BoE balances rate cuts, sticky inflation and UK growth risks

The Bank of England’s cautious shift toward easing comes at a time when inflation remains elevated, growth is subdued and markets are reassessing the outlook for UK rates and sterling.

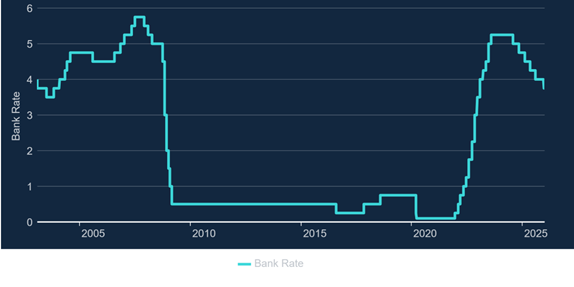

Bank of England cut its benchmark interest rate to 3.75% at its December meeting.

Easing from 3.8% in September to 3.2% in November.

GDP grew by 0.4%, followed by 1.1% in 2024, with 2025 expected to end at 1.25%.

Price action is currently testing key resistance levels.

Cautious rate cuts

The Bank of England (BoE) cut its benchmark interest rate to 3.75% at its December meeting. This move reflects the Bank’s main priority - bringing inflation under control. While inflation has been easing, it’s still the highest among major Western economies and remains above the 2.0% target.

The decision was not unanimous. The Monetary Policy Committee (MPC) approved the cut by a narrow 5-4 vote, highlighting clear divisions within the committee and concerns about moving too quickly with rate cuts.

The BoE is currently balancing two pressures. On one side, the UK economy is showing signs of stagnation and the labour market is cooling, which supports the case for lower rates. On the other, inflation remains elevated, requiring caution to prevent price pressures from returning.

Markets expect two additional 25-basis-point rate cuts in 2026. However, the BoE has stressed that any further easing will depend on incoming data. Rate cuts will only continue if inflation shows a sustained and measurable slowdown. As a result, the central bank’s flexibility remains limited as it carefully weighs economic growth risks against the need to maintain price stability.

UK inflation above target

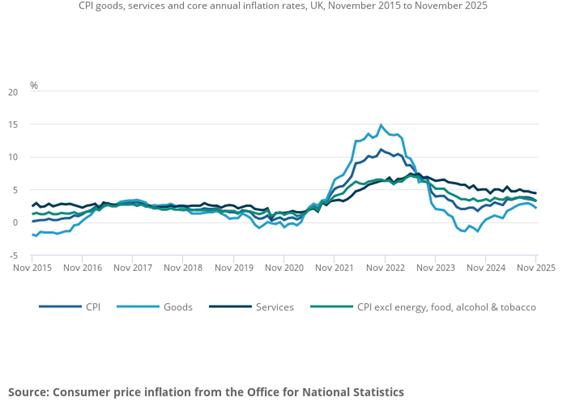

According to the Office for National Statistics (ONS), headline inflation has slowed notably, easing from 3.8% in September to 3.2% in November. Despite this improvement, inflation remains well above the 2% target, meaning price pressures are still a key concern for policymakers.

While the Bank of England expects inflation to move closer to its target during 2026, services inflation remains a key concern, currently standing at 4.4%. This persistence is largely driven by strong wage growth. Total average weekly earnings, including bonuses, rose by 4.7% in October 2025, continuing to add pressure to service-sector prices.

Looking at the components of November’s inflation data, the main factors pulling inflation lower were reduced spending on food, non-alcoholic beverages, alcohol and tobacco. Since 2022, the easing in goods prices has been the main driver behind the slowdown in headline inflation. In contrast, services inflation has remained more resilient, continuing to account for a larger share of overall price pressures (see Figure 2).

Growth risk in the UK economy

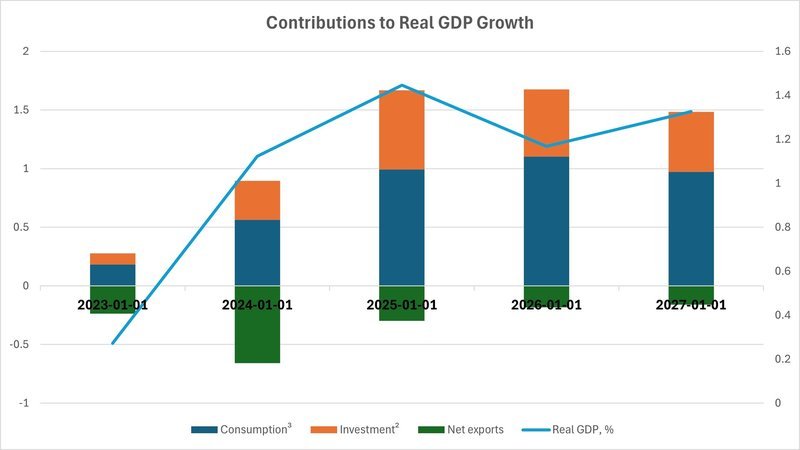

Weak economic growth continues to be a long-standing challenge for the United Kingdom. In 2023, Gross Domestic Product (GDP) grew by just 0.4%, followed by 1.1% in 2024, with 2025 expected to end at 1.25%. In each of these years, growth has remained well below the long-term historical average of 2.44% (1949–2024), according to Trading Economics.

The Organisation for Economic Co-operation and Development (OECD) expects UK GDP growth to slow to 1.2% in 2026, before edging slightly higher to 1.3% in 2027.

This moderation is mainly linked to tighter budgets limiting domestic consumption, alongside the ongoing effects of global macroeconomic uncertainty. The OECD also anticipates a neutral monetary policy path, with inflation gradually easing toward 2.5% in 2026 and 2.1% in 2027.

At the same time, fiscal policy is expected to remain restrictive, reflecting high public borrowing costs, a rising debt-to-GDP ratio and a large budget deficit.

Projections for real GDP in 2026 point to a more challenging growth mix. Investment is expected to gradually contract, consumption growth is set to slow and the contribution from net exports is likely to weaken (see Figure 3).

GBPUSD technical analysis

From a technical perspective, the overall trend in GBP/USD remains broadly bullish. However, price action is currently testing key resistance levels in the near term. Momentum indicators, including the MACD (Moving Average Convergence Divergence), point to a slight loss of upward momentum, suggesting the bullish strength may be easing.

At the same time, the ADX (Average Directional Index) is beginning to signal building bearish pressure. This suggests the market may enter a phase of consolidation or a short-term correction before the next significant move develops.

Figure 4: GBP/USD exchange rate (2024–2025). Source: Intercontinental Exchange data; proprietary analysis conducted via Trading View.