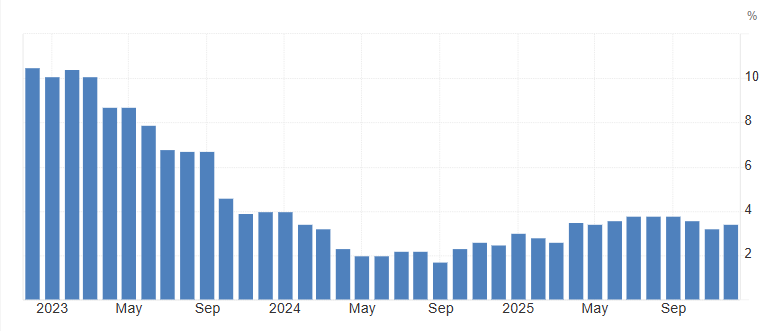

Inflation ticks higher

UK consumer price inflation rose to 3.4% in December 2025, up from November’s eight-month low of 3.2% and slightly above the 3.3% expected. The increase was driven by higher prices for alcohol and tobacco (5.2%), transport (4.0%), food and drinks (4.5%), and restaurants and hotels (3.8%). Services inflation edged up to 4.5%, while core inflation, excluding volatile items, held at 3.2%, its lowest since December 2024. Economists say the year-end uptick may complicate the Bank of England’s efforts to return inflation to its 2% target.

Looking ahead, further pressure on prices could come from rising energy costs and supply chain disruptions. Wage growth may also add to domestic inflationary pressures in early 2026. Analysts expect the BOE to carefully monitor these trends before deciding on any rate adjustments. Consumer spending may slow if higher prices persist, particularly in transport and food sectors. Overall, the outlook suggests a cautious approach for monetary policy in the coming months.

Source: Office for National Statistics

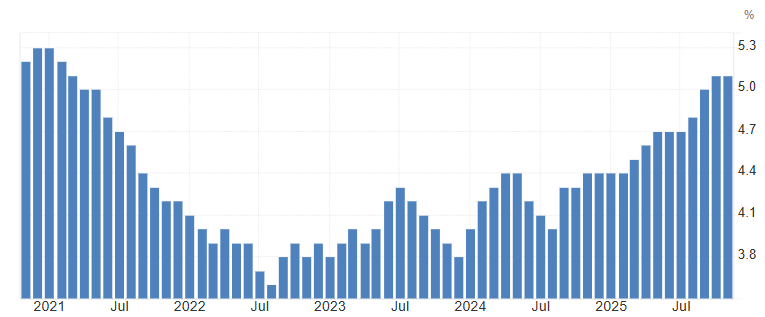

Labour market dynamics and Unemployment rates

The labour market data released earlier provides important context ahead of the CPI print. Employment increased by 82,000 in the three months to November 2025, far outpacing expectations and offering evidence of ongoing job creation. On an annual basis, employment is 513,000 higher, supported by growth in employee positions and part-time self-employment. However, full-time self-employment fell, which suggests that some workers may be moving into less stable or part-time roles even as headline employment rises.

Unemployment rates

The unemployment rate held steady at 5.1%, slightly above forecasts, and remains at its highest level since March 2021. The increase in unemployment across nearly all duration buckets, short-term, medium-term, and long-term points to emerging slack in the labour market. The rise in individuals holding second jobs now 1.294 million, or 3.8% of employed further indicates that many workers may be supplementing income rather than benefiting from strong wage growth. Taken together, these trends suggest a labour market that is still relatively resilient but showing early signs of softening the dynamic that will be closely watched alongside today’s inflation data.

Source: Office for National Statistics

Wages and monetary policy outlook

Earnings data points to a further cooling of wage pressures. Regular pay excluding bonuses rose 4.5% year-on-year, slightly easing from the prior period and matching market expectations. Private-sector wages slowed to 3.6%, the weakest pace since 2020, while public-sector pay accelerated to a record 7.9%. After adjusting for inflation (based on forecasts), real wages are expected to have risen modestly, holding steady for a second consecutive period.

Monetary policy outlook

With wage growth cooling and inflation forecasts moderate, the Bank of England faces a delicate balancing act. December’s CPI print of 3.4%, slightly above expectations, will be a key data point. If inflation stabilizes or slows in the coming months, it may support a continued policy pause, with the BoE keeping rates on hold until there is clearer evidence of sustained disinflation. However, if inflationary pressures, particularly from transport, food, and services persist or accelerate, policymakers could signal a more cautious stance, leaving the door open to further tightening or delaying potential rate cuts.

Markets are likely to view the data that inflation easing only gradually, employment remaining solid but uneven, and monetary policy continuing to be highly data-dependent through early 2026.