Bitcoin under pressure as risk sentiment weakens

Cryptocurrency markets opened the day under broad pressure on Tuesday, with Bitcoin sliding sharply and other major digital assets following suit. Bitcoin has fallen nearly 4%, slipping below the $86,000 level and trading near weekly low as risk appetite deteriorates among traders.

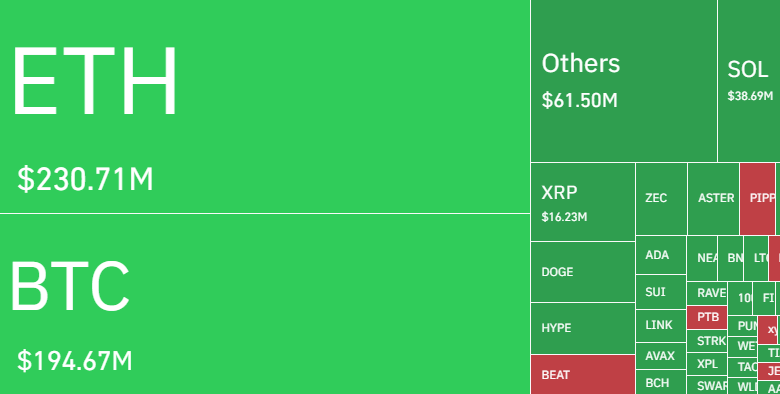

liquidations of long positions totaling over $584 million.

Bitcoin trading near 3-weeks low.

Bitcoin net Outflows last 24hrs 2K BTC.

Selling pressure comes from short-term traders

One of the key drivers of the recent decline has been liquidation in the futures market totaling over $584 million. This created a chain reaction where selling led to more liquidation, which then pushed prices even lower, this liquidation events often help reset the market by clearing out excessive risk and reducing overcrowded bullish positions. At the same time, investors are becoming more cautious because of uncertainty around monetary policy and global markets. With interest rates expected to stay higher for longer, traders are less willing to take aggressive bets on volatile assets like crypto. Bitcoin has increasingly traded in line with risk assets such as technology stocks, meaning weakness in equities has spilled over into digital assets. This has reduced short-term confidence, especially among momentum traders. Despite the current weakness, the broader structure of the market does not suggest panic or a breakdown in confidence. Long-term holders have not shown signs of mass selling, and on-chain data continues to point to accumulation during dips rather than widespread capitulation. This suggests that much of the selling pressure comes from short-term traders rather than long-term investors.

Source: Coinglass

Technical outlook

Bitcoin appears to have completed a full five-wave impulse move to the upside, suggesting that the broader trend over the past cycle was predominantly bullish. This move developed alongside increased liquidity, strong market participation, and rising interest from both retail and institutional participants. Following the completion of Wave (5), Bitcoin entered a broader corrective phase, which aligns with typical market cycle behavior and does not, by itself, indicate a trend reversal. The recent price decline has brought Bitcoin back toward a rising support trendline and a key horizontal area near $86,000. This zone is notable from a technical perspective, as it aligns with previous price structure and the lower boundary of the broader upward channel. If price were to move below recent monthly lows, historical technical behavior suggests the possibility of further downside toward the $72,000 region. Conversely, from a structural viewpoint, a move back above the $108,000 area would indicate renewed upside momentum within the broader trend.

Source: Trading View

Cooling sell pressure

Since November 22, the conclusion from exchange flow data has been clear: Bitcoin outflows have consistently been larger than inflows. This means more BTC has been leaving exchanges than entering them, which usually suggests that investors are choosing to hold their coins in private wallets rather than keep them on platforms where selling is easier. This behavior often reflects reduced panic and a longer-term mindset, even during periods of price weakness. Importantly, since December 7, there have been no major spikes in inflows. The lack of strong inflows indicates that there is no broad rush to sell, despite recent volatility and liquidation. Instead, the market appears to be digesting earlier excess leverage and rebalancing positions. Taken together, these trends support the idea that selling pressure is becoming more controlled, and that the current phase looks more like consolidation and positioning rather than a full-scale distribution or exit from the market.

Source: Coinglass