UK unemployment hits five-year high as wage growth cools, bolstering case for BOE rate cut

Labour-market data show rising joblessness and moderating pay pressures, reinforcing expectations of an interest-rate reduction in the spring.

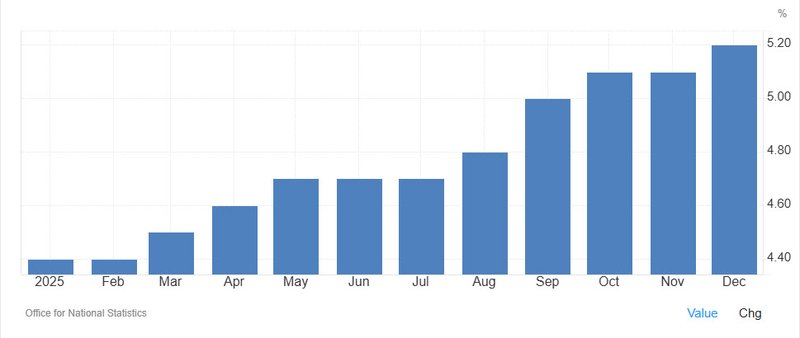

UK unemployment rises to 5.2%, highest in nearly five years

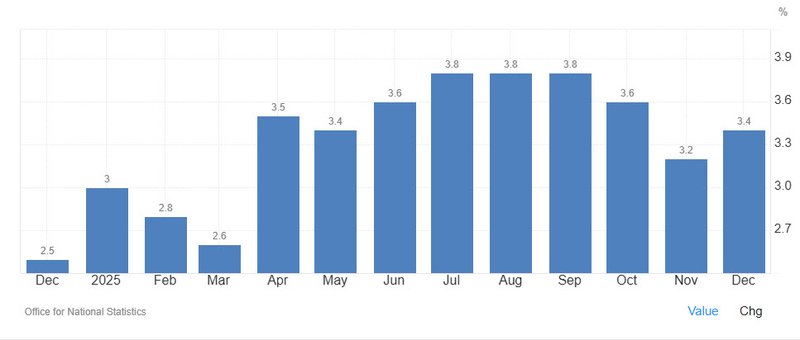

Private-sector wage growth slows to 3.4%, lowest since 2020

Payroll employment falls by 11,000 in January

Markets fully price in a BOE rate cut by April

UK unemployment climbed to its highest level in almost five years in the final quarter of last year, while wage growth continued to ease, signaling a further cooling of the labour market and strengthening the case for lower borrowing costs.

The jobless rate rose to 5.2%, up from the previous quarter and above the 5.1% expected by economists, according to data from the Office for National Statistics. The increase marks the highest unemployment reading since 2021, underscoring mounting slack in the jobs market.

Source: TradingEconomics

At the same time, regular private-sector wage growth — the pay measure most closely watched by the Bank of England — slowed to 3.4%, its weakest pace in more than five years. That figure is approaching the roughly 3.25% rate the central bank considers consistent with its 2% inflation target. Overall pay growth excluding bonuses also cooled, easing to 4.2%.

Separate tax data showed the number of employees on payrolls declined by 11,000 in January, adding to evidence that hiring momentum is fading.

Rate-cut expectations build

The softer labour-market backdrop is likely to reassure policymakers that wage-driven inflation pressures are easing quickly enough to allow further monetary loosening.

The BOE’s Monetary Policy Committee held its benchmark rate at 3.75% earlier this month in a closely split 5–4 decision. Governor Andrew Bailey sided with a majority to keep rates unchanged, though the narrow margin highlighted divisions within the committee.

Financial markets are now almost fully pricing in a quarter-point rate cut by April. Deputy Governor Sarah Breeden has recently indicated that a reduction could come by the end of that month if data continue to soften.

At the more hawkish end of the committee, Chief Economist Huw Pill has argued that rates remain too low and should stay on hold for now, citing lingering inflation risks.

Critical week for policymakers

The labour data arrive ahead of a busy stretch for UK policymakers. Inflation figures are due Wednesday, with economists expecting consumer price growth to ease to 3% in January from 3.4% previously. Retail sales and public finance data will follow later in the week.

Source: TradingEconomics

The MPC will receive one more round of labour and inflation readings before its next rate decision on March 19.

In its latest projections, the BOE warned that unemployment could rise to 5.3% by the spring. The central bank also downgraded its 2026 growth forecast to 0.9% from 1.2%, reflecting weak demand conditions.

Recent figures showed the UK economy expanded just 0.1% in the fourth quarter, below expectations and highlighting fragile momentum.

Bailey has signaled that he is increasingly concerned about weak demand and loosening labour conditions, suggesting that risks to growth may now outweigh lingering inflation pressures. The latest wage and unemployment data reinforce that narrative, potentially paving the way for a spring rate cut if inflation continues to moderate.

For markets, the trajectory is becoming clearer: softer jobs data, cooling pay growth and slowing output are aligning to shift the BOE’s focus from inflation containment toward supporting growth — provided price pressures continue to ease.