AMD soars near highs on OpenAI deal; Nasdaq climbs

Today's report focuses on relevant financial and economic data. Chip producer AMD announced a strategic alliance with OpenAI that could lead to a considerable increase in revenue for the company. Consequently, positive market sentiment helped the Nasdaq100 index reach a new high. In turn, gold and Bitcoin achieved new records, showing a duality between the search for safe-haven assets and an appetite for risk.

AMD's share price increased by 23.71% following the announcement of an alliance with OpenAI.

The US government shutdown continues, despite attempts by Democratic and Republican representatives to resume federal funding.

The Japanese yen depreciated by 2% amid political changes in Japan.

The price of gold reached a record high amid a search for safe-haven assets, while Bitcoin also achieved a new high.

AMD announces supply agreement with OpenAI

Shares in semiconductor company Advanced Micro Devices (AMD) closed with a gain of 23.71% following the announcement of a strategic alliance with OpenAI. The partnership involves a steady supply of chips to the company led by Sam Altman. If the deal is completed, AMD's annual revenue would increase considerably, while the partnership could enhance the leadership positions of both companies within the technology industry.

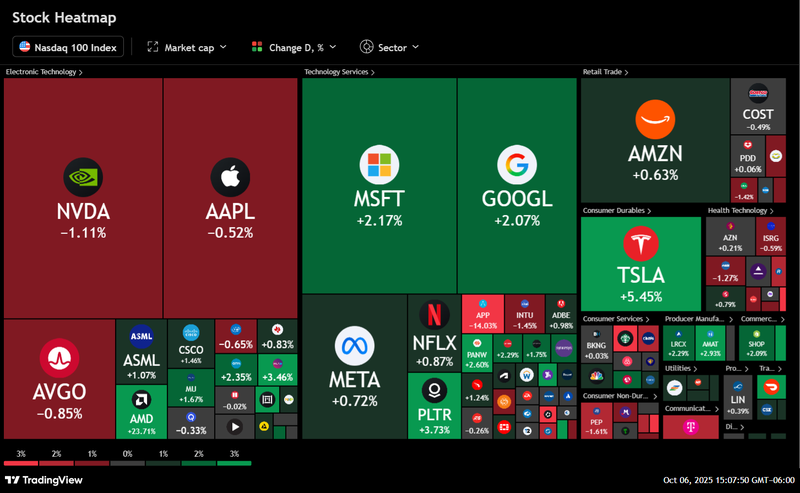

While US markets closed mixed, companies linked to the semiconductor sector showed a notable performance (see Figure 1). The optimistic market sentiment reflects the growing prospect that the industry can continue its growth trajectory amid increased investment in strategic projects and alliances.

The Nasdaq100 index closed the trading session with a gain of 0.76%, setting a new record high. In turn, the S&P500 achieved an increase of 0.36%. In contrast, the Dow Jones decreased by 0.14%.

Figure 1. Nasdaq100 Heatmap (October 6, 2025). Source: Image obtained from TradingView.

Why is the strategic alliance between AMD and OpenAI relevant?

Although the overvaluation of US equity markets, particularly in the technology industry, is a visible concern, a key criticism has been that companies were not justifying their growth through expansion projects. Several technology companies were more interested in compensating their shareholders through buybacks, rather than increasing their Capital Expenditure (CapEx) levels.

Therefore, the announcement of large-scale investment projects and strategic alliances by companies in the industry is significant. This includes private-party alliances, such as the case of AMD and OpenAI, alongside government-promoted investments, such as the investment in Intel announced by the White House.

Although higher investment does not immediately eliminate overvaluation concerns, the information is significant because it improves the growth prospects for the companies involved.

US government shutdown remains unresolved

The White House struck a more subdued tone regarding its threat to cut public payrolls if Congress does not restore federal funding. This development is relevant as it reduces the probability of mass redundancies among federal employees, although US President Donald Trump has mentioned that there could be job losses if the government shutdown is prolonged without an agreement.

Despite these pressures, the government shutdown remains in force, now in its sixth day. Democratic and Republican representatives are in constant debate to find a funding solution. However, at present, no decisive progress has been made that would suggest a resumption of activities is imminent. As a result, investors are turning to private economic reports in the absence of official data. The probability of a 25-basis-point cut, as measured by CME Group's FedWatch, remains above 90%. The focus now turns to the release of the FOMC minutes scheduled for Wednesday, 8 October.

Gold hits new record high on political uncertainty and geopolitical risk

The gold futures contract (GCZ25) achieved a new all-time high, reaching $3,976 per ounce, an increase of 1.72% at today's close. Gold remains the main safe-haven asset in the context of global political and economic uncertainty. The US government shutdown and political changes in Japan add to geopolitical tensions stemming from the Russian-Ukrainian conflict and the conflict in the Middle East. In turn, the expectation of future cuts by the Fed explains, to some extent, the appreciation of the precious metal amid the potential for dollar depreciation.

Investors continue to seek refuge, even though risk appetite remains high, as some equity markets (such as in the US and Japan) have reached new records. In turn, Bitcoin reached a new all-time high of $124,900 approximately, which implies an increase of 1.14% at the close of the market.

Japanese yen weakens amid expectations of monetary pause

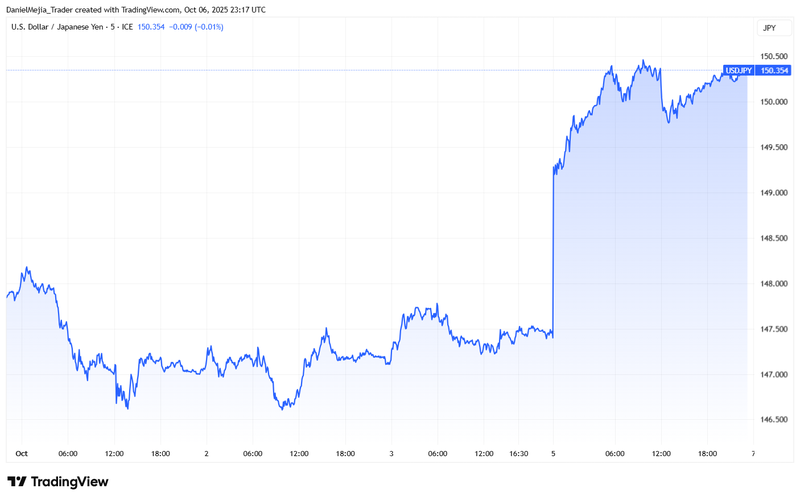

The Japanese yen depreciated against the US dollar by approximately 2% (see Figure 2), while yields on ten-year bonds showed an increase of 1.63%. The weakness in the yen came after the Liberal Democratic Party named Sanae Takaichi as its new leader, positioning her as Japan's next prime minister. Takaichi, a conservative, has shown interest in boosting the economy through aggressive spending and an expansive monetary policy. However, if she wins the election, this vision could conflict with the Bank of Japan's stated objective of containing inflation in the short and medium term.

In contrast, the Nikkei225 index achieved a new all-time high by reaching 47,944 points, an increase of 4.75% in today's session. The prospective new leader's expansionary stance appears to be boosting equity markets based on implied growth expectations.

Figure 2. USD/JPY parity (weekly change). Source: Image obtained from TradingView.

Key Economic Events This Week

Tuesday

- Australia: Consumer Confidence Change

- New Zealand: RBNZ Interest Rate Decision

Wednesday

- Germany: Industrial Production

- US: FOMC Minutes

Thursday

- Germany: Trade Balance

- US: Fed Chair Powell Speaks

Friday

- Canada: Unemployment Rate

- US: Michigan Consumer Sentiment