What’s next for crypto? Fed’s liquidity pivot reignites the fire

The Federal Reserve’s upcoming quantitative easing program could trigger a powerful crypto rally as liquidity returns to markets. But with valuations already high and inflation sticky, analysts warn that the next surge could form a dangerous bubble.

The Fed will restart quantitative easing in December, ending its tightening phase

Renewed liquidity is expected to lift risk assets, led by crypto markets.

Analysts warn that easing amid high valuations could inflate a new bubble.

Bitcoin and Ethereum could lead a liquidity-driven bull run reminiscent of 2020.

The fed pivots back to liquidity

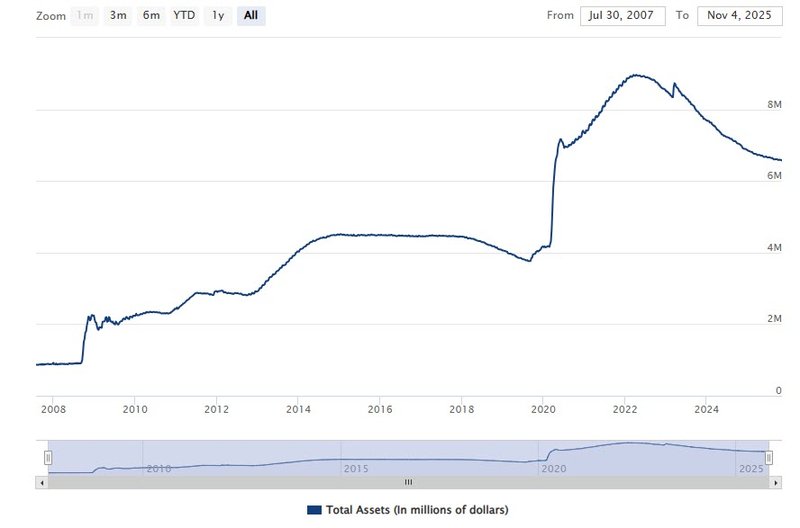

After two years of draining liquidity from financial markets, the Federal Reserve is preparing to reverse course. Chair Jerome Powell confirmed that the Fed will end balance-sheet runoff on December 1, marking the start of a new phase of quantitative easing (QE).

“Our long-stated plan has been to stop balance-sheet runoff when reserves are somewhat above the level we judge consistent with ample reserve conditions,” Powell noted in his latest remarks. “Signs have clearly emerged that we have reached that standard.”

While he described the decision as a “technical adjustment,” investors saw it as a clear signal that the Fed’s tightening cycle has effectively ended. By resuming asset purchases—or allowing liquidity to rebuild through expiring securities—the central bank will inject fresh cash into the system, easing financial conditions and lowering borrowing costs.

The shift also reveals a subtle but important change in priorities: from combating inflation to safeguarding market stability. That psychological turn alone may be enough to awaken the dormant speculative forces that defined the post-2020 era.

Source: Federalreserve.gov

Crypto stands first in line for liquidity

In an environment where money becomes cheaper and abundant, few asset classes respond as sharply as crypto. Bitcoin and Ethereum, widely viewed as barometers of global liquidity, have historically been the first beneficiaries of renewed easing.

If quantitative easing resumes as planned, analysts expect a chain reaction. Institutional capital could rotate back into digital assets, stablecoin supply could expand, and risk appetite could cascade through altcoins and meme tokens.

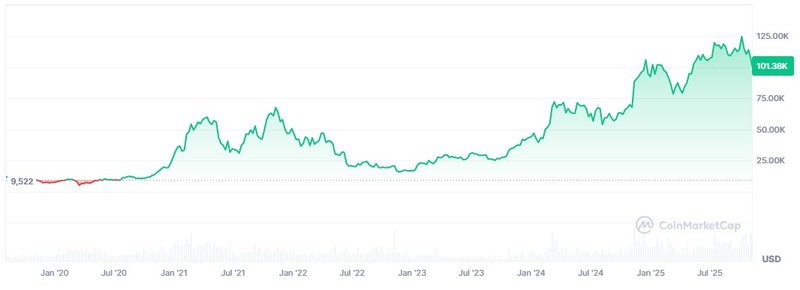

The familiar narrative would return: “money printer go brrr,” renewed inflation-hedge speculation, and the re-emergence of crypto as the purest expression of liquidity-driven optimism. For short-term traders, this could ignite the most powerful rally since the 2020 bull cycle, when Bitcoin surged from $10,000 to nearly $70,000 in a year.

But while liquidity can lift markets swiftly, it rarely discriminates between sustainable growth and speculative excess.

Source: coinmarketcap

The anatomy of a bubble

The macro backdrop today is strikingly different from the one that followed the pandemic shock. The U.S. economy remains overheated, with record stock valuations, tight labor markets, and persistent inflation near 3%. Injecting fresh liquidity into such conditions risks overstretching already inflated assets.

The combination of easy money, large fiscal deficits, and high investor leverage could propel valuations to levels detached from fundamentals. As capital floods into risk assets, crypto could once again become the emblem of financial exuberance—a mirror reflecting the same speculative fever that fueled the last cycle’s mania.

Monetary veterans caution that easing into strength is far riskier than easing into weakness. Once inflation reignites, the Fed could be forced into another round of rapid tightening, creating a violent liquidity whiplash. The reversal would expose leveraged bets, drain liquidity from digital markets, and trigger sharp sell-offs across equities, bonds, and crypto alike.

Euphoria before the turn

For now, markets are celebrating the coming wave of liquidity. Bitcoin’s correlation with global money supply has strengthened again, and volatility gauges show renewed investor optimism. Yet the deeper question remains: is this the start of a sustainable recovery—or the final euphoric chapter of a long liquidity-driven cycle?

Every easing phase in history has carried both opportunity and danger. The same liquidity that powers innovation and risk-taking can also inflate bubbles that burst under their own weight.

If December’s QE launch sparks another crypto boom, it may offer short-term profits but carry the seeds of longer-term instability. What looks like a new beginning could, in hindsight, be remembered as the last great rally before the tide turns.