BoJ policies and higher yields add pressure to carry trades

Japan’s gradual shift toward policy normalisation, rising government bond yields and a narrowing rate gap are reshaping expectations for the yen and increasing pressure on long-standing carry trades.

Inflation has remained above the 2% target since March 2022.

Japanese government bond (JGB) yields have risen sharply, with 10-year maturities reaching 2.123%.

The yen carry trade is becoming increasingly vulnerable.

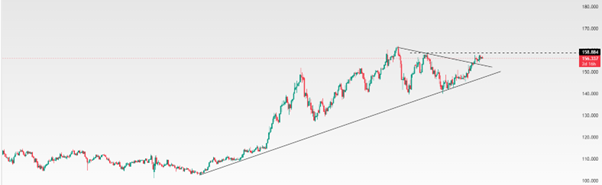

Resistance is seen around 157.5–158.0.

BoJ normalisation and policy shift

The Bank of Japan is expected to continue its gradual path toward policy normalisation this year, rather than move toward aggressive tightening.

Inflation has remained above the 2% target since March 2022, supporting the view that price pressures are becoming more durable rather than temporary. Even so, despite inflation staying above target, markets are not currently pricing in a rate hike in the first quarter of 2026.

This approach reflects the Bank of Japan’s focus on maintaining flexibility, giving policymakers more time to assess whether higher inflation is sustainable and to avoid harming economic growth through premature tightening.

If inflation remains above target later in the year, the BoJ is likely to move forward with measured interest rate increases, with markets currently pricing modest hikes beginning in mid-2026. The key risk lies in execution. Faster-than-expected policy moves or sharp yen volatility could disrupt domestic growth, impact exporters and strain fiscal stability, particularly given Japan’s high debt burden.

Rising JGB yields and market implications

Japanese government bond (JGB) yields have risen sharply, with 10-year maturities reaching 2.123%, highlighting a clear upward trend as markets price in continued monetary policy adjustment.

Higher yields raise the cost of funding in yen and make domestic fixed-income assets more attractive, which could reduce capital flowing into overseas markets. If yields continue to move toward the 2.3-2.4% range, domestic liquidity may tighten further.

This would likely support a stronger yen, add pressure on exporters and signal that markets are expecting a more sustained path of policy normalisation.

Based on current economic data, moderate GDP growth, inflation remaining above 2% for more than 14 consecutive months and steady wage gains, markets generally expect JGB yields to stay elevated and edge higher in Q1 2026. Sharp spikes are seen as unlikely, as the Bank of Japan remains cautious about triggering excessive market volatility.

As yields rise gradually, markets may become more sensitive to unexpected shocks or delays in policy implementation, which could amplify short-term volatility in exchange rates and carry-trade positions.

Yen carry trade unwind and global effects

As the year unfolds, the yen carry trade is becoming increasingly vulnerable, as the interest rate gap between Japan and other major economies continues to narrow.

Even modest rate hikes by the Bank of Japan and higher JGB yields are reducing the appeal of borrowing yen to fund higher-yielding assets overseas. Current data points to a gradual unwinding of carry trades, as investors trim exposure and increase hedging activity.

The likely outcome is a firmer yen during periods of global risk aversion, alongside reduced liquidity in risk-sensitive assets. The main risk lies in acceleration, which could lead to disorderly unwinds, sharp moves in the yen and wider market disruptions.

USDJPY technical outlook

USD/JPY has stabilised around 156.6 following recent losses, finding support from Japan’s modest rate hikes and the Bank of Japan’s guidance pointing to a gradual path of policy normalisation.

From a technical perspective, resistance is seen around 157.5–158.0, while support sits near 156.0. Looking ahead, USD/JPY could move toward 160.0 if global risk appetite weakens and US yields rise. Conversely, a sharp strengthening of the yen could pull the pair lower toward 155.0. Market focus remains firmly on JGB yields, carry trade dynamics and Bank of Japan communication.