Bitcoin consolidates while Ethereum builds for the next cycle

Crypto markets are transitioning from a fast-moving rally into a more thoughtful phase. Bitcoin is consolidating after a strong year, acting as a stability anchor, while Ethereum continues to build quietly through fundamentals rather than price momentum. The next major move will likely depend on liquidity returning in early 2026, clarity on global monetary policy, and whether investors are ready to shift from defense back to growth.

Crypto is no longer in a “everything goes up” phase.

Bitcoin is behaving more like a mature asset: less explosive day-to-day.

Bitcoin leads to price stability and dominance, Ethereum’s focus is more on network activity.

What is driving price action now

The cryptocurrency market is ending the year in a more cautious and selective mood after a very strong 2025. Earlier in the year, broad optimism around ETFs, institutional adoption, and expectations of easier global monetary policy pushed most digital assets sharply higher. Recently, however, momentum has slowed. Liquidity is thinner near year-end, traders are locking in profits, and markets are reacting more to positioning and risk management than to hype. Volatility remains elevated, but it is becoming more uneven, with capital concentrating on the largest and most liquid assets rather than flowing across the entire market. In simple terms, crypto is no longer in a “everything goes up” phase. Investors are becoming more selective, focusing on fundamentals, use cases, and relative strength as they prepare for 2026.

Bitcoin consolidation after a powerful year

Bitcoin remains the anchor of the crypto market and continues to dictate overall sentiment. After posting strong gains earlier in 2025, Bitcoin has entered a consolidation phase, trading below recent highs as buyers and sellers reach a temporary balance. This pause is not a sign of weakness on its own. Instead, it reflects profit-taking after a long rally and caution ahead of year-end. Institutional interest remains strong, supported by steady inflows into Bitcoin-related investment products and its growing role as a digital store of value. At the same time, macro factors still matter. Expectations of U.S. rate cuts in 2026, a softer dollar, and ongoing geopolitical uncertainty continue to support Bitcoin’s longer-term narrative. Importantly, Bitcoin dominance remains elevated near 59%, showing that capital is still concentrated in BTC rather than rotating aggressively into altcoins. This reinforces Bitcoin’s leadership role in the market. For now, Bitcoin is behaving more like a mature asset: less explosive day-to-day but still setting the tone for the broader crypto space. Traders are watching closely whether it can hold key support levels and build a solid base for the next major move.

Source: Trading View

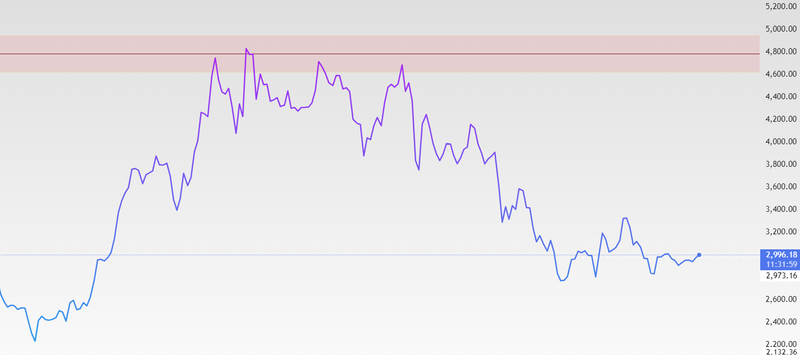

Ethereum fundamentals improve, but price lags

Ethereum’s fundamentals continue to improve, but price action has lagged behind that progress. Network activity remains healthy, with steady growth in on-chain usage, continued development around scaling solutions, and rising interest in Ethereum’s role as the backbone for DeFi and tokenized assets. However, despite these supportive fundamentals, Ether has struggled to translate strength into sustained upside. The price has repeatedly failed to hold above the key resistance zone around $3,300, where selling pressure has remained strong. Each attempt to break higher has been met with profit-taking, suggesting that investors are still cautious and waiting for a clearer catalyst. Part of this hesitation reflects broader market behavior, as capital remains concentrated in Bitcoin and risk appetite for large altcoins is still selective. Until Ether can firmly reclaim and hold above the $3,300 level, its upside may remain limited in the short term, even as the longer-term outlook continues to improve on the back of stronger fundamentals.

Source: Trading View