RBNZ between sticky inflation and weakening labour

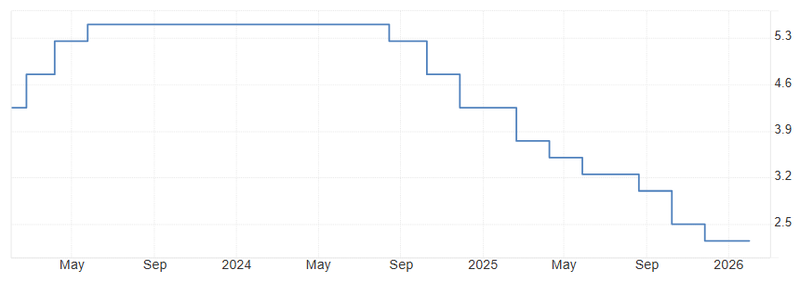

New Zealand heads into Wednesday’s Monetary policy statement with a genuine split in expectations around what the Reserve Bank of New Zealand will signal next. The Official Cash Rate sits at 2.25%, and most economists surveyed expect Governor Anna Breman and her committee to leave it unchanged. The bigger debate is not about this week’s decision it is about what comes next.

Economists argue it is too early for the central bank to revise GDP forecasts higher.

Unemployment rate climbed to 5.4%, its highest level since 2015.

Core inflation remains elevated at 3.2%, suggesting underlying price pressures have not fully eased.

Policymakers may hint at a possible rate hike later in 2026 if current trends persist.

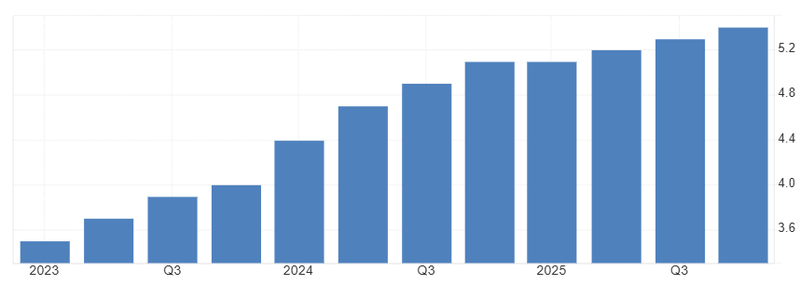

GDP growth is stronger than expected

Despite cautious commentary from some forecasters, recent economic data has shown clear signs of improvement across several sectors. Building consents have picked up, tourism continues to recover steadily, export activity remains firm, and manufacturing indicators suggest improving demand.

The rate cuts delivered during the second half of 2025 appear to have supported confidence. Businesses are showing more willingness to invest, and forward spending intentions have strengthened. While retail sales remain uneven, broader activity data suggests the economy is gaining traction.

Some economists argue it is too early for the central bank to revise GDP growth YoY forecasts higher. Yet the flow of incoming data makes that stance increasingly difficult to defend.

Source: Statistics New Zealand

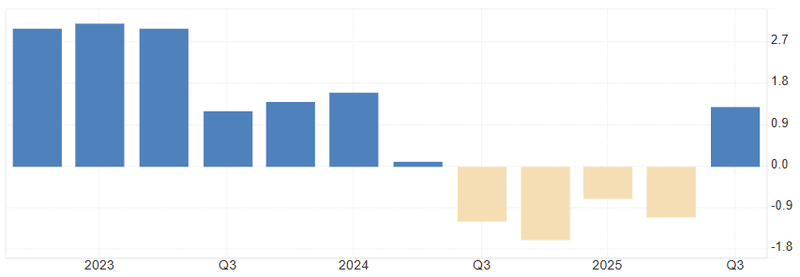

Labour market a conflicted picture

The labour market presents a more complicated story. Employment growth and hours worked rose above expectations in the December quarter, signaling resilience in hiring.

However, the unemployment rate climbed to 5.4%, its highest level since 2015. The number of unemployed increased to 165,000, up by 5,000. At first glance, this appears concerning.

Part of the rise reflects increased labour force participation, as more people re-enter the workforce and actively seek jobs. Employment data also tends to lag economic turning points, meaning current figures reflect hiring decisions made months ago. If activity continues improving, labour conditions may stabilize later in 2026.

Still, the direction of unemployment remains a key concern for policymakers.

Source: Statistics New Zealand

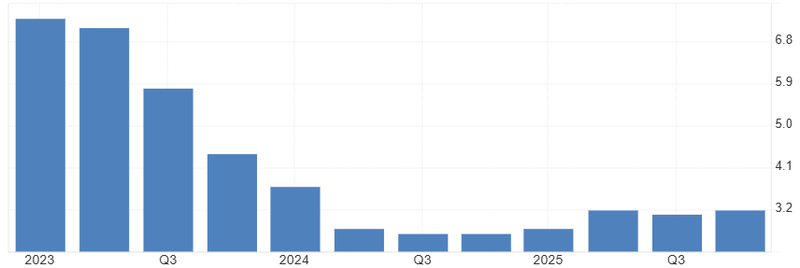

Inflation is still sticky

Core inflation remains elevated at 3.2%, signaling that underlying price pressures are proving more persistent than headline numbers suggest. While overall inflation has moderated from previous peaks, much of that decline has been driven by softer energy costs and easing prices for imported goods. In contrast, domestically driven inflation including housing, services, insurance, and wage-related expenses continues to run firm.

This matters because non-tradable inflation typically reflects internal economic dynamics such as labor market conditions and consumer demand. These components tend to adjust more slowly and can remain sticky even when global price pressures fade.

For the Reserve Bank of New Zealand, this creates a delicate balance. Inflation is no longer accelerating, but it is not yet comfortably back within the target range. Cutting rates too soon could risk reigniting price pressures, while maintaining tight policy for too long could slow the broader recovery.

Source: Statistics New Zealand

Policy expectations, hold Now, hike later

Most economists expect Governor Anna Breman to leave the OCR unchanged at 2.25% this week. Stability appears the most balanced short-term approach given mixed economic signals.

However, markets will pay close attention to the tone of the statement. At the previous meeting, the bank suggested rates could remain unchanged for the rest of the year. Now, with economic activity strengthening and inflation still above target, there is growing speculation that policymakers may hint at a possible rate hike later in 2026 if current trends persist.

Hike later

If economic momentum continues across construction, tourism, exports, and manufacturing, and if wage pressures remain firm, the case for tightening later this year will strengthen.

On the other hand, if unemployment continues rising and retail demand weakens further, policymakers may choose extended caution.

New Zealand’s economy appears to be moving out of its softer phase, but it is not yet in a fully secure expansion. This week’s statement is unlikely to deliver immediate action — but it could clarify whether the next policy move leans toward patience or preparation for tightening.

Source: Reserve Bank of New Zealand