Bitcoin eyes liquidity tailwind as shutdown end nears and ‘tariff dividend’ talk grows

With a 41-day U.S. shutdown nearing resolution and a proposed $2,000 “tariff dividend” on the table, liquidity could be gearing up for a comeback—exactly the kind of fuel that has historically supercharged Bitcoin after prior shutdowns.

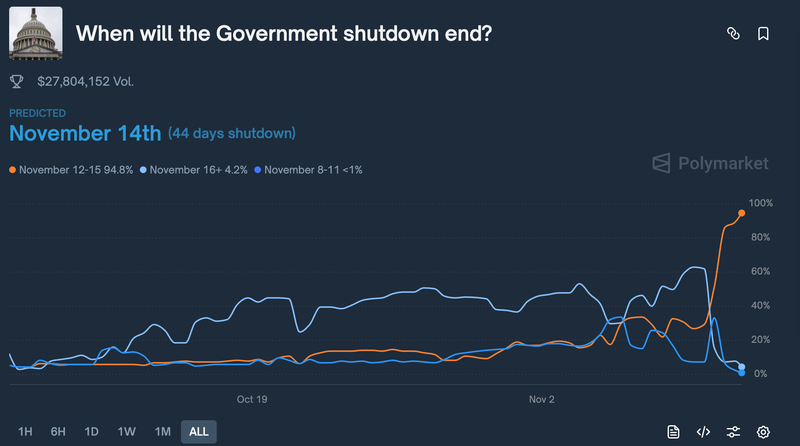

Senate step points to reopening; odds of an end this week are high

Bitcoin surged ~96% and ~157% after the 2018 and 2019 shutdowns

A “tariff dividend” (cash or tax relief) would add fresh fiscal impulse

Setup is bullish—but froth and cycle timing argue for drawdown risk

Shutdown mechanics: Why liquidity matters

A 60–40 procedural vote in the senate opens the door to ending the 41-day government closure. Prediction markets assign a high probability to a formal restart within days. Even before the ink dries, markets tend to front-run the liquidity effect: federal pay resumes, contracts restart, delayed transfers flow, and the “data blackout” that constrained risk appetite begins to lift. Those shifts typically ease financial conditions at the margin—favorable for high-beta assets like Bitcoin.

Source: Polymarkets

History doesn’t rhyme, it compounds

In the two most recent analogues—February 2018 and January 2019—Bitcoin rallied roughly 96% and 157% in the weeks and months after the shutdowns ended. Causality is messy: those bursts coincided with broader risk recoveries. Still, the pattern is consistent with a liquidity-on pivot once fiscal taps re-open. The current setup rhymes: reopening plus fresh fiscal messaging increases the probability of a post-shutdown impulse, even if the price response lags.

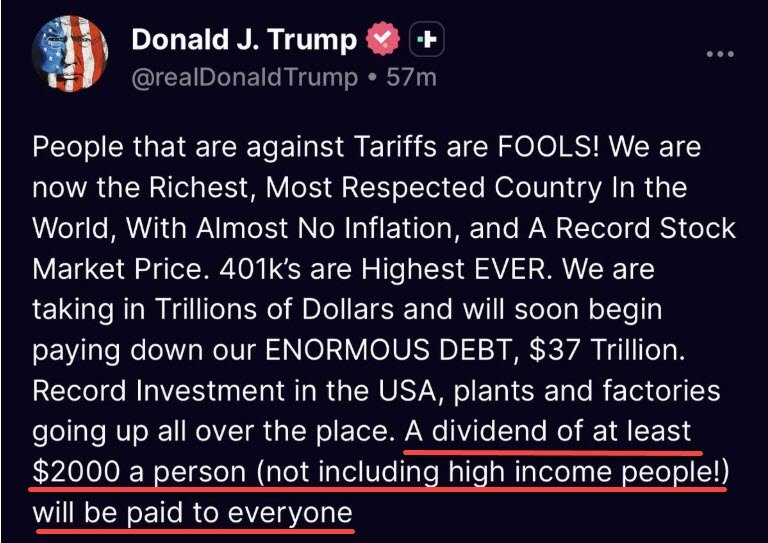

Source: X.com

What a ‘tariff dividend’ would do

A proposed $2,000 per-citizen “tariff dividend” would constitute meaningful stimulus whether delivered as a cash transfer or via tax relief (e.g., targeted exemptions). Either route raises disposable income and liquidity. Combined with easing inflation fears relative to worst-case tariff scenarios, that cocktail tends to tilt portfolios back toward risk. Crypto—being the purest expression of liquidity beta—usually sees early inflows.

Market positioning and levels

Into the headlines, BTC is holding near $104k despite reported spikes in short-term holder exchange supply. A clean close back above the post-shutdown rumor highs would open $114k–$117k, then $119k–$120k; failure keeps the focus on $109.5k, then the psychological $100k handle. Expect headline-driven chop until the house vote and signature are done.

Risk case: When liquidity bites back

Two watch-outs can turn a promising setup into a bull trap:

- Policy delivery risk: delays or dilution of stimulus (e.g., shifting from cash to narrow credits) would mute the impulse.

- Cycle fatigue: a 65-month liquidity cycle model points to a peak into Q1–Q2 2026, with scope for a 15–20% corrective air-pocket if valuations run ahead of flows.