U.S. economic data points to gradual cooling

Yesterday’s economic data suggested that the U.S. economy is gradually slowing down. The Dollar Index (DXY) stayed under pressure and failed to reach recent highs, as investors reassessed expectations for Federal Reserve policy in the coming months. While the data did not indicate a sharp slowdown, it reinforced the view that economic momentum is easing, especially in the labor market and consumer spending.

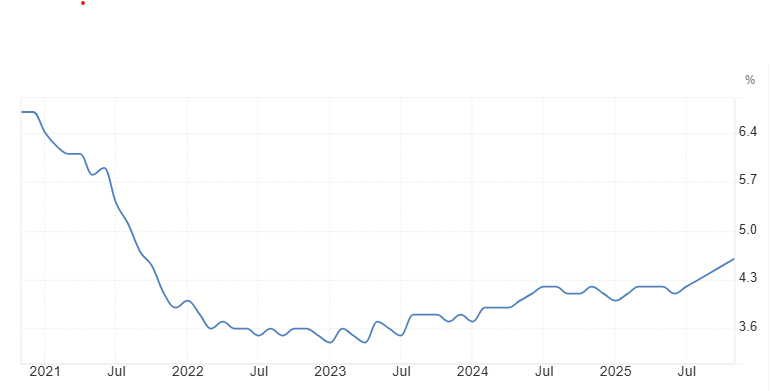

U.S. unemployment rate rose to 4.6%, the highest level since September 2021.

High probability that the Fed will leave interest rates unchanged at its next meeting.

Fed increased its purchases of short-term Treasury bills.

Unemployment shows a gradual rise

The latest labor market report showed that the U.S. unemployment rate increased to 4.6%, its highest level since September 2021. This rise indicates that hiring is slowing, and companies are becoming more cautious about expanding their workforce amid higher interest rates and slower economic growth. Nonfarm payrolls (NFP) data also showed a moderation in labor demand. While jobs are still being added, the pace of hiring has slowed compared with earlier in the year. This suggests that businesses are taking a more careful approach to hiring as financial conditions remain restrictive. Average hourly earnings posted their smallest monthly increase since August 2023, signaling a slowdown in wage growth. Slower wage growth is important for policymakers because it reduces the risk of inflation being driven by higher labor costs. Overall, the data show that the labor market is cooling gradually, not collapsing. Employment conditions remain relatively healthy but hiring and wage growth are slowing. This gradual shift is likely to influence Federal Reserve decisions in the coming months, as officials look for evidence that labor market pressure is easing without causing a sharp economic slowdown.

Source: U.S. Bureau of Labor Statistics

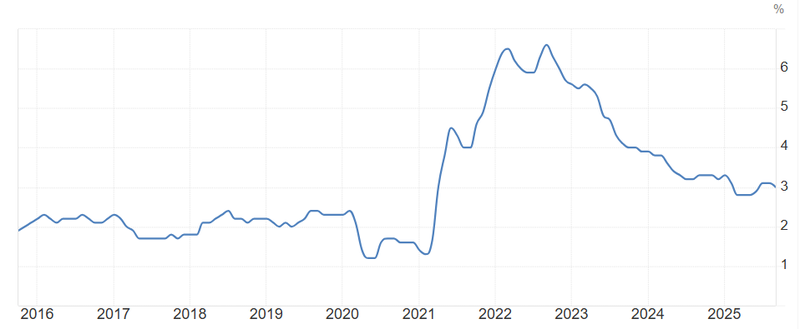

Fed between easing and tightening

There is currently a 75% chance that the Federal Reserve will keep interest rates unchanged at its next meeting. Policymakers are trying to balance signs of slower growth against inflation that remains above target. It’s worth noting that 20 days before the last Fed decision, the probability of no change was 70%, but it later jumped to 90% in favor of a rate cut. While the labor market data points to cooling, the Fed wants sustained evidence before changing policy, which keeps markets cautious about near-term rate cuts. Retail sales data also show signs of slowing. Sales declined 0.1% after a previous increase of 0.4%, suggesting that consumer spending is starting to soften under high interest rates and rising prices. Since consumer spending drives most of U.S. economic growth, weaker retail activity supports the view that the economy is slowing gradually but not collapsing. Tomorrow’s CPI release will be crucial for shaping market expectations. The previous annual CPI reading was 3.0%, and forecasts point to a slight rise to 3.1%. If inflation comes in higher than expected, it will support the Fed keeping rates unchanged for longer. If inflation is softer, expectations for rate cuts later in the year may increase. Until then, markets are likely to stay range-bound, with investors cautious about taking strong positions.

Source: U.S. Bureau of Labor Statistics

Fed starts buying U.S. Treasury Bills

Market attention has also focused on the Federal Reserve’s recent activity in the Treasury bill market. This week, the Fed increased its purchases of short-term Treasury bills, mainly to ensure money markets run smoothly and prevent funding disruptions, rather than to signal a return to large-scale stimulus. These purchases focus on short-term Treasuries, especially bills with maturities under one year. They are meant to address technical issues in the financial system, not to influence overall interest rates or monetary policy. Some investors see these purchases as supportive for risk assets, like stocks or credit-sensitive investments. However, the Fed has emphasized that these actions are technical in nature. Unlike previous QE programs, which involved buying large amounts of long-term Treasuries and mortgage-backed securities to stimulate the economy, these Treasury bill purchases are smaller and aimed only at keeping markets functioning properly.