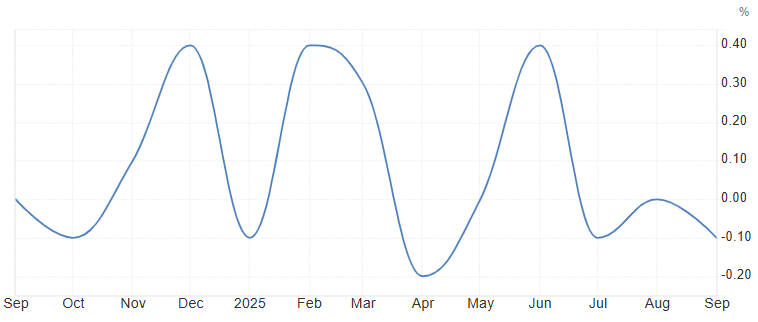

UK GDP expectations to rebound to 0.1% despite rising Unemployment rate to 5.0%

On November 12, 2025, the United Kingdom reported a small decline in its economy, with GDP falling by -0.1%, slightly below the expected 0.0%. This shows that the economy is still under pressure. Services and manufacturing were weak, and small gains in construction were not enough to offset the slowdown. Consumers are spending cautiously because prices are rising, and businesses are holding back on investments.

Rising living costs, inflation, and economic uncertainty are slowing growth.

GDP is expected to rebound slightly to 0.1% in tomorrow’s report.

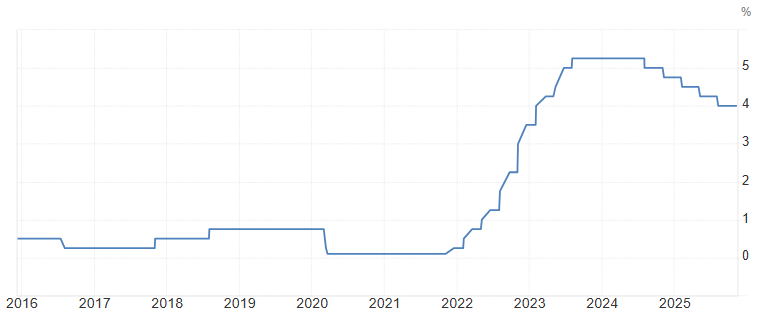

Weak growth may lead the Bank of England to keep interest rates low.

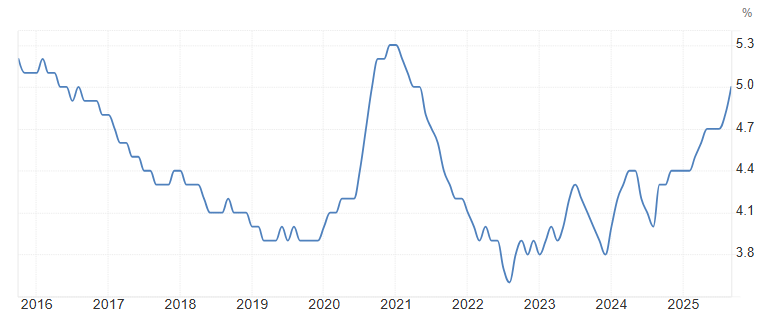

Unemployment rate reached 5.0%, the highest level in Sep 2020.

Consumer demand and business investment remain weak

Higher prices and economic uncertainty are making households focus on essentials and delay bigger purchases. Even though wages are rising in some areas, they are not keeping up with costs, so people are spending carefully. Businesses are also hesitant to invest in big projects or expansion. Many are taking a “wait and see” approach due to uncertainty about future demand, interest rate changes, and global conditions. Delays in investments, new equipment, and hiring are keeping overall growth slow, even if some sectors are doing slightly better.

Expecting a small rebound

GDP reports can quickly influence financial markets. If growth meets or exceeds expectations, the British pound may strengthen. If growth is weaker than expected, the currency could fall. UK stocks, especially in consumer goods and industrial sectors, may see short-term swings. Bond yields could also change as investors adjust expectations for interest rates. The slight contraction in November and the expected rebound to 0.1% make GDP an important indicator of the UK’s economic health. Watching consumer spending, business investment, and BoE guidance will help show whether the economy is stabilizing or needs further support.

Source: Office for National Statistics

Between rate cuts and “higher for longer”

The Bank of England is keeping a close eye on the situation. Weak growth and careful spending may lead the BoE to maintain low interest rates or even consider easing in the near term. However, if inflation remains high, the BoE may hold off on rate cuts, trying to balance supporting growth with keeping prices stable.

Source: Bank of England

Unemployment rate hits 5.0%

The United Kingdom’s unemployment rate reached 5.0%, the highest level in Sep 2020. This rise shows that the job market is under pressure as the economy struggles to grow. Many businesses are cautious about hiring because they are unsure about future demand, inflation, and possible interest rate changes. The increase in unemployment is most noticeable in sectors like retail, hospitality, and leisure. For people looking for work, this means more competition for jobs and slower wage growth. The higher unemployment rate could also make households more careful with spending, which may slow economic recovery even further. Policymakers are watching closely, as rising joblessness could influence decisions on interest rates and support measures to help the economy.

Source: Office for National Statistics