Not Saylor, nor ETFs: The systemic trigger behind Bitcoin flash crash

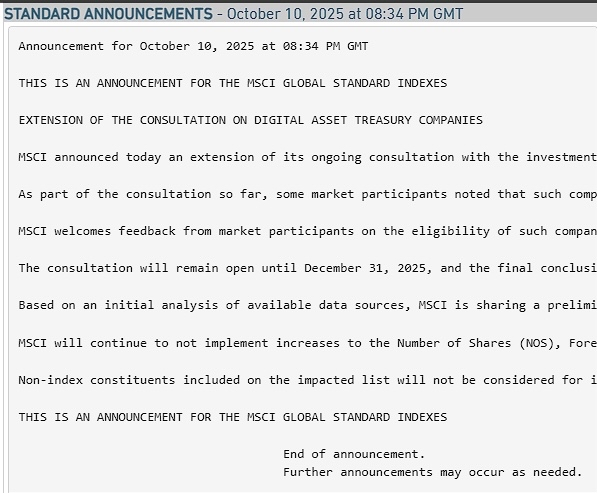

October 10, $20B wiped out in minutes altcoins cratered and bitcoin collapsed.MSCI, a major global index provider, released a formal update extending its public consultation on how to classify digital asset treasury (DAT) companies. The proposal under debate excludes MSCI equity indexes any company whose crypto holdings make up a large portion of its total assets.

Positions were forced closed algorithmically, not via human trading.

Crypto platforms don’t have protections to slow down cascading liquidations.

Institutional flow could dry or reverse and make the ghost of starting bear market rise.

The crash was more than just a glitch

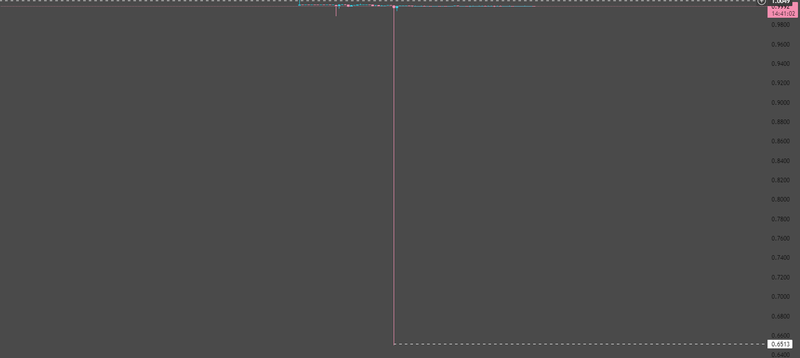

According to post-mortems, there was de-pegging event stablecoin (USDe) on a major exchange (Binance) briefly dropped in price to $0.65 while on other exchanges it remained $1.

The platform used internal book prices to assess collateral, this plunge drastically undermined collateral value for many users, this triggered a wave of deleveraging, positions were forced close algorithmically not via human trading.

The automatic deleveraging cascade snowballed, record leveraged liquidations occurred across exchanged contributing to a historic liquidity drawdown.

Source: Trading View

Link between MSCI & the crash

Many markets observers tie the sudden price collapse to the MSCI announcement, timing of the notification and the crash are closely aligned in time. MSCI classifies treasury companies as funds, passive index managers may be forced to sell, triggering future stress. And according to some big holders, they knew the implications of MSCI review and positioned accordingly before the decision became public. Tom Lee (BitMine) commented that part of the crash was due to automatic deleveraging triggered by technical glitch suggesting mechanical factors played a major role. Using internal spot pricing rather than reliable oracles makes collateral vulnerable to local mispricing, market makers reduce exposures in panic, order books become shallow, and force sales to move prices dramatically. Some crypto treasury (like MicroStrategy) could be treated more like funds than traditional operating companies, being dropped from indices can trigger massive outflows, MSCI has said the decision will be announced on January 15, 2026.Most important point we should focus on is unlike traditional equites; many crypto platforms don’t have coordinated halts or protection to slowdown cascading liquidations.

Why MSCI decision matters

Companies like MicroStrategy, BitMine, and others are under direct risk, if classified as funds, they could be excluded from major MSCI benchmarks, that exclusion could force billions in passive selling; some analysts warn that index tracking funds could be compelled to dump those equities.

For the crypto market, this isn’t just about few companies, it’s about confidence if major treasures are de-indexed, institutional flow could dry or reverse and makes the ghost of starting bear market rise. Many now argue that the depeg of USDe and a pricing oracle failure played equally important role in triggering cascades, the market was heavily levered, and ta overextension meant any shock could lead to outsized liquidation even without intentional selling.

More than a crash

The October 10 crash was not just another liquidations event, it exposed holes in market design; particularly around how exchanges, collateral systems, and index providers interact. The MSCI announcement acted as a catalyst, but it was the systemic fragility beneath the surface that turned a shock into a historic wipeout. This isn’t simply about short selling institutions; it’s about whether key crypto players are structurally integrated into the trade world or permanently relegated to a riskier, more volatile fringe.