US regulatory setback and market reaction

Cryptocurrency markets have shown mixed performance in the wake of regulatory uncertainty. Bitcoin has traded in a narrow range near $95,000–$96,000, The US Senate Banking Committee has postponed its scheduled markup, At the same time, other segments of the regulatory apparatus remain active. The Agriculture Committee’s planned January 27 markup signals continued legislative engagement.

The US Senate Banking Committee has postponed its scheduled markup.

Bitcoin was reported around $95,436, while major altcoins such as Solana and Dogecoin were under pressure.

The Agriculture Committee’s planned January 27 markup signals continued legislative engagement.

US senate delays crypto bill

The US Senate Banking Committee has postponed its scheduled markup of a high‑profile cryptocurrency regulatory bill following public opposition from Coinbase CEO Brian Armstrong. The draft legislation, often referred to as the Digital Asset Market Clarity Act or a crypto market‑structure bill, was expected to be debated in committee this week but was delayed late Wednesday after Coinbase withdrew its support. The bill aimed to clarify how digital assets should be regulated in the United States, including defining when tokens are securities or commodities and determining the role of regulators such as the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC).

Armstrong’s concerns are centered on several provisions in the draft that he said could be detrimental to the industry. This included language that would effectively prohibit tokenized equities, impose broad restrictions on decentralized finance (DeFi), weaken the CFTC’s authority relative to the SEC, and eliminate the ability for consumer platforms to offer rewards on stablecoin holdings.

Bitcoin holds, altcoins lag

Cryptocurrency markets have shown mixed performance in the wake of regulatory uncertainty. Bitcoin has traded in a narrow range near $95,000–$96,000, reflecting a degree of resilience despite regulatory headwinds. On January 16, Bitcoin was reported around $95,436, while major altcoins such as Solana and Dogecoin were under pressure, with Solana near $142 and Dogecoin around $0.13. The total crypto market capitalization was approximately $3.22 trillion at the same time.

Market reports indicate that risk appetite has been uneven. Bitcoin’s dominance has climbed toward 60% of total market cap, suggesting capital concentration in the largest asset while smaller tokens lag. Recent sessions saw Bitcoin facing resistance near the $97,000 level, with price retracements over the past days indicating a cautious stance among traders.

Bitcoin’s relative strength compared with altcoins reflects broader macro and regulatory sentiment. In some reports, softer US inflation data and persistent geopolitical uncertainty have supported Bitcoin as a perceived store of value, even as broader risk markets remain tentative.

Source: Trading View

Next for crypto regulation

Some market forecasts suggest that a comprehensive framework could unlock further institutional participation and capital inflows into regulated products such as spot Bitcoin and Ethereum ETFs, which currently hold over $100–$120 billion in combined assets.

Following the Senate’s postponement of the crypto market structure bill after Coinbase’s opposition, regulatory clarity in the U.S. is now likely to unfold gradually through 2026. Committees are expected to revisit markups, but broader political dynamics, including the 2026 midterms, may push final legislation into late 2026 or beyond.

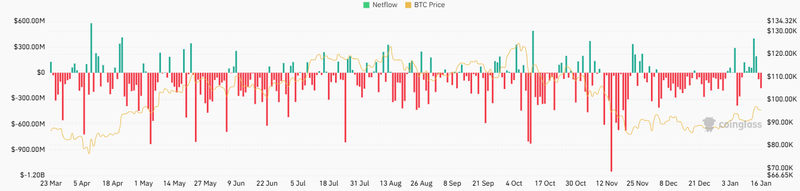

Market signals reflect this uncertainty. Bitcoin recorded consecutive record outflows from exchanges: $75 million on January 15 and $179 million on January 16, suggesting holders are moving assets into private custody. Such flows reduce available sell-side liquidity and indicate strategic positioning by long-term holders amid regulatory ambiguity.

Price behavior mirrors this cautious sentiment: Bitcoin trades near $95,000–$96,000, while altcoins lag, highlighting selective risk appetite. Institutional analysis suggests that eventual legislative clarity could encourage renewed inflows into regulated products like spot Bitcoin ETFs, but near-term volatility is likely to persist as markets digest both policy headlines and liquidity trends.

Source: Coinglass