Dogecoin eyes revival as ETFs launch

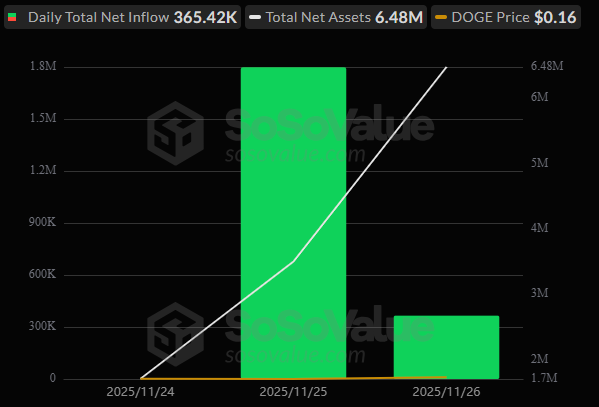

On 24 November 2025, the first U.S. spot ETFs for DOGE by Grayscale Investments began trading on NYSE Arca. Another fund by Bitwise was also launched, offering additional regulated exposure for investors who prefer traditional brokerage routes.

DOGE recently broke above the $0.150 resistance level.

Trading volumes were modest, and the immediate impact on DOGE price was minimal.

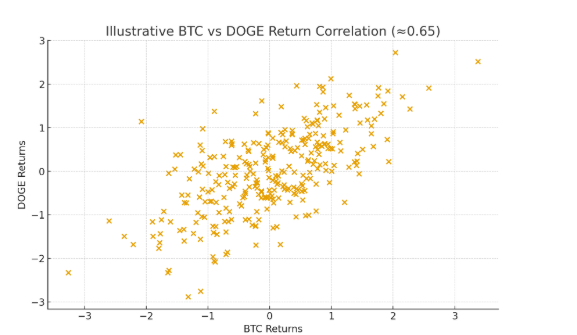

Strong positive correlation between BTC and DOGE correlation coefficient of roughly 0.68.

Technical outlook

DOGE forms potentially bullish structure, a series of higher lows and hold above week low. key support around $0.1480–$0.1490. If this zone holds, the bulls may aim for resistance levels near $0.1765–$0.1920. While Bitcoin gained 4.5% by increased expectations of a Federal Reserve rate cut in December with markets pricing in an 85% probability compared to 44% a days ago, Dogecoin has lagged the recovery. The bad performance reflects that investors are not willing to take risks as traders focus on Bitcoin rather than lower liquidity tokens, if Bitcoin hold above the $90,000 zone the investors trust on Alts will be back.

Source: Trading View

Grayscale Investments began trading in NYSE Arca

DOGE ETF marks a turning point in how retail and institutional investors can access the coin. For many, it represents a step toward mainstream recognition, trading volumes were modest, and the immediate impact on DOGE price was minimal. In other words: institutional legitimacy does not guarantee an immediate price rally as trust is broken between investors and Alts after the latest crash happened. For now, ETFs offer regulated exposure and might help stabilise liquidity, but Dogecoin future performance will likely depend on a broader set of factors Bitcoin sentiment, macroeconomic conditions, and renewed interest from investors.

Source: SoSoValue

0.65 correlated coefficient between BTC and DOGE

Bitcoin and Dogecoin continue to show a meaningful positive correlation, currently estimated around 0.65. This indicates that Dogecoin tends to move in the same general direction as Bitcoin, though with higher volatility. When Bitcoin attracts liquidity and bullish momentum, Dogecoin often follows as risk appetite expands across the broader crypto market. Dogecoin typically shows sharper and more volatile price swings. The synchronized peaks and pullbacks in the diagram highlight how shifts in Bitcoin momentum often lead similar reactions in Dogecoin, reflecting Bitcoin’s role as the primary driver of sentiment and liquidity across the broader crypto market.