Powell signals another fed cut as weak hiring pressures unemployment

Federal Reserve Chair Jerome Powell indicated that the U.S. central bank remains on course to deliver another quarter-point rate cut later this month, even as a prolonged government shutdown obscures key economic data. Speaking at the National Association for Business Economics conference, Powell acknowledged that hiring momentum has weakened and cautioned that further declines in job openings could soon translate into higher unemployment.

Powell says slower hiring raises “downside risks” to employment.

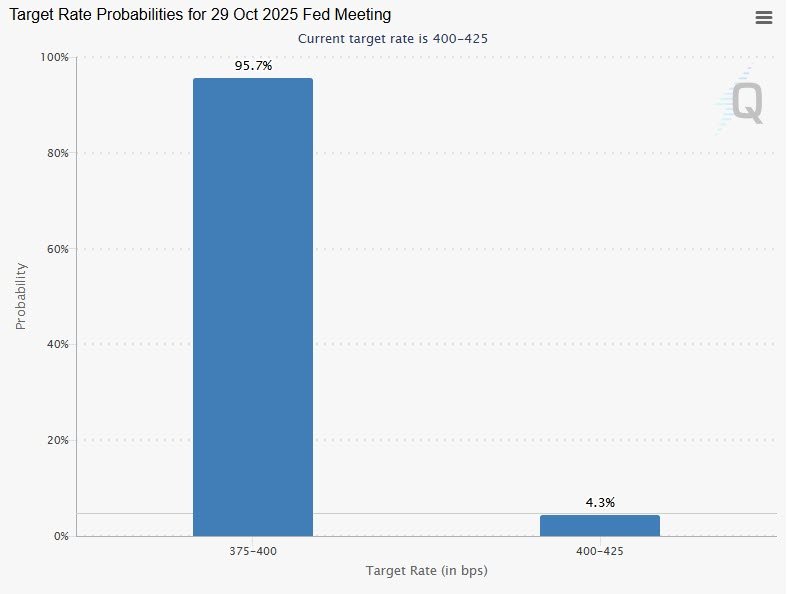

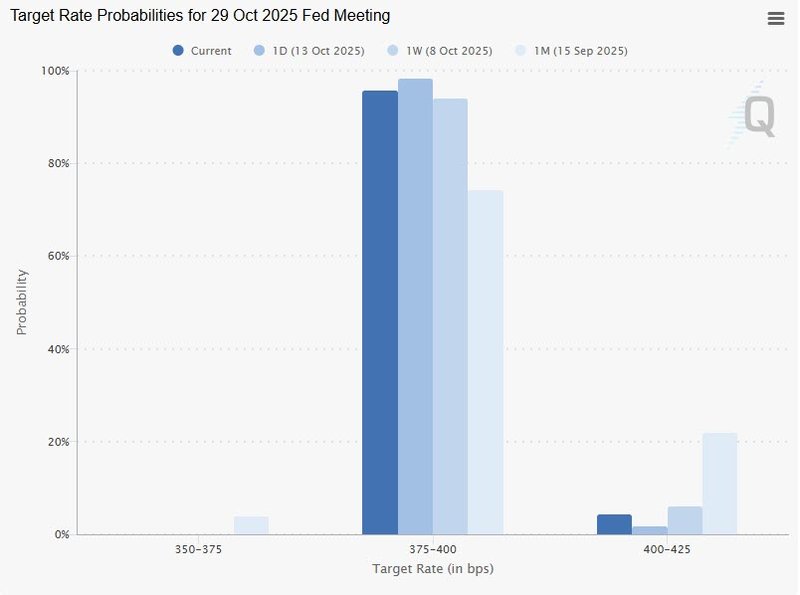

Markets fully price a quarter-point cut at the October 28–29 meeting

Government shutdown hampers the Fed’s access to official data.

Powell hints the Fed could soon halt balance-sheet runoff to preserve liquidity.

Policy path steady despite uncertainty

Federal Reserve Chair Jerome Powell reaffirmed that the central bank remains committed to its easing trajectory, signaling another rate cut at the upcoming October meeting. His remarks suggest the Fed will stay the course set in September, when policymakers reduced rates for the first time this year and projected two additional cuts by December.

“The economic outlook has not materially changed,” Powell said, emphasizing that while inflation remains above target, the softening labor market now poses a greater risk to the recovery. Investors took the message as confirmation that another 25-basis-point reduction is imminent, with futures markets assigning nearly a 100% probability to such a move.

Source: CMEgroup

Hiring slowdown intensifies pressure

Powell’s remarks carried a notable shift in tone: concern that the slowdown in hiring could soon spill into unemployment. “You’re at a place where further declines in job openings might very well show up in unemployment,” he said. While unemployment has remained relatively low at 4.3%, the Fed chief warned that the labor market’s resilience may be fading.

Source: CMEgroup

Data from private sources point to a decline in job creation and a rise in layoffs across several sectors. “The risks to the employment side of the mandate are rising,” said Yelena Shulyatyeva, senior U.S. economist at the Conference Board. “That’s what is going to drive the decision in the near term.”

The Fed’s September reduction to a 4%–4.25% target range was meant to cushion against those risks. Yet, with the Labor Department delaying its payrolls report due to the shutdown, policymakers are being forced to rely on private-sector data and market signals rather than official releases.

The data dilemma

The ongoing government shutdown has introduced a rare blind spot into monetary policymaking. Several key indicators—including employment and inflation data—have been delayed or disrupted. Powell described official statistics as the “gold standard” and cautioned that no private alternative can replace them.

“We don’t expect that we’d be able to replace the data we’re not getting,” he said. “If this goes on for a while, it could become more challenging.” That uncertainty complicates the Fed’s twin mandates: price stability and maximum employment. Inflation remains above the 2% target, but falling labor demand risks pushing the economy toward stagnation.

Growing divisions inside the fed

While Powell projects confidence in the near-term direction of policy, internal divisions within the Federal Open Market Committee are widening. In September, nine of nineteen officials signaled support for one or fewer additional cuts this year. The divergence reflects differing assessments of how quickly inflation will return to target and whether the recent slowdown warrants a deeper easing cycle.

The mixed signals reveal growing uncertainty about the long-term path for rates. Those are the cues of, we don’t really know where we’re going longer term.

Liquidity and balance sheet adjustments

Beyond interest rates, Powell also hinted that the Fed may soon stop shrinking its balance sheet — an important step to preserve stability in short-term funding markets. Quantitative tightening, or QT, has gradually reduced the Fed’s asset holdings since 2022, but officials now worry that continued runoff could drain liquidity excessively as bank reserves approach “ample” levels.

That shift would mark a subtle but significant pivot in policy strategy: one that prioritizes financial system stability over further balance sheet normalization. Markets viewed Powell’s remark as a sign the central bank is preparing to fine-tune liquidity conditions heading into 2026.

Balancing risk and restraint

As October’s meeting approaches, the Fed finds itself managing an increasingly asymmetric risk profile. A premature pause could endanger the labor market, while deeper cuts risk reigniting inflation pressures. For now, Powell’s comments signal a preference for caution — easing enough to sustain growth, but not so aggressively as to undermine credibility.

With political gridlock constraining fiscal visibility and the data blackout limiting analytical clarity, the coming months will test the Fed’s ability to steer policy by instinct rather than metrics.

The Fed is flying blind — but not without a compass.