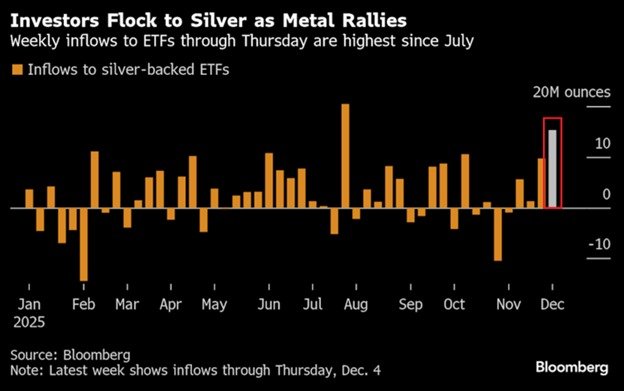

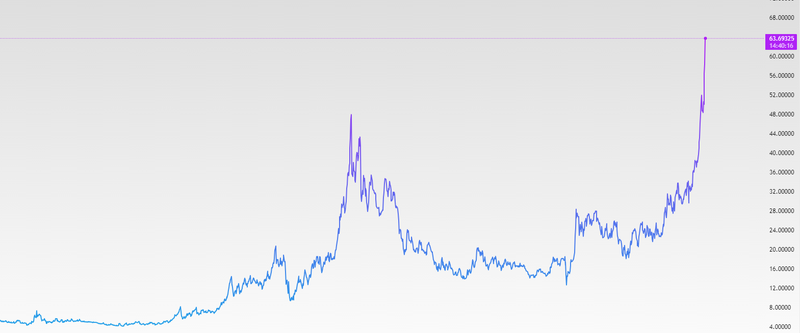

Strong ETF inflows and industrial demand fuel silver 98% YoY rally

Silver stayed above $63 per ounce on Friday, close to its all-time high, as tight supply met strong demand from investors. Prices also got a boost after the U.S. Federal Reserve cut interest rates, making silver and other non-yielding assets more attractive.

Fed delivered a quarter‑point rate reduction.

Rising lease rates and elevated borrowing costs for physical silver.

Mine production growth has been limited.

ETFs pushing Silver

The Fed’s decision was less strict than many expected. Fed Chair Jerome Powell said future rate hikes are unlikely, with only one possible cut next year and another in 2027. This “dovish” approach has made silver more appealing. ETF demand has been a big factor in silver’s rise. Silver-backed ETFs have been buying large amounts of the metal, sometimes at a pace that nearly matches or even exceeds the total added in November. For example, more than 15 million ounces of silver went into ETFs over just four days, almost as much as all of November.

Source: Bloomberg

Industrial & physical demand

The physical silver market is also tight. Rising borrowing and leasing costs, especially in London, show that the shortage isn’t just on paper it’s real. Inventories are falling, and both investors and industrial users are competing for available silver. Industrial demand is strong, with silver needed for solar panels, electric vehicles, AI data centers, and other high-tech applications. These industries are using more silver as they grow, putting further pressure on supply. Mine production isn’t keeping up. The silver market is expected to stay in deficit for the fifth year in a row, meaning demand will continue to outpace supply. This imbalance is a key reason prices are rising and why the current rally is more than just a short-term spike. Some analysts think silver could reach $100 per ounce next year if the trend continues.

Could silver’s rally extend into 2026

Silver is a smaller market than gold, so prices can be volatile. Sharp drops are possible if investor demand or industrial use changes suddenly. Still, many investors see silver as a rare opportunity, combining strong fundamentals with technical conditions that could support a continued rally into 2026. For the first time, silver has increased more than 98% year-over-year, highlighting the strength of this rally. Some forecasts suggest that silver could test even higher levels. However, as markets tighten and prices climb, volatility remains a risk. Analysts caution that sharp corrections are possible given silver’s smaller market size relative to gold and its sensitivity to shifts in industrial demand and investor flows. Nonetheless, for many investors, silver’s current dynamics reflect a rare combination of fundamental strength and technical breakout conditions that support an extended rally into 2026.

Source: Trading View