Fed meeting today as Trump says rates will “come down a lot”

The Federal Reserve is widely expected to keep interest rates unchanged this week, resisting mounting pressure from the White House as officials weigh stubborn inflation against signs of labour-market stabilization and renewed political scrutiny of the central bank’s independence.

Rates seen on hold after three cuts last year, despite White House pressure

Inflation remains above the Fed’s 2% target as job growth shows tentative stability

Political scrutiny of the Fed escalates with subpoenas and legal challenges

Rates on pause after last year’s cuts

US central bankers are expected to leave borrowing costs unchanged at their meeting on Wednesday, following three rate cuts last year aimed at cushioning the economy after hiring slowed sharply in the wake of President Donald Trump’s tariff escalation last April.

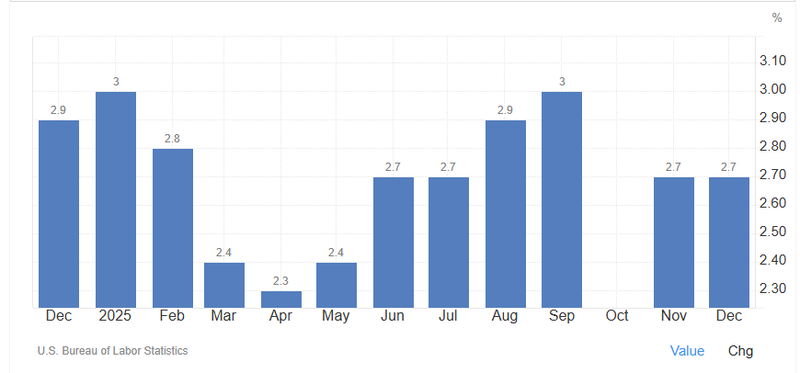

While those moves were designed to prevent a deeper labour-market downturn, policymakers now see signs that unemployment has steadied and growth may be regaining momentum. Inflation, however, remains stubbornly above the Federal Reserve’s 2% target, reinforcing the case for caution and keeping rates where they are for now.

Source: TradingEconomics

Inflation versus employment: the core dilemma

The policy debate inside the Fed remains finely balanced. Some officials argue that further easing should wait until inflation shows clearer signs of cooling, while others believe modest additional cuts could help shore up hiring, which has yet to meaningfully rebound.

In December, only 12 of the 19 participants in the Federal Open Market Committee signaled support for at least one additional rate cut this year. It is expected now two cuts in 2026, with June or later seen as the most likely window.

Powell under pressure as independence tested

Chair Jerome Powell enters the meeting under extraordinary political pressure. Earlier this month, he disclosed that the Fed had received subpoenas from the Justice Department linked to his congressional testimony on a $2.5 billion renovation of the central bank’s headquarters. Powell said the investigation was being used as a pretext to pressure the Fed into cutting rates faster.

The situation intensified last week when the Supreme Court took up a case stemming from Trump’s earlier attempt to remove Fed Governor Lisa Cook, an unprecedented move in the institution’s 112-year history. Justices appeared inclined to allow Cook to remain in her post while the case proceeds.

Succession talk and market unease

Trump has also indicated he is close to naming a successor to Powell, whose term as chair expires in May. An announcement could come as soon as this week, adding another layer of uncertainty to markets already sensitive to questions around Fed independence.

The pressure campaign may have backfired, with senior Republicans in the Senate voicing support for Powell and threatening to block confirmation of any replacement until legal issues are resolved.

Quieter chair, louder signals from others

Powell himself has kept a lower public profile in recent months, leaving much of the policy messaging to other officials. That, analysts say, underscores the collective nature of rate decisions and may reflect a deliberate effort to shield the institution amid political turbulence.

This year, Beth Hammack, president of the Cleveland Fed; Neel Kashkari, president of the Minneapolis Fed; Lorie Logan, president of the Dallas Fed; and Anna Paulson, president of the Philadelphia Fed, will vote on rate decisions. All have recently expressed some skepticism of the need for further cuts anytime soon.

In a speech earlier this month, Paulson said an improving economy should allow more rate cuts later in the year.

Fragile confidence backdrop

Despite expectations that larger tax refunds and firmer growth could support consumer spending, sentiment remains fragile. The Conference Board reported this week that US consumer confidence fell to its lowest level in more than a decade, highlighting the delicate balance facing policymakers as they navigate inflation risks, weak hiring and rising political scrutiny.

Rates will come down “a lot”

Speaking in Iowa on Tuesday, Trump again criticized Powell, accusing the Fed chair of moving too slowly on monetary policy. “We call him too late. He’s too late,” Trump said.

He argued Powell has been deliberately keeping borrowing costs elevated, saying the chair “wants to keep rates as high as possible,” while claiming his administration has still managed to push “rates down.”

With Powell set to step aside as chair in May, Trump said the US would get a “great Fed chairman,” adding that an announcement would come “pretty soon.” He also said interest rates will “come down a lot” under his nominee.

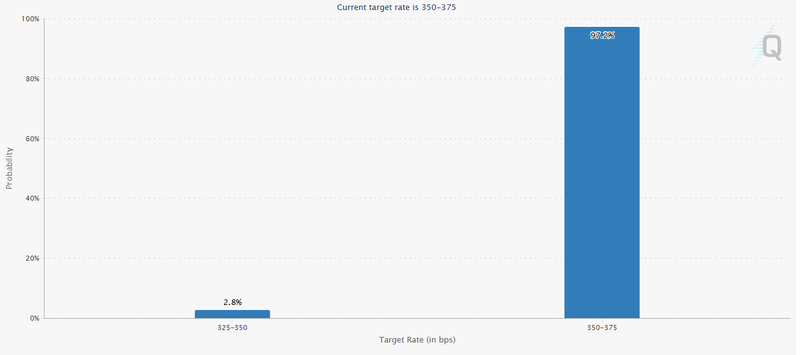

Trump’s remarks came ahead of Wednesday’s Federal Open Market Committee decision, where rates are widely expected to be left unchanged. The CME Group’s FedWatch tool showed a 97.2% implied probability of no move.

Source: CME Group

Trump says he has picked the next fed chair

As scrutiny around the Federal Reserve’s independence grows, Trump said last week he has already made his choice for the next chair.

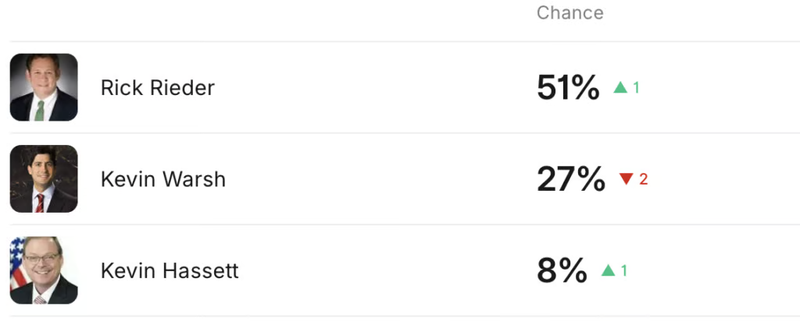

Kalshi prediction markets point to BlackRock’s global fixed-income CIO Rick Rieder as the leading candidate, with a 51% implied chance. Former Fed Governor Kevin Warsh was next at 27%, while National Economic Council Director Kevin Hassett stood at 7%.

Source: Kalshi