Nasdaq falls 3% as investors rethink tech and AI stocks

Nasdaq dropped around 3% after investors started pulling back from technology and AI-related stocks. The move came after months of strong gains, as many traders decided to take profits and reassessed how much risk they want to hold and concern about the amount of funding compared to the return they are getting. Most of the selling were seen in large technology companies, especially those linked to artificial intelligence. While AI remains a long-term growth story.

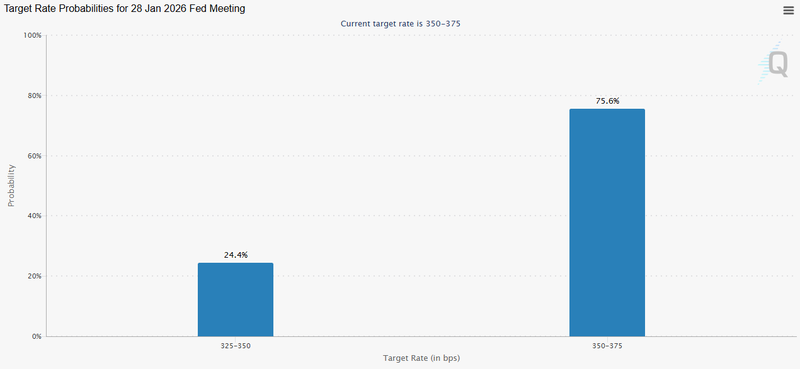

75% probability the Fed will not cut rates at its January meeting.

ServiceNow led the latest drop, falling 11.5%.

Money could flow back into big tech and AI companies.

Concerns of 2026 policy

Interest rates are a key reason behind the recent Nasdaq drop. Even though markets expect rate cuts later on, borrowing costs are still high right now. In fact, traders are pricing about a 75% chance that the Federal Reserve will not cut rates at its January meeting. This has made investors more cautious, especially with tech stocks. Many technology companies rely heavily on future earnings, so higher rates reduce how much investors are willing to pay for them today. Comments from New York Fed President John Williams added to the caution. He said policy is likely to stay on hold until new economic data gives clearer direction. This reinforced the idea that rate relief may take longer than some investors had hoped, putting pressure on growth and AI-related stocks. Another reason for the decline is that the trade became crowded. A small group of large tech companies had been responsible for much of Nasdaq’s gains. When sentiment shifted, selling in those names quickly dragged the whole index lower. Despite the sharp drop, this does not look like panic. Investors are not leaving the stock market altogether. Instead, money is rotating in other areas, such as Russell 2000, which have been performing better recently.

Source: CME Group

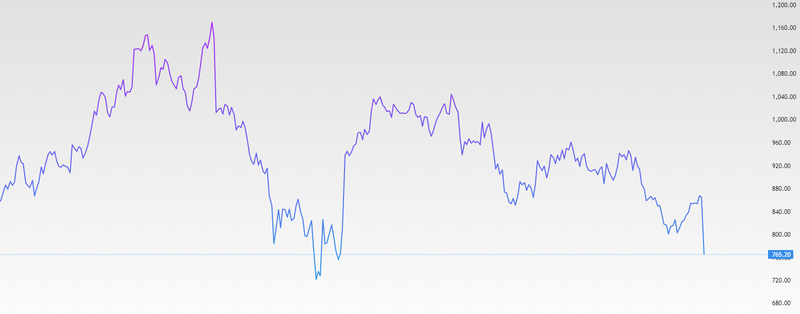

ServiceNow led the latest drop

Most of the selling came from AI-related and semiconductor stocks. Broadcom continued to fall, adding to losses from earlier sessions, while Oracle and Core Weave also dropped as investors worried about how quickly AI spending will grow. Nvidia rose slightly, but it wasn’t enough to offset the weakness across the tech sector. By the end of the day, the Nasdaq fell 0.6%, underperforming other major U.S. indexes showing that the sell-off mainly hit tech stocks. Concerns about AI stocks have been growing all month. After a strong rally fueled by excitement over AI, investors became more cautious, questioning whether these companies’ future earnings justify their high valuations. Many AI stocks had become crowded trades, with a few large tech companies driving most of Nasdaq’s gains. When sentiment shifted, selling in these heavily traded stocks had a big impact on the index. ServiceNow led the latest drop, falling 11.5%. Investors are worried that its plan to spend heavily, especially after a year in which the stock already lost value could stretch the company’s finances and increase risk. Some fear it could dilute earnings or require taking on debt or issuing more shares. Adding to the pressure, KeyBanc Capital Markets downgraded ServiceNow to “Underweight,” citing risks in its business model and potential disruption from AI, making investors even more cautious.

Source: Trading View

Investors shifting from Nasdaq to Russell 2000

Investors are closely watching how money is moving across different parts of the market, as this rotation could determine which sectors perform best in the coming months. Right now, AI and semiconductor stocks are under pressure, while the Russell 2000 and value stocks are attracting more investment. This shift shows that investors are becoming more cautious, seeking safer or undervalued opportunities. Analysts say that if interest rates remain steady and the economy continues to show strength, money could flow back into big tech and AI companies. However, investors are likely to focus on firms with clear growth plans and manageable risks. This means the recent drop in tech stocks doesn’t necessarily indicate a full market crash; instead, it could offer opportunities to invest in the strongest companies at better prices. Investors are also starting to compare the funds and capital invested in these companies with the profits they generate in the short and mid-term, rather than just focusing on long-term growth.