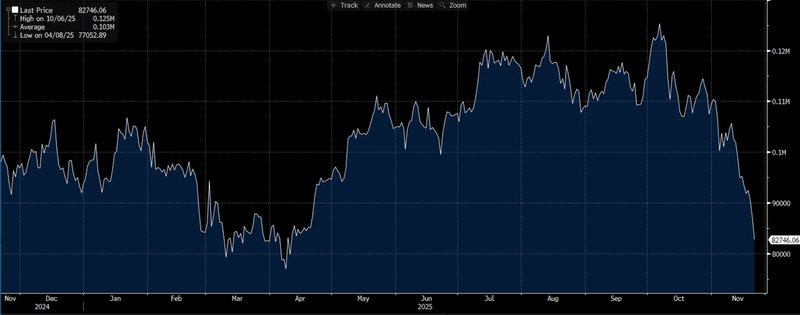

Crypto market extends slide as Bitcoin breaks below $86,000

Bitcoin’s selloff deepened in Asia trading, with prices slipping below $86,000 as whales offload holdings, dormant wallets wake up and options markets rotate into downside protection. Thin liquidity and policy uncertainty are turning crypto into the weak spot of global risk assets.

Bitcoin drops to around $82,400, down more than 20% over the past month

Options positioning clusters around the $85,000 and $82,000 downside strikes

Long-dormant wallets move tens of thousands of coins onto exchanges

MicroStrategy’s break-even zone near $74,400 is back on the market’s radar

Crypto market extends retreat as sellers stay in control

The cryptocurrency market extended a retreat that has now stretched beyond a month, with Bitcoin leading the move lower in Asia on Friday.

The benchmark coin fell as much as 2.1% intraday, briefly breaking below $86,000 for the first time since April. Bitcoin was changing hands around $83,000–$82,000, leaving it down more than 10% over the past 24 hours and more than 20% over the past month.

Source: Bloomberg

The move follows weeks of position unwinding after October’s record run-up, when leveraged bets and momentum flows pushed prices into stretched territory. As those positions have been forced out, liquidity on major venues has thinned, making the market more sensitive to relatively modest selling waves.

Whales lean into the four-year cycle narrative

On the supply side, large holders have been steadily reducing exposure. On-chain and fund-flow data suggest that “whale” entities have sold more than $20 billion worth of Bitcoin since September, mirroring the typical pattern seen late in previous four-year cycles.

Some analysts argue the cycle narrative is more psychology than fundamentals, but it has become self-fulfilling: once big wallets start de-risking, the liquidity gap amplifies every sell program and accelerates downside moves.

Adding further pressure, market makers report a heavy stream of coins from long-dormant wallets into centralized exchanges. Tens of thousands of previously inactive Bitcoin have moved in recent days after years off the grid, swelling the offer side just as natural spot demand is drying up.

Options market rotates toward downside protection

Derivatives flows are reinforcing the bearish tilt. On the main crypto options venues, demand for downside protection is concentrated around the $85,000 strike, followed by $82,000. Put open interest at those levels has overtaken many of the previously popular upside calls, signaling that traders are actively hedging against further declines rather than chasing a quick rebound.

Volatility curves remain skewed toward puts for both BTC and ETH, with traders rolling existing downside positions lower to keep protection in place as spot prices slide. That structure points to a market more focused on capital preservation than on adding fresh risk.

Macro uncertainty and a broken liquidity link

Unlike earlier corrections where crypto moved in lockstep with high-beta tech stocks, this latest leg lower has played out against a relatively resilient equity backdrop. Strong earnings from major AI names such as Nvidia have helped keep headline indices supported, even as cryptocurrencies endure their own internal deleveraging cycle.

Still, macro nerves are never far away. Shifting expectations around Federal Reserve policy, a patchy data backdrop after the government shutdown and uncertainty over the timing and depth of future rate cuts are all weighing on investors’ appetite for the riskiest corners of the market.

MicroStrategy’s break-even line comes back into focus

The latest price action is also dragging attention back to the biggest listed proxy for Bitcoin exposure: MicroStrategy. With spot BTC drifting toward the company’s estimated average break-even zone around $74,400, equity investors are starting to reassess how much downside they are willing to tolerate.

A large US bank has already warned that MicroStrategy could face index-related risks early next year, including the possibility of passive outflows if the stock is removed from key benchmarks. Any forced selling there would add another stress point to an already fragile crypto environment.

A fragile market waiting for a new catalyst

For now, the market is caught between exhausted buyers and emboldened sellers.

- Leverage has been flushed out but not fully rebuilt

- Spot books remain thin and skewed toward offers

- Options positioning is defensive rather than opportunistic

Unless a fresh macro or regulatory catalyst emerges to restore confidence and attract new capital, Bitcoin is likely to trade as a “liquidity asset” first and a “macro hedge” second — highly sensitive to flows, positioning and sentiment, and unforgiving when the bid disappears.