EU inflation tick lifts euro as BoE, OECD warn of risks

The euro registered a modest gain after European Union inflation accelerated slightly more than expected. At the same time, the Bank of England and the OECD issued warnings about financial-stability risks stemming from elevated valuations in AI-linked equities and broader trade-policy uncertainty.

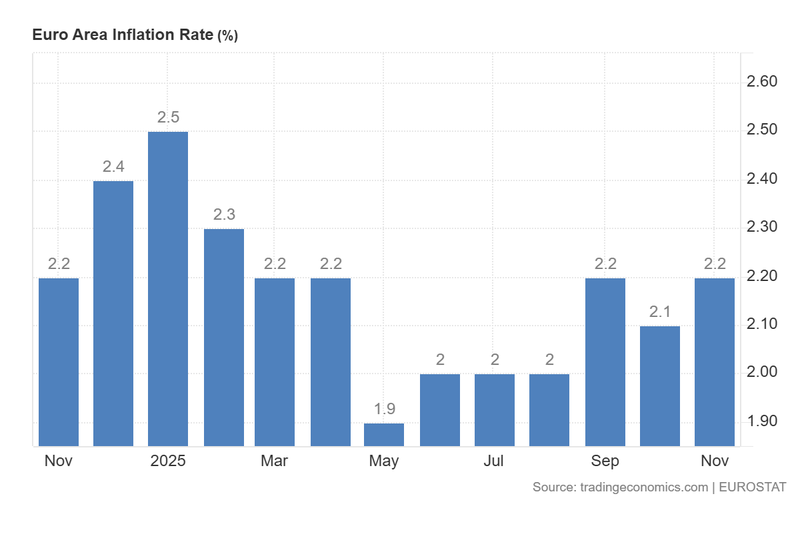

Eurostat data showed EU headline inflation edging up to 2.2 per cent year-on-year, above consensus, while core inflation remained steady at 2.4 per cent.

The Bank of England’s semi-annual Financial Stability Report highlighted risks from richly valued AI-exposure, venture capital, and potential strains in sovereign debt funding markets.

The OECD trimmed its global growth forecast, warning that US tariff measures and trade-policy uncertainty could reduce growth from 3.2 per cent (2025) to 2.9 per cent (2026).

Euro gains as EU inflation surprises to the upside

Eurostat reported that headline inflation in the European Union accelerated marginally to 2.2 per cent year-on-year, a touch above market expectations. Core inflation — which excludes volatile energy and food components — held steady at 2.4 per cent, below some forecasts that had pencilled in a modest rise to 2.5 per cent.

Sector detail from Trading Economics indicates services led the uptick, while energy prices exerted downward pressure. At country level, Germany exhibited the most notable core inflation acceleration (c. 2.7 per cent year-on-year), whereas the Netherlands recorded one of the larger slowdowns (from c. 3.0 per cent to 2.6 per cent year-on-year).

The slightly higher headline print provided the euro with a near-term tailwind: the single currency appreciated modestly by approximately 0.13 per cent to 1.1624 against the US dollar. Market commentary also highlighted reports that President Donald Trump had nominated Kevin Hassett as the next chair of the Federal Reserve; investor conjecture that such a change could presage a more expansionary US stance weighed on dollar sentiment and supported the euro on the day.

Figure 1. Euro Area inflation (year-on-year). Source: data from the Eurostat; figure obtained from Trading Economics.

BoE flags vulnerabilities from AI valuations and funding markets

The Bank of England’s Financial Stability Report highlighted a range of potential vulnerabilities. According to Reuters, the Bank of England and Governor Andrew Bailey warned that AI-driven exuberance has lifted valuations in parts of the equity market to levels comparable with earlier periods of excessive pricing. The Bank warned that if investor expectations for AI-driven profitability prove optimistic, a correction could transmit losses to the financial system.

The Report also drew attention to leverage and funding risks in fixed-income markets. In particular, the BoE noted the role of hedge funds and repo financing in sovereign debt markets: an abrupt withdrawal of funding could force rapid deleveraging and place additional stress on government bond markets.

Despite these cautions, market reaction was muted: sterling was essentially unchanged near USD 1.3209, and the FTSE 100 barely moved on the day (down c. 0.01 per cent).

OECD warns of slower growth as tariffs and valuation risks bite

The OECD’s latest Economic Outlook revised global growth lower, projecting a slowdown from 3.2 per cent in 2025 to 2.9 per cent in 2026. The organisation singled out the potential macroeconomic drag from US tariff measures and broader trade-policy uncertainty. According to the OECD, tariffs could raise input costs, depress investment and erode consumption once inventory buffers run down.

According to Reuters, the agency also highlighted a related risk: increasingly elevated valuations in firms associated with artificial intelligence. If profitability and growth expectations for these firms fail to materialise, equity markets could undergo significant adjustment, with attendant knock-on effects for confidence and balance-sheet health.

Markets will be watching how these two narratives — trade policy and AI valuations — evolve, because their intersection has the potential to influence growth, inflation and financial-stability outcomes in the year ahead.