Amazon hits record highs as US stocks climb

US equity markets advanced after a wave of third-quarter results that largely exceeded expectations, led by Amazon’s strong performance. Investors weighed robust corporate fundamentals against recent hawkish commentary from Federal Reserve Chair Jerome Powell, who warned that a December rate cut is not assured.

Amazon’s Q3 results outperformed forecasts, lifting the e-commerce giant to a record market capitalisation and supporting broader US market gains.

Apple also beat revenue and EPS estimates but traded lower on the day, reflecting mixed investor reaction.

Approximately 83 per cent of S&P 500 constituents that have reported to date exceeded analysts’ expectations (according to LSEG information).

Euro-area headline inflation decelerated to 2.1 per cent while core inflation remained at 2.4 per cent; the euro weakened modestly.

China’s PMI prints were mixed: the manufacturing PMI remained in contraction at 49.0, while the non-manufacturing PMI edged into expansion at 50.1.

Amazon beats expectations and drives markets higher

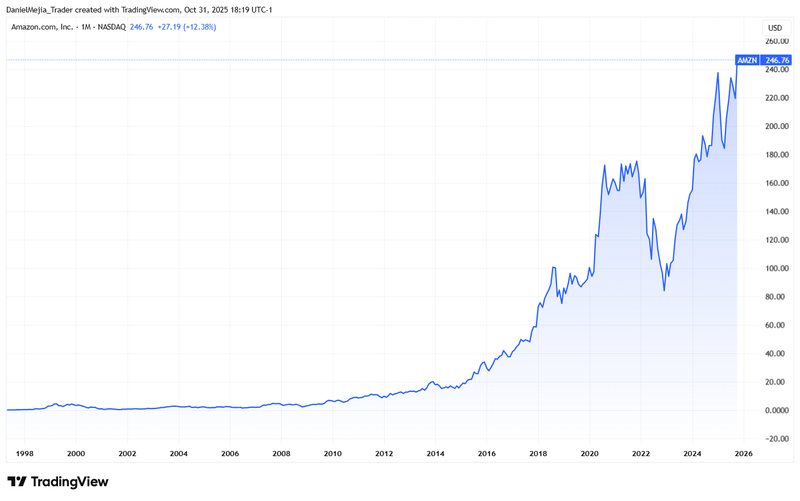

Amazon reported stronger-than-expected third-quarter results, underpinning a marked rally in its share price and providing momentum to US markets. After the close, Amazon disclosed revenue of US$180.2 billion versus a consensus of US$177.75 billion, representing year-on-year growth of approximately 13.4 per cent. Diluted earnings per share were US$1.95, ahead of an expected US$1.56, implying year-on-year EPS growth of roughly 36 per cent. The company cited robust demand for cloud computing services (AWS) as a principal growth driver.

Investor enthusiasm for Amazon pushed the stock up c. 9.58 per cent to US$244.22 at the close, taking its market capitalisation to about US$2.6 trillion — a record level. By contrast, Apple’s shares fell c. 0.38 per cent on the day despite reporting revenue and EPS above consensus, illustrating a degree of differentiation in investor interpretation of results across major technology names.

According to LSEG data, roughly 83 per cent of the c. 315 S&P 500 companies that have reported so far posted results above analysts’ forecasts. While this represents a strong reporting season, commentators note that some forecasts had already been tempered to reflect potential tariff impacts and other macro risks that may compress near-term margins, particularly on EPS.

Despite the favourable corporate data, the market continued to digest recent statements from Federal Reserve Chair Jerome Powell, who cautioned that a December rate cut is not guaranteed given uncertainty over tariff effects and delays in official data flows. Nevertheless, the Dow Jones closed up c. 0.09 per cent to 47,552, the S&P 500 rose c. 0.26 per cent to 6,840, and the Nasdaq-100 advanced c. 0.84 per cent to 25,957.

Figure 1. Amazon stock prices: historical overview (1998-2025). Source: data from the Nasdaq Exchange. Figure obtained from TradingView.

Euro-area inflation moderates; ECB stance affirmed

Eurostat reported that headline inflation in the European Union eased to 2.1 per cent from 2.2 per cent, in line with expectations. Core inflation, which excludes food and energy, remained unchanged at 2.4 per cent — marginally above the anticipated 2.3 per cent. The data provided support for the European Central Bank’s decision to maintain its policy rate at 2.15 per cent, with the institution characterising price pressures as broadly in check.

The euro weakened approximately 0.30 per cent to 1.1532 US dollars following the release, reflecting both the moderation in headline inflation and a broader US dollar dynamic.

China’s PMIs mixed: manufacturing contracts, services expand

China’s National Bureau of Statistics reported a manufacturing PMI of 49.0, signalling a continued contraction and marking seven consecutive months below the 50 threshold. Subcomponents such as new orders, export orders and employment showed notable weakness. Conversely, the non-manufacturing PMI rose to 50.1, indicating modest expansion and improved business confidence, possibly supported by a reduction in bilateral trade tensions.

Market response in China was subdued but positive overall: the Hang Seng rose c. 0.27 per cent to 25,975, while the FTSE China A50 increased c. 0.20 per cent to 15,281.

If you're interested in trading indices, foreign exchange, shares, or commodities, consider exploring the CFD contracts offered by Equiti Group. Please note that trading leveraged derivatives involves a high level of risk and may not be suitable for all investors.