Yen faces pressure amid intervention signals, rate uncertainty, and inflation gap

The current weakness, combined with signals of possible intervention, keeps investors alert to currency market volatility. At the same time, Japan’s interest rate policy remains flexible, with additional hikes possible if economic conditions improve. However, inflation remains below the target level needed to justify aggressive tightening.

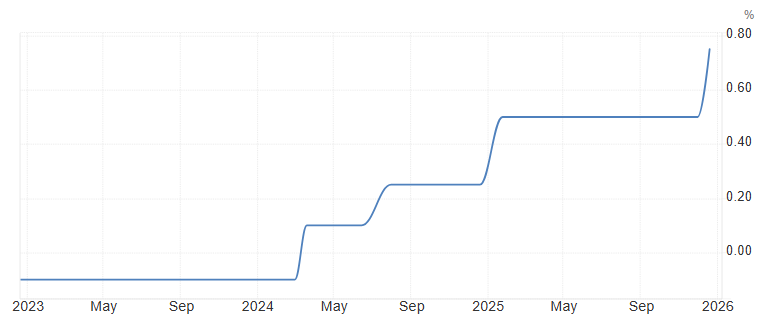

Bank of Japan raised its policy rate to 0.75% the highest since 1995.

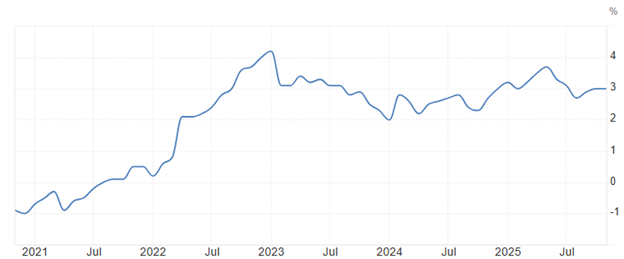

Inflation in Japan has stabilized above the BOJ’s long-standing 2% target.

Headline inflation has shown a gradual increase.

Tokyo signals currency intervention

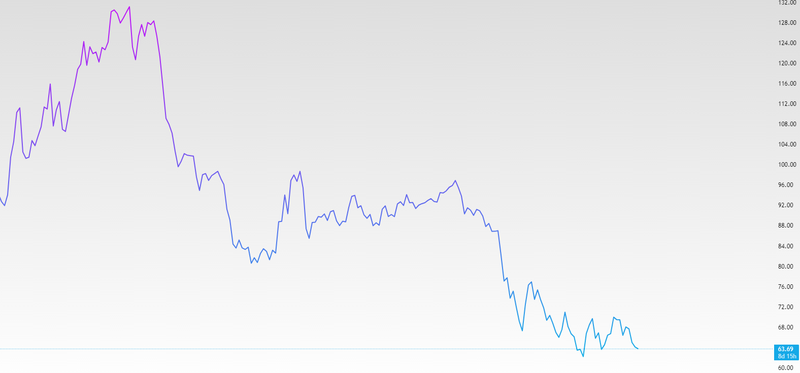

The Japanese yen continues to face pressure against major currencies, approaching multi-year lows and drawing attention from authorities. Finance Minister Satsuki Katayama stated that Japan has a “free hand” to address excessive currency movements, signaling that Tokyo may intervene if the yen weakens sharply. This comes amid concerns over higher import costs, rising inflation, and the impact on household purchasing power. The yen index, which measures the currency against a basket of major global currencies, has been near historic lows, highlighting ongoing vulnerability despite recent policy adjustments. Analysts note that Japan often uses verbal intervention, or “jawboning,” as a first step to curb speculative moves before taking direct action in the forex market. Such statements can slow sharp depreciation but do not always reverse trends immediately. Weakness is also fueled by large interest rate gaps with the U.S. and Europe. While the Bank of Japan raised its policy rate to 0.75% the highest since 1995 the increase remains modest compared with foreign rates, encouraging capital outflows toward higher-yielding currencies. Markets are closely watching official statements for potential intervention, especially as the yen approaches extreme levels or sharp one-sided moves. The interplay between currency pressures and BOJ guidance continues to shape expectations for the yen and Japanese financial markets.

Source: Trading View

Interest rate hikes remain open for 2026

The Bank of Japan’s (BOJ) cautious approach to tightening monetary policy continues to strongly influence market expectations. While the recent increase of the policy rate to 0.75% marked the highest level since 1995 and represented a historic shift away from decades of near-zero rates, policymakers have made it clear that future adjustments will be gradual and data-driven. Inflation in Japan has stabilized above the BOJ’s long-standing 2% target, signaling persistent price pressures, yet wage growth, although improving in some sectors, is not yet broad-based across the economy. This careful approach leaves room for additional rate hikes in 2026, but only if underlying economic conditions such as steady GDP growth, sustained inflation, and healthy industrial output support further tightening. Analysts note that Japan’s slow normalization path is deliberately designed to prevent shocks to the recovery, maintain financial stability, and give markets sufficient time to adjust to higher borrowing costs. Financial markets are already reacting to this gradual shift. Japanese government bond yields, especially at the long end of the curve, have risen as investors price in expectations of higher future rates. The yield curve is showing signs of steepening, reflecting confidence that the BOJ may continue its measured exit from ultra-loose monetary policy while keeping short-term rates anchored to support gradual economic adjustment. This combination of cautious rate hikes and a slowly adjusting yield curve underscores the BOJ’s balancing act: curbing inflationary pressures without destabilizing growth, while gradually signaling to markets that Japan’s era of emergency-style monetary support is coming to an end.

Source: Bank of Japan

Inflation still below target

A key factor constraining aggressive rate hikes in Japan is the trajectory of inflation, which remains below levels that would justify rapid tightening. Headline inflation has shown a gradual increase, reflecting higher costs for energy, imported goods, and certain commodities, while core inflation excluding volatile items such as fresh food—has also edged above the BOJ’s 2% target. Despite these gains, the inflationary pressure is not uniform across the economy. Price increases are largely concentrated in sectors benefiting from strong wage gains or supply-side pressures, whereas consumer prices in other areas, such as services and household essentials, show only modest growth. Analysts emphasize that for the BOJ to move decisively, inflation needs to be sustained and broad-based across multiple sectors. Temporary spikes or isolated sectoral gains are insufficient to trigger aggressive rate hikes, as doing so could risk slowing economic activity or undermining household consumption. Wage growth, while improving in large corporations and specific industries, has yet to reach smaller and medium-sized businesses, limiting the transmission of higher incomes into broader consumer demand. Current CPI data indicates that the economy is moving in the right direction, with inflation showing gradual but incomplete signs of persistence. This reinforces the BOJ’s step-by-step, data-driven approach to policy normalization, ensuring that any further rate increases are well-supported by sustained economic and price trends rather than short-term fluctuations.

Source: Statistics Bureau of Japan