U.S. GDP forecasts fall slowing to 3.2%

U.S. prepares to release its advance estimate for third quarter GDP this week, economists are revising down the growth outlook. Earlier estimates suggested growth was near 3.8%, but many forecasters now expect a slower pace closer to 3.2% or below. This adjustment doesn’t signal recession, but it shows a moderation in economic momentum and reflects several important trends shaping the U.S. economy today.

Tariffs and global supply chain tensions have added friction to exports and imports.

Demand higher yields to compensate for inflation and opportunity cost.

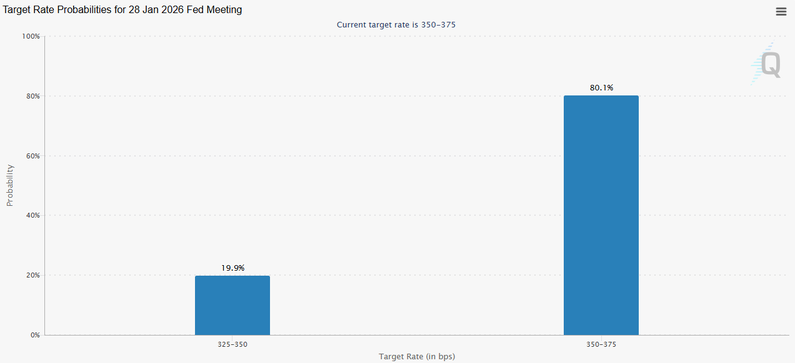

Probability near 80% that the Fed will not cut interest rates in January.

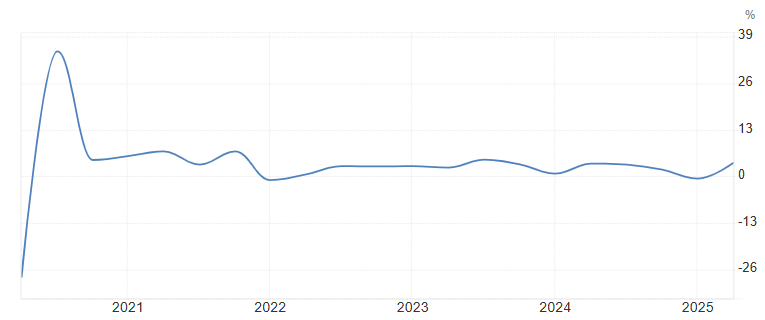

Why U.S. GDP forecasts are being revised lower

A key reason for the lower forecast is weakening consumer demand. Consumer spending which typically accounts for about two‑thirds of U.S. GDP has shown signs of slowing. Higher borrowing costs, especially for housing and auto loans, have made consumers more cautious about large purchases. This hesitation reduces the overall contribution of consumption to GDP growth. Another factor is slowing business investment. After a strong run of corporate spending on equipment and technology earlier in the year, many companies are pulling back. Higher financing costs and uncertainty about future demand have caused firms to delay or scale back investment plans. This softer investment picture dampens the overall growth forecast. Trade conditions and external pressures also play a part. Tariffs and global supply chain tensions have added friction to exports and imports, reducing net external demand for U.S. goods and services. And disruptions to data collection such as those tied to government shutdowns can shift reported growth figures, sometimes causing revisions that lower short‑term estimates.

Source: U.S. Bureau of Economic Analysis

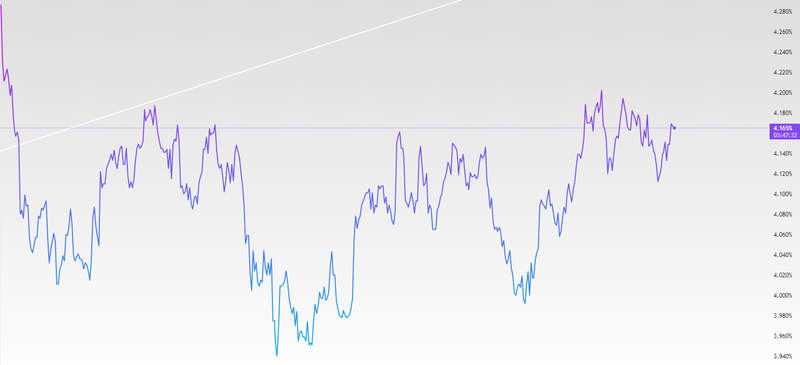

Yields and CPI interact with growth expectations

The yield on the U.S. 10‑year Treasury is a key barometer of how investors judge future growth and inflation. When yields rise, as they have recently, it often means markets expect central banks to keep policy tighter for longer. If markets believe growth will remain robust or inflation will persist, they demand higher yields to compensate for inflation and opportunity cost. Higher yields can, in turn, dampen future economic growth by raising borrowing costs for borrowers, essentially feeding back into slower GDP growth rates. This dynamic has been evident as yields have climbed amid tighter monetary conditions globally. Recent inflation data showed the CPI easing to about 2.7% from earlier expected levels near 3.1%. While this slowdown in inflation might seem positive, analysts caution that the data may be distorted by disruptions in survey collection, especially from government shutdowns, making some portions of the CPI less reliable. Still, a lower CPI reading reduces immediate inflation pressure and theoretically gives the Federal Reserve more room to ease policy later. But in practice, inflation remaining above the central bank’s 2% target means the Fed is unlikely to rush to cut rates. The dollar’s strength shifts in commodity prices, and sticky core inflation components also all influence how yields and growth expectations adjust over time. The interplay between yields and GDP expectations can be viewed through frameworks like the Taylor Rule, which links interest rates to inflation and output gaps. When growth slows and inflation cools, the rule would normally suggest lower interest rates but if inflation remains above target and growth is only moderating, policymakers may choose to keep rates unchanged longer.

Source: Trading View

Why the market sees a low chance of a January rate cut

Markets assign a high probability of 80% that the Fed will not cut interest rates in January. Even with the recent drop in CPI, inflation has generally hovered above the Fed’s long‑run target of 2% for much of 2025. This means the central bank is less inclined to ease policy until it sees a sustained decline toward target, not just a single data print. Labor market indicators have shown uneven signals, for example, unemployment rising to multi‑year highs even as some job gains continue. This mixed picture gives the Fed reason to be cautious. Recent statements from Fed officials, such as New York Fed President John Williams, highlight a view that inflation may slow into 2026, but that policy is “well‑positioned” and that premature cuts could risk a rebound in price pressures. At its latest meetings, the Fed has communicated a preference for patience. Officials have emphasized that future rate decisions will be data‑dependent, meaning they will wait for clear trends rather than reacting to shorter noise. This more cautious stance pushes potential cuts farther into 2026 or beyond. Taking together, these conditions slower but still positive growth, inflation above target, and ongoing labor market transitions make it unlikely that the Fed will cut rates in January 2026, even if markets hoped for an early easing.

Source: CME Group