The dollar wobbles ahead of fed decision

The dollar index held around 97 on Tuesday as the Federal Reserve’s two-day policy meeting gets underway later in the day. The central bank is widely expected to keep rates unchanged, though concerns about its independence from political pressure remain in focus.

Fed is widely expected to keep interest rates unchanged.

$1.2 trillion government funding package.

US 10-year treasury yield fell below 4.22%.

US and Japanese officials could coordinate a currency intervention.

Fed under pressure

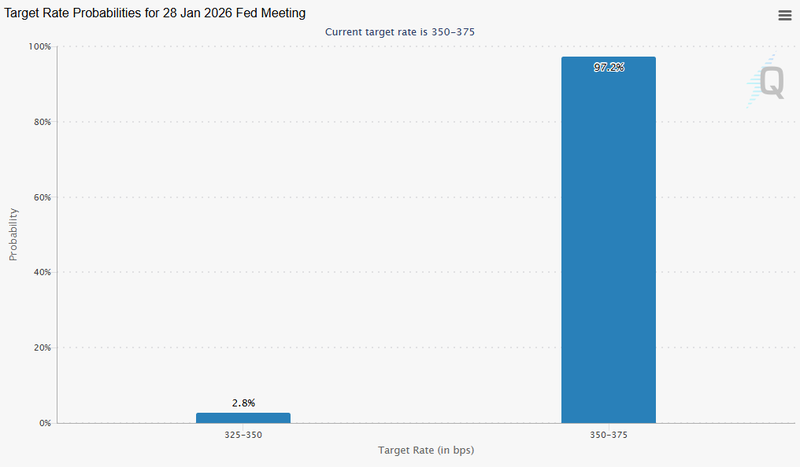

While the Fed is widely expected to keep interest rates unchanged, markets are far more focused on what comes next rather than today’s decision itself. Concerns about the Fed’s independence have resurfaced, driven by speculation that President Donald Trump may soon announce a new Fed chair, potentially as early as this week.

If a more dovish candidate is nominated, one who favors lower interest rates, it could signal an easier monetary path ahead. That expectation alone has been enough to weigh on the dollar, as lower rates tend to reduce the appeal of US assets to global investors.

Source: CME Group

US dollar under pressure

The US dollar is starting the week on shaky ground. The dollar index hovered around 97 on Tuesday, near its weakest level in more than four months, after falling for three consecutive sessions, investors are growing cautious as political uncertainty and Federal Reserve.

Source: Trading economics

Politics adds another layer of risk

At the same time, Washington is once again flirting with fiscal disruption. Democratic leaders have threatened to block a $1.2 trillion government funding package if it includes additional allocations for Homeland Security. This has revived fears of another government shutdown; a scenario markets have learned to dislike deeply.

For investors, shutdown risk is not just a political headline, it creates uncertainty around economic data, government spending, and overall stability. That uncertainty has reinforced what traders increasingly describe as the “sell America” trade, where capital shifts away from US assets toward perceived safer or more stable alternatives.

Treasury yields reflect growing caution

The bond market is telling a similar story. The US 10-year Treasury yield fell below 4.22% on Monday, its lowest level in nearly two weeks. Falling yields suggest rising demand for safety and declining confidence in near-term economic momentum.

Investors are positioning defensively ahead of the Fed’s decision on Wednesday. While no rate change is expected, markets will closely analyze the Fed’s economic projections, inflation outlook, and guidance on future rate cuts. Even subtle shifts in tone could drive sharp moves in currencies and bonds.

Source: Trading economics

Global factors are amplifying dollar weakness

Beyond domestic issues, geopolitical and trade tensions continue to weigh on sentiment. Adding to the dollar’s struggles is speculation that US and Japanese officials could coordinate a currency intervention, a move that has already boosted the Japanese yen. Any action aimed at supporting the yen would naturally come at the dollar’s expense.

Dollar’s direction

The dollar’s direction will likely depend on three key developments; Fed communication, a dovish signal or softer economic outlook could extend dollar weakness. Political clarity Progress on government funding or confirmation of a new Fed chair will matter. Global coordination any confirmed currency intervention would keep pressure on the greenback.

For now, the dollar remains vulnerable. Unless political risks fade or the Fed pushes back against rate-cut expectations, the path of least resistance appears lower. Markets are no longer just reacting to economic data, they are reacting to confidence, and right now, confidence in the US policy outlook is being tested.