Bitcoin rebounds after inflation report, but market risks remain

Bitcoin rebounded after U.S. inflation data came in softer than expected, easing concerns about tighter Federal Reserve policies. However, broader market risks, such as trade tensions and economic uncertainties, continue to impact sentiment.

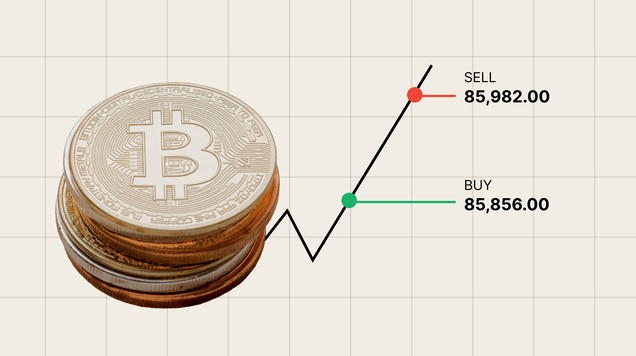

Bitcoin rose 2% after softer February CPI data.

Annual inflation slowed to 2.8%, easing Fed tightening fears.

Broader market risks, like trade tensions, persist.

Bitcoin hit $82,000, still 30% below December highs.

Bitcoin climbed on Wednesday after U.S. inflation data came in softer than expected, easing concerns that rising consumer prices would prompt more aggressive Federal Reserve policy tightening. However, broader market risks, including trade tensions and shifting economic policies, continue to weigh on sentiment.

The Consumer Price Index (CPI) increased 0.2% in February, with annual inflation slowing to 2.8%, according to the Labor Department. The data sparked a relief rally in risk assets, with Bitcoin gaining 2% in the last 24 hours to reach $82,000 after falling below $79,000 earlier in the week. Other major cryptocurrencies also advanced, with XRP up 6%, Dogecoin rising 4%, and Cardano adding 2%.

The CPI numbers were encouraging, but investors should not assume the rally will last. External factors such as trade disputes and potential tariff escalations could reintroduce inflationary pressures, keeping volatility high across both traditional and digital asset markets.”

Despite the rebound, the crypto market remains significantly off its December highs, shedding nearly 30% of its total market capitalization since the Federal Reserve signaled fewer rate cuts in 2025 than previously anticipated. A slower pace of monetary easing has reduced liquidity, prompting investors to shift away from speculative assets.

Trade uncertainty has further complicated the outlook. President Donald Trump has imposed—and later partially rolled back—tariffs on imports from China, Canada, and Mexico, raising concerns over retaliatory measures that could push consumer prices higher. In a weekend interview with Fox News, Trump declined to rule out the possibility of a recession, referring to the current economic phase as a "period of transition."

Meanwhile, the administration’s long-awaited crypto policy changes have done little to boost confidence in the sector. Trump announced the creation of a national crypto reserve consisting of Bitcoin and other digital assets, but instead of new purchases, the government will rely on existing holdings from asset seizures.

While Wednesday’s inflation report provided a temporary lift to crypto markets, the broader economic landscape remains uncertain. Investors are bracing for continued volatility as monetary policy, trade relations, and regulatory developments unfold in the months ahead.