Tax hikes and slowing growth push UK 10-year yield to 4.46%

Reeves’ proposal for a substantial tax increase pushed the 10-year yield up to 4.46% alongside rising December rate-cut expectations to 85%, pointing to weakening investor confidence in the current policy outlook.

The fiscal buffer has been raised to roughly £22 billion.

Experts argue that parts of the budget resemble “fiscal fiction.”

The mix of higher taxes and potentially sluggish growth is weighing on sentiment.

Fiscal Measures and Market Response

Reeves proposed a substantial tax increase collectively worth around £26 billion over the coming years, targeting income, property, dividends, and high-value homes. At the same time, certain measures were introduced for households, including a planned £150 annual cut in energy bills. The government argues that these moves are necessary to repair public finances, reduce borrowing, and provide fiscal headroom. The forecast fiscal buffer has been raised to roughly £22 billion, a critical cushion against economic turbulence.

Growth Projections Soft

The UK’s productivity and economic growth forecasts were revised downward, reflecting the fiscal tightening ahead. Investors remain cautious about the scale of the tax hikes and are gradually losing confidence in the current government agenda, which has contributed to the rise in bond yields. By 2030, one in four workers could be taxed at the 40% rate, a shift that may heavily burden middle-income households.

Monetary Policy Implications

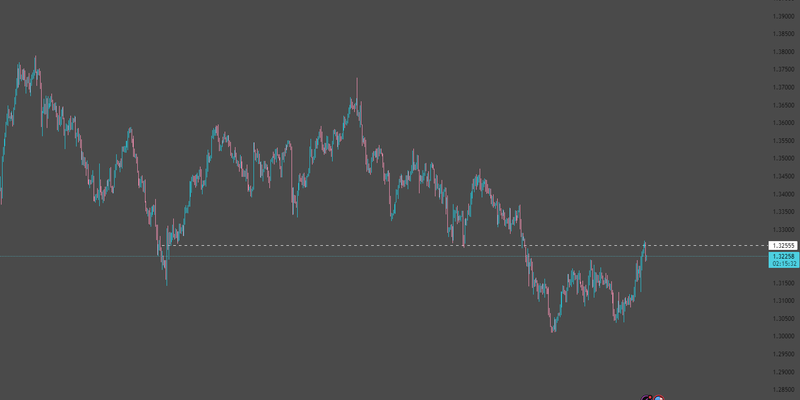

The mix of higher taxes, potentially sluggish growth, and revised inflation expectations may prompt the Bank of England to tread carefully. Further economic events, including inflation, wage growth, and consumer spending data, will shape whether monetary policy tilts toward easing or remains tight. Despite recent pressure on the U.S. dollar and the index recording its largest decline in weeks, the pound failed to benefit from USD weakness. This suggests that UK fiscal and monetary policy concerns, along with weakening investor trust in the government, continue to place GBP/USD under short-selling pressure as it tests the 1.3255 pivot zone.

Source: Trading View