China deflation persists; Japan, EU industrial output falls

Consumption and production indicators in major economies showed contraction. China recorded deflation in its consumer price index, while industrial production in Japan and the European Union contracted.

China’s CPI contracted 0.3 per cent year-on-year, marking a second consecutive month of deflation.

Japan’s industrial production fell 1.5 per cent month-on-month and 1.6 per cent year-on-year, with significant weakness in electronics, chemicals and electrical machinery.

EU industrial production contracted 1.2 per cent month-on-month, slowing annual growth to 1.1 per cent; capital goods and durable consumer goods were principal contributors to the decline.

Deflation in China persists in the face of weak domestic demand

According to the National Bureau of Statistics of China, the consumer price index (CPI) recorded a deflationary outcome for the second consecutive month, declining 0.3 per cent year-on-year. This result was weaker than consensus expectations, which had forecast a decrease of 0.1 per cent. Month-on-month inflation rose by 0.1 per cent, below estimates but up on the prior month’s 0.0 per cent.

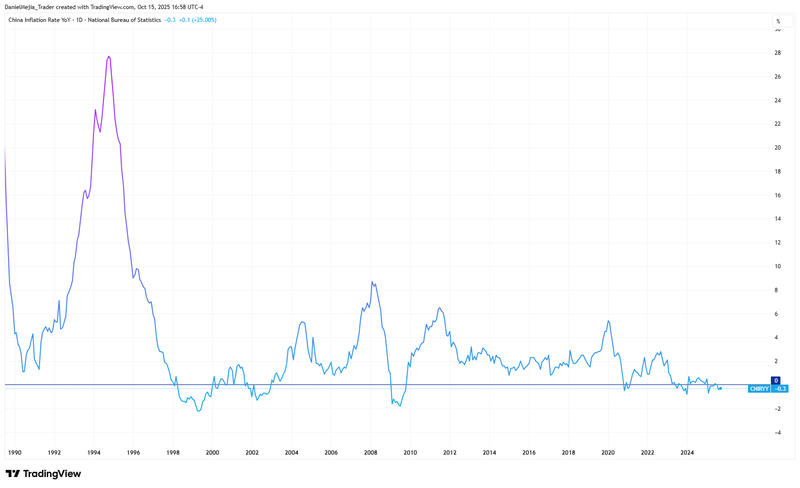

Figure 1 shows that episodes of deflation have historically been uncommon and have tended to occur during recessions or in later stages of economic weakness. Although the Chinese economy has not entered a technical recession, the data indicate that domestic consumption has not fully recovered from the post-pandemic slowdown and the ongoing real-estate sector difficulties, which have weighed on consumer confidence.

Consumer sentiment may also be affected by elevated trade tensions. Reuters reported that the United States and China implemented reciprocal port tariffs, increasing bilateral trade frictions. Leaders of both countries are expected to meet in South Korea at the end of October, which markets may interpret as an opportunity for negotiation or détente.

Market reactions were mixed in China: Hong Kong’s Hang Seng index fell 0.19 per cent to 25,848 points, while the CSI300 index, which comprises leading stocks from the Shanghai and Shenzhen exchanges, rose 1.48 per cent to 4,606 points.

Figure 1. China Inflation Rate YoY (1986-2025). Source: data from China’s National Bureau of Statistics. Own analysis conducted via TradingView.

Why is the deflation data important in China?

The emergence of deflation in the CPI is significant because it signals weak domestic demand. If households are not purchasing domestically produced goods and services, firms may be compelled to seek external markets, which can raise exports in the short term but leave domestic activity stagnant. Producers facing subdued demand frequently respond by lowering prices to stimulate sales; this compresses profit margins and can lead firms to cut costs, with potential consequences for employment and shareholder returns.

Japan’s industrial production shrinks below estimates

Data from Japan’s Ministry of Economy, Trade and Industry (METI) show that industrial production in Japan fell 1.5 per cent month-on-month, a larger decline than the 1.2 per cent expected by analysts. On a year-on-year basis, production contracted by 1.6 per cent, worsening from the prior reading of −0.04 per cent.

Trading Economics reports that the largest month-on-month contributors to the decline were electronic equipment (information and communications), down 16.5 per cent; chemical products (inorganic and organic), down 5.4 per cent; and electrical machinery, down 4.9 per cent.

Part of the weakness in production may be related to a fall in exports in August, which has been affected in part by US tariffs. The automotive sector—accounting for roughly 24 per cent of Japan’s total exports—has been notably exposed. Given the high degree of integration of the automotive industry with intermediate-goods supply chains, disruptions there can amplify weakness across manufacturing output.

On markets, the Japanese yen was unchanged against the US dollar, while the Nikkei 225 gained 1.76 per cent to 47,672 points.

EU monthly industrial production came in below forecast

Eurostat data indicate that industrial production in the European Union contracted by 1.2 per cent month-on-month, a slightly smaller contraction than some forecasts of 1.6 per cent. As a result, year-on-year industrial growth slowed to 1.1 per cent from 2.0 per cent previously.

Trading Economics identifies capital goods (−2.2 per cent) and durable consumer goods (−1.6 per cent) as the sectors contributing most to the monthly decline. By country, Germany recorded a pronounced contraction of 5.2 per cent, and Italy fell 2.4 per cent, exerting substantial influence on the EU aggregate.

In foreign-exchange and equity markets, the euro appreciated by approximately 0.32 per cent amid general dollar weakness, while Germany’s DAX 40 declined 0.23 per cent to 24,181 points.