Why UK inflation is diverging from the euro area

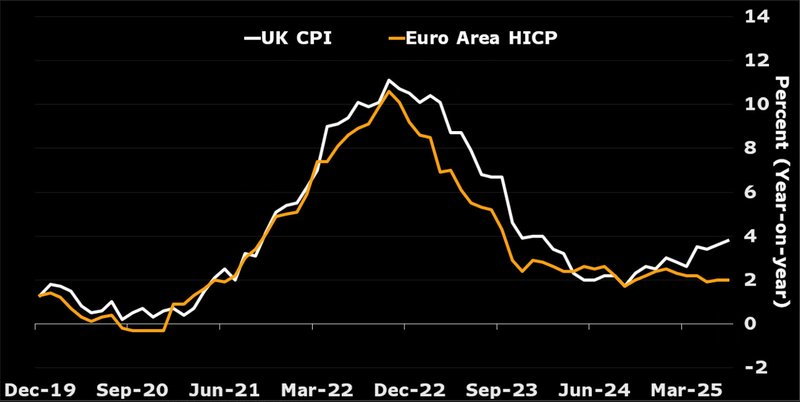

UK inflation surged to 3.8% in July 2025, more than double its level a year ago, while the euro area remains close to the ECB’s 2% target. Structural factors—from energy pricing to wage growth and tax policies—explain the widening gap.

UK inflation rose from 1.7% in September 2024 to 3.8% in July 2025, while euro area inflation stayed around 2%.

Energy price mechanics and Ofgem’s quarterly cap have amplified the UK’s swings compared to eurozone pricing structures.

Tax hikes, regulated prices, and sticky wage growth have added persistent upward pressure on UK inflation.

Slower wage growth and fewer one-off regulated price increases are needed for the inflation gap to narrow.

The Bank of England faces the risk that strong real wage gains fuel longer-lasting inflationary pressures.

The inflation gap widens

In September 2024, UK and euro area inflation were identical at 1.7%. Fast forward a year, and the UK’s rate has more than doubled to 3.8% while the euro area remains close to the European Central Bank’s 2% target. The near two-point gap is one of the largest divergences in recent history.

The biggest driver is energy. UK household energy bills are tied to a regulated cap updated quarterly by Ofgem. This mechanism introduces a lag in how wholesale energy price changes feed into consumer bills. In contrast, eurozone countries tend to pass through wholesale energy costs more quickly and only adjust when shifts are sustained.

This timing difference explains much of the UK’s recent acceleration. In 2024, sharp drops in energy bills artificially suppressed CPI. As those base effects fell out of the annual comparison in 2025, underlying inflation pressures became visible.

Source: Bloomberg

Beyond energy: wages, taxes, and regulated prices

While energy explains much of the shift, other forces are at play:

- Wages: UK private sector pay growth was 5.5% in early 2025, well above the euro area’s 3.8%. Despite some slowdown, wage settlements remain sticky, especially in services.

- Taxes and regulation: new VAT on private school fees, higher vehicle excise duty, and rising water bills have each added incremental inflationary pressure. Analysts estimate these factors alone contributed around 0.3 percentage points to annual CPI.

- Services inflation: unlike the euro area, where services inflation eased, UK services inflation has remained broadly stable. This reflects firms adjusting to higher labor costs and national insurance contributions.

Together, these factors have prevented UK inflation from easing in line with Europe.

Why the Bank of England is concerned

The Bank of England is particularly wary of wage resistance. British workers have been more effective at preserving real incomes compared to euro-area counterparts. Since 2019, UK real wages are around 5% higher, while eurozone wages have barely budged.

This resilience boosts household spending power but risks embedding inflation expectations. If workers continue to push back against real wage erosion, inflation could prove more persistent, complicating monetary policy.

What it will take to close the gap

For the UK’s inflation differential with the euro area to narrow, several conditions must align:

- One-off regulated price hikes must fade. Unless the UK government leans heavily on indirect taxation in its next budget, this upward impulse should diminish.

- Wage growth must slow further. Forward-looking data suggest UK pay growth could slip below 4% by year-end, closer to euro area levels.

- Energy pricing must stabilize. If wholesale prices remain calm, Ofgem’s quarterly updates will stop amplifying inflation swings.

Even then, risks remain. Should households and firms continue to expect higher prices, the UK’s inflation gap could persist into 2026.

The UK’s inflation divergence from the euro area is not just a story of energy bills—it reflects structural pressures in wages, taxes, and policy design. While base effects may fade in the months ahead, the Bank of England must remain alert to the risk that inflationary psychology hardens.

For now, the UK stands at a crossroads: either wage growth and regulated costs moderate, allowing inflation to converge back toward 2%, or sticky pay settlements keep Britain on a different trajectory well into 2026.