Euro stocks fall on policy and valuation uncertainty

European equity markets retreated as investors digested renewed uncertainty over the Federal Reserve’s policy path and lingering concerns about stretched valuations in the technology sector. Softer-than-expected US jobless-claims data reinforced caution, prompting a modest bid for gold as a hedge against policy-driven volatility.

Hawkish signals from Fed officials have materially reduced the market-implied probability of a near-term rate cut, prompting a risk-off response in European equities.

Tech-sector valuation risk is elevated ahead of key US earnings (notably Nvidia), increasing sensitivity to any disappointment and amplifying market downside.

US labour-market weakness—illustrated by a rise in both initial and continuing jobless claims—has increased uncertainty about growth and the Fed’s timing for easing.

Gold registered a small advance as investors reallocated to safe assets in response to weaker employment data and greater policy ambiguity.

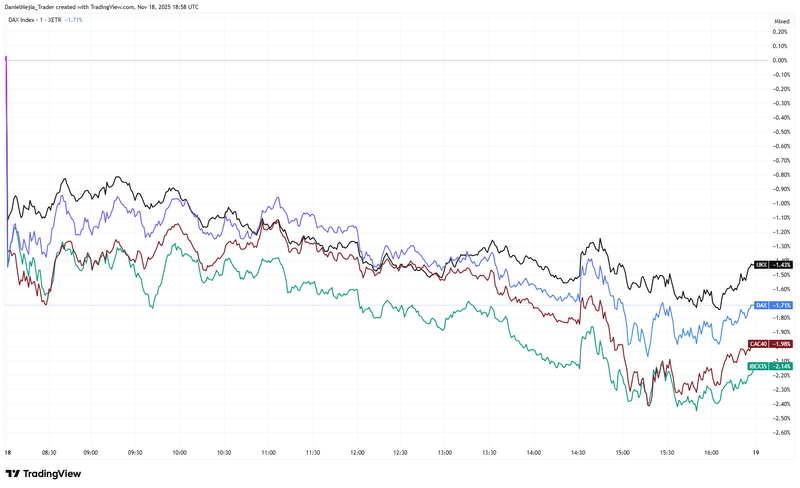

European stock indices fall amid Fed uncertainty and valuation concerns

European markets declined broadly as investors shifted to a more cautious stance. The prospect of a less accommodative Federal Reserve, signalled by recent commentary from FOMC members and reflected in a lower market-implied probability of a December cut, undermined global risk appetite. At the same time, concern over rich valuations in the technology sector—and the prospect of earnings that fail to justify those multiples—exerted additional downward pressure.

Movements were sizeable across major bourses: the CAC-40 fell c. 1.86 per cent to c. 7,967 points, the DAX-40 lost c. 1.74 per cent to c. 23,180, the IBEX-35 declined c. 2.14 per cent to c. 15,826, and the FTSE-100 eased c. 1.27 per cent to c. 9,552. Market attention is converging on imminent US releases and corporate results, with Nvidia’s quarterly report singled out as a potential catalyst given the company’s centrality to AI-driven valuation narratives.

Figure 1. DAX-40, IBEX-35, FTSE-100, CAC-40 (daily performance). Source: Own analysis via TradingView.

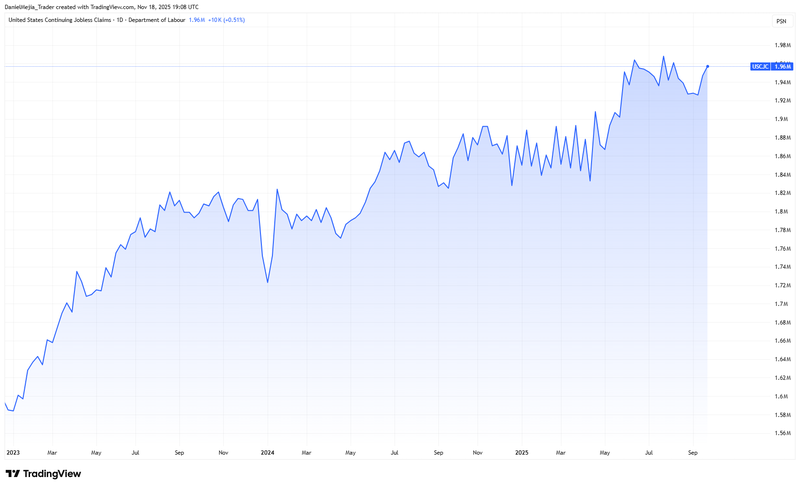

US jobless claims come in above expectations as the upward trend persists

US labour-market indicators signalled further fragility. Continuing jobless claims rose to 1,947,000 from 1,916,000 (consensus c. 1,930,000), while initial claims increased to 232,000 from 219,000 (consensus c. 223,000). The persistence of elevated continuing claims—part of a broader rising trend since 2023—underscores the softening dynamics in the labour market even though current levels remain below the peaks seen in prior severe downturns.

These weekly claims will be interpreted alongside forthcoming official employment releases, which will provide a fuller picture of labour-market health and inform monetary-policy expectations. For now, the claims data contributed to risk-off positioning and increased attention on whether the Federal Reserve will still consider easing at its December meeting.

Figure 2. US continuing jobless claims (2023–2025). Source: US Department of Labor; Figure obtained from TradingView.

Gold edges higher on weak employment signals and policy ambiguity

Gold futures (GCZ25) posted a modest gain—circa 0.16 per cent to about US$4,081 per ounce—on the back of weaker-than-expected US jobless-claims data and elevated uncertainty around the Fed’s path. In an environment where the timing and scale of rate cuts are unclear, precious metals frequently benefit from safe-haven flows and portfolio hedging.

Market participants will monitor upcoming US macro releases closely (employment data will be presented on Thursday November 20). If official employment data were to confirm a meaningful deterioration that pushes the Federal Reserve toward earlier policy easing, the market narrative would shift accordingly; however, if labor-market indicators instead show continued resilience, it would reinforce expectations that policy settings could remain restrictive for longer.

Figure 3. Gold futures (GCZ25) year-to-date. Source: COMEX; Figure obtained from TradingView.