Sticky inflation, steady bonds

President Trump’s latest move threatening to decertify Canadian-made aircraft and slap a 50% tariff on any aircraft sold into the US turns trade tension into a direct hit on a high-value Canadian industry.

Canada’s rate outlook is no longer just about inflation data or growth forecasts.

Yield holding near 3.42% reflects declining long-term inflation anxiety.

Since 2024, CPI has oscillated between 2.9% and 2.4%.

Trump targets Canadian economy

Trade risk is no longer theoretical for Canada. It has become specific, targeted, and harder to ignore. President Trump’s latest move threatening to decertify Canadian-made aircraft and slap a 50% tariff on any aircraft sold into the US turns trade tension into a direct hit on a high-value Canadian industry.

Trade tension and economy

This matters for monetary policy because sectors like aerospace don’t adjust easily. These are long-cycle businesses built on multi-year contracts, skilled labor, and complex supply chains. When uncertainty hits, companies don’t gradually scale back they pause. Orders get delayed, investment decisions are shelved, and confidence erodes quickly.

For the broader economy, that kind of shock tends to slow growth faster than it pushes up inflation. Exports weaken, capital spending cools, and financial conditions tighten as risk premiums rise. In that scenario, the pressure on the Bank of Canada would lean toward easing, even if inflation is still hovering near target.

Monetary policy

But it’s not a one-way street. Trade tensions would almost certainly weigh on the Canadian dollar. A weaker currency raises the cost of imports and can quietly re-ignite inflation, especially in goods tied to global supply chains. That limits how much room the Bank has to cut rates without creating new problems.

This is why the Bank is keeping its options open. It’s not signaling a cut or a hike because it can’t yet see how far this trade dispute will go. Until there’s clarity on whether these threats turn into real barriers, policy can’t be locked in.

Canada’s rate outlook is no longer just about inflation data or growth forecasts. It now hinges on political decisions that can change quickly and that uncertainty is shaping the Bank’s cautious stance more than any single economic release.

Bond markets signal confidence

Canadian bond markets interpreted the January decision as confirmation that tightening is firmly off the table without pricing in an imminent downturn. The 10-year government bond yield holding near 3.42% reflects declining long-term inflation anxiety rather than recession fear.

Softer core inflation data and the Bank’s confidence that CPI will remain close to target encouraged investors to reduce term premiums at the long end of the curve. Global forces reinforced the move. Falling real yields abroad, particularly in the US, pulled Canadian yields lower through cross-border demand for duration and easing swap spreads.

Positioning also mattered. Investors who had previously reduced exposure during risk-on phases moved back into government bonds following the Bank’s guidance. Portfolio rebalancing and defensive flows supported by rising gold prices added further demand for high-quality sovereign assets.

Source: Trading economics

Inflation is controlled, but not resolved

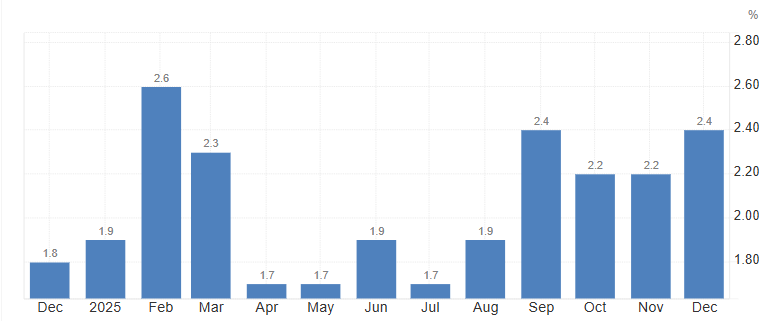

Inflation remains the key constraint on policy flexibility. Headline CPI is running at 2.4%, its highest level since February 2025. While this sits comfortably within the Bank’s target range, it also highlights a more uncomfortable truth: inflation has proven stubborn.

Since 2024, CPI has oscillated between 2.9% and 2.4%, refusing to settle cleanly back at 2%. That persistence matters. It explains why the Governing Council is hesitant to pre-commit to easing, even as growth risks rise. Inflation is no longer the primary threat, but it is not fully neutralized.

This stickiness keeps policy biased toward patience. Excess supply in the economy is helping offset trade-related cost pressures for now, but any sharp currency weakness or renewed global price shock could quickly shift the inflation narrative again.

Source: Statistics Canada

What comes next for policy and markets

Looking ahead, the Bank of Canada is likely to remain on hold in the near term, but its reaction function has clearly widened. Growth data, labor market resilience, and above all trade developments will matter more than small month to month moves in inflation.

If tariff threats turn into concrete action, markets may begin pricing a precautionary rate cut even without a dramatic slowdown. If trade tensions fade and global growth stabilizes, the Bank can afford to stay patient well into the second half of the year.