Ethereum outshines Bitcoin but joins broad market pullback

After setting new all-time highs, Bitcoin and Ether are facing a sharp correction, with whale activity, profit-taking, and nearly $900 million in liquidations weighing on sentiment across the crypto market.

Bitcoin dropped below $110,000 for the first time in a month, with whales unloading 24,000 BTC and sparking $277 million in forced liquidations.

Ether extended losses after reaching $4,954, with leveraged traders hit hardest—$320 million wiped out in a single day.

The total crypto market cap shed $166 billion in 24 hours, slipping to $3.73 trillion, a critical support level.

Ether’s record rally meets resistance

Ether briefly stole the spotlight from Bitcoin last week, pushing above $4,950 to mark its first all-time high in nearly four years. The surge was fueled by dovish signals from the Federal Reserve and heavy inflows into Ethereum ETFs. Yet the momentum quickly faded, with ETH now trading near $4,400, down from its weekend peak.

Despite the pullback, Ethereum remains one of 2025’s strongest performers, gaining about 40% year-to-date and steadily narrowing Bitcoin’s dominance. ETF inflows continue to favor Ether, suggesting institutions are positioning more aggressively in altcoins compared to Bitcoin.

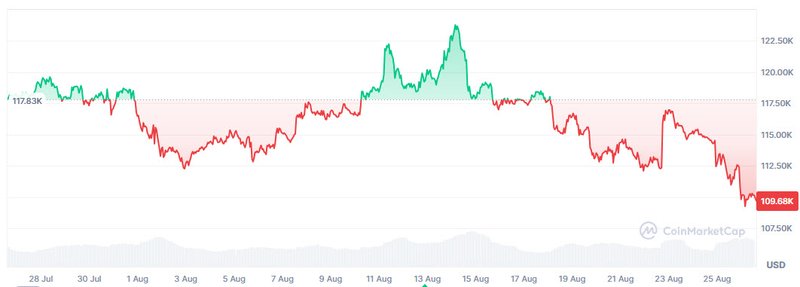

Bitcoin slips below $110K on whale sales

Bitcoin, which reached fresh records earlier in August, has reversed course sharply. The flagship cryptocurrency fell to $109,700, breaking below the $110,000 psychological support for the first time in a month.

The downturn was accelerated by the liquidation of 24,000 BTC (worth $2.7 billion) from a major whale wallet. Screenshots shared by blockchain trackers showed the address “19D5J…WoZ1C” unloading multiple tranches of 3,000–6,000 BTC between August 16–24.

Profit-taking intensified as traders booked $3.3 billion in realized gains, leading to a cascade of liquidations that shook the broader market.

Nearly $900M in leveraged bets wiped out

The correction triggered $818 million in long liquidations within 24 hours, catching overleveraged traders off guard. In total, nearly $900 million was wiped out across the crypto landscape.

- Ether traders suffered the most, with $320 million in losses.

- Bitcoin liquidations reached $277 million.

- Altcoins including Solana, XRP, and Dogecoin saw a combined $90 million in positions forced out.

Macro headwinds add to volatility

The broader backdrop remains highly macro-driven. Fed Chair Jerome Powell’s dovish tone lifted expectations for a September rate cut to 84%, but traders remain cautious with critical data ahead, including U.S. GDP on Aug. 28 and unemployment figures in early September.

High interest rates remain a risk for crypto markets: tighter liquidity, higher financing costs for miners, and weaker exchange volumes could suppress recovery momentum. Options markets now reflect heightened defensive positioning, with stronger demand for puts on both Bitcoin and Ether.

Technical outlook

- Bitcoin support: $108,000 (historical bounce point). If breached, next level at $105,000.

- Ethereum support: $4,200 zone, with resistance back at $4,950.

- Market cap: $3.73 trillion remains the critical threshold—losing it could trigger another wave of outflows.