US growth is solid as sticky inflation pressures the Fed

The US enters 2026 with growth intact and inflation above target, keeping the Fed in a difficult holding pattern. It’s not a recession backdrop, but an untidy one as political pressure tests data-led policy this quarter.

Core inflation remains below 3% year-on-year.

Growth is expected around 2% in 2026.

Job growth is slowing to approximately 50,000–60,000 positions per month, with unemployment at 4.4% at the start of 2026.

Interest rates are expected to remain in the 3.50%–3.75% range, with a rate hold in the January meeting seen as the base scenario.

Federal Reserve communication may carry as much weight as policy actions, with verbal hawkishness potentially interpreted as a political signaling move.

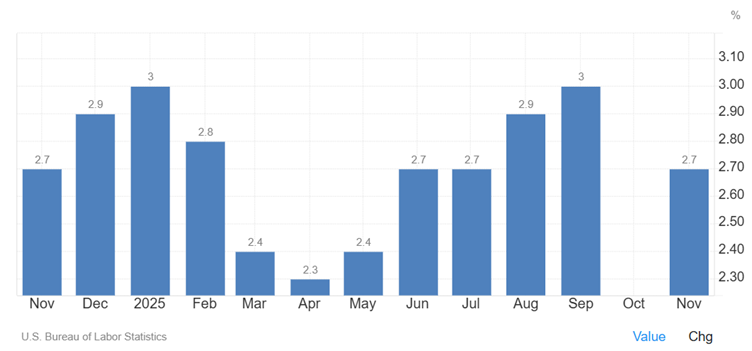

Inflation has eased but progress is slowing

Disinflation has come a long way from its early-2020s peak, but progress is slowing in the final stretch. Headline inflation is holding just below 3% year-on-year, with core not far behind. Services remain the sticking point, with housing, healthcare and insurance, as well as the wider services complex, easing only gradually.

Tariffs are adding uncertainty to an already sticky inflation picture. The import measures introduced in 2025 act as a lagged cost shock, working through supply chains and into consumer prices.

Powell has framed the impact as meaningful but temporary, suggesting the Fed does not want to overreact to a policy-driven bump. Even so, “temporary” can last long enough to shape expectations, which is a risk the Fed is actively managing.

Source: TradingEconomics

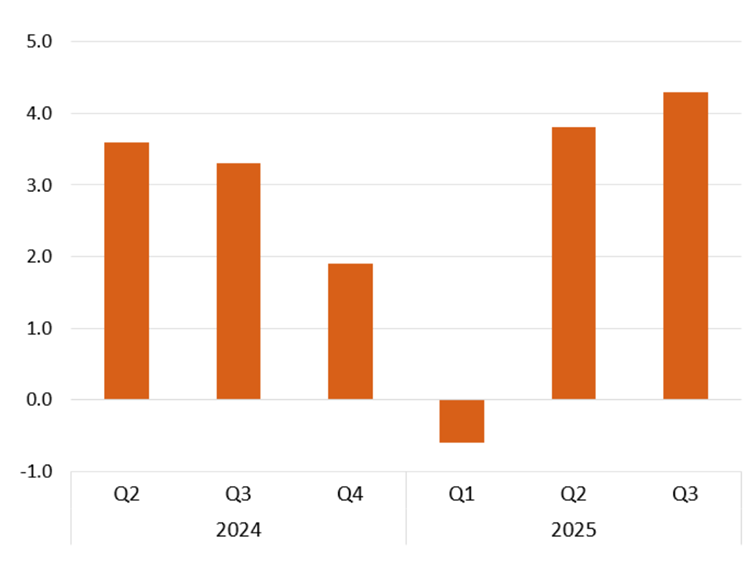

Growth is near trend, but not thrilling

Activity looks steady rather than standout. Growth around 2% in 2026 keeps the economy near trend, with Q1 broadly fitting that profile. Consumers have adjusted to higher rates without buckling, while business investment is finding support from AI-linked capital spending and ongoing infrastructure build-out.

Source: US Bureau Economic Analysis

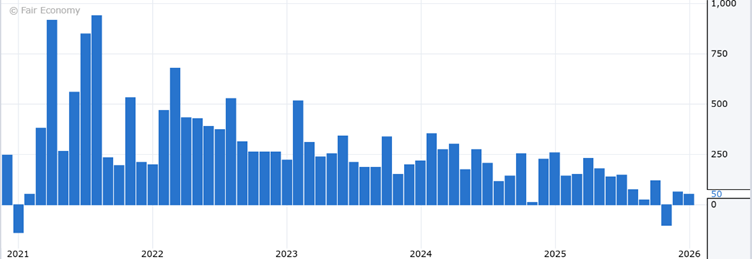

Labour uptrend is still unfolding

The labour market has cooled from its post-pandemic peak, but remains intact. Hiring is expected to slow to around 50,000–60,000 jobs per month, with unemployment near 4.4% in early 2026. That moderation should ease wage pressure over time, but not enough to force the Fed into action at every meeting.

Source: ForexFactory

Rates look set to stay on hold through Q1

With the target range at 3.50%–3.75%, markets are pricing a hold into late January. March is the first real decision point and even then a cut needs two conditions: inflation continues to drift lower and labour softening that looks persistent, not noisy. The Fed can wait if growth holds near trend and financial conditions don’t tighten sharply on their own.

Independence is the new risk premium

The political backdrop is no longer just noise. Powell has suggested that Justice Department subpoenas linked to his testimony on Fed headquarters renovations form part of a broader pressure campaign, with implications for rate-setting. Even if policy remains data-driven, the perception of interference can lift uncertainty premia and make markets more sensitive to policy signals.

In Q1, tone may matter as much as action. Markets will be listening for whether Powell sounds restrictive, conditional or quietly preparing to pivot.

The economy looks durable. Inflation remains sticky. The Fed is conditional. Politics, meanwhile, are messy, which is why Q1 may be shaped less by any single data point and more by whether the Fed can keep the narrative anchored to data dependence.

Trend support under pressure

The dollar index is hovering near 97.40, resting on a rising trendline that dates back to the 2011 low. A sustained break below that support would shift focus to the 96.10 area, particularly if driven by narrowing rate differentials. If the trendline holds, consolidation with a mild rebound bias looks more likely, keeping the 100 level as the next key reference.