Fed cuts rates, signals new neutral stance; markets climb

The Federal Reserve reduced its policy rate by 25 basis points to 3.75 per cent and revised its economic projections, signalling a move to a more neutral stance for 2026. Although the Fed upgraded near-term GDP and lowered its PCE forecast, it emphasised the continued trade-off between persistently elevated inflation and emerging labour-market weakness. Markets responded positively: equities rose, yields fell and the dollar softened.

The Fed cut the federal funds rate by 25 basis points to 3.75 per cent and described its stance for 2026 as broadly neutral.

Policymakers upgraded the 2026 GDP projection (to 2.3 per cent) and trimmed the PCE inflation forecast (to 2.4 per cent), but highlighted ongoing uncertainty around tariffs and labour-market dynamics.

The Bank of Canada left its policy rate at 2.25 per cent, amid improving employment amid still elevated core inflation.

Chinese CPI accelerated to 0.7 per cent year-on-year, a tentative sign of recovering domestic demand, while core inflation remained at 1.2 per cent.

Fed cuts interest rates and adopts a neutral stance amid mandate divergence

The Federal Reserve reduced its policy rate by 25 basis points to 3.75 per cent and released updated economic projections that, overall, were more constructive than earlier forecasts. Notable adjustments included an upward revision to projected real GDP growth for 2026—from 1.8 per cent to 2.3 per cent—and a modest reduction in the PCE inflation path (from 2.6 per cent to 2.4 per cent). Projections for the unemployment rate and the longer-run federal funds rate were left unchanged at 4.4 per cent and 3.4 per cent respectively.

In the post-meeting press conference, Chair Jerome Powell emphasised that the Committee now views policy as closer to neutral, but stressed that the outlook remains “complex.” The Fed highlighted two offsetting forces: inflation that is still elevated and signs of weakening in parts of the labour market. Policymakers reiterated a meeting-by-meeting approach, noting uncertainty over the inflationary impact of recent tariff measures and the lagged effects of earlier tightening.

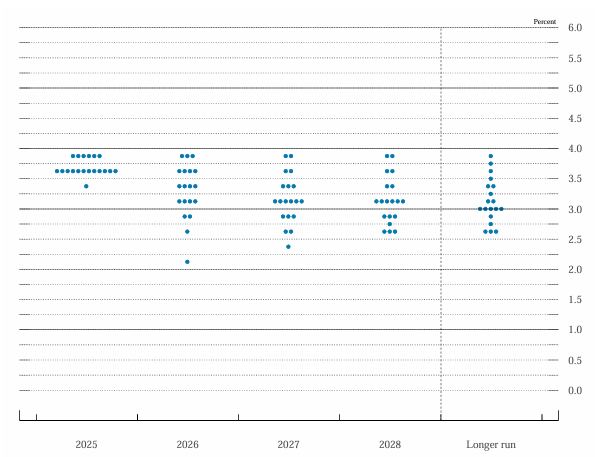

The Federal Open Market Committee’s (FOMC) participants continued to diverge in their policy assessments, underscoring that future adjustments will depend on incoming data. The market response was broadly positive: the S&P 500 rose 0.68 per cent to 6,886, the Nasdaq gained 0.42 per cent to 25,776, and the Dow Jones advanced 1.05 per cent to 48,057. Ten-year Treasury yields fell by roughly 3.5 basis points to 4.15 per cent, while the US dollar index (DXY) declined 0.59 per cent to 98.66.

Figure 1. FOMC participants’ assessment of appropriate monetary policy (December 10, 2025). Source: Federal Reserve Economic Projections.

BoC keeps rates unchanged as job market improves

The Bank of Canada retained its policy rate at 2.25 per cent, in line with market expectations. The decision reflected a mixed backdrop: headline inflation is close to the BoC’s objective (2.2 per cent YoY) but core inflation remains higher (2.9 per cent YoY). Crucially, the unemployment rate has retraced from recent highs—helping to ease some near-term policy pressure.

The BoC’s statement suggested a data-dependent approach, with officials stressing the importance of sustained disinflation before considering rate reductions. The Canadian dollar strengthened on the announcement, appreciating roughly 0.38 per cent to CAD 1.3792 per US dollar, reflecting the relative policy divergence with the Fed.

Chinese inflation edges higher, hinting at a modest consumption recovery

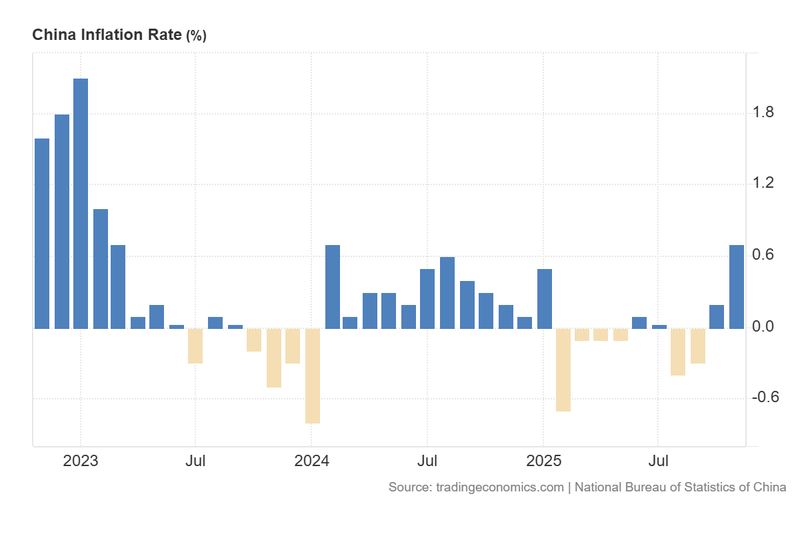

China’s consumer price index rose to 0.7 per cent year-on-year in the latest release, up from 0.2 per cent, while core inflation (excluding food and energy) held at 1.2 per cent. The uptick—small though it is—represents the highest reading since February 2024 and was driven by increases in clothing (+1.9%), healthcare (+1.6%) and education (+0.8%).

Market participants view the rise as an early sign that domestic consumption may be stabilising, but levels remain well below those consistent with robust demand. Equity reaction was muted: the FTSE China A50 slipped 0.67 per cent to 15,211 despite the inflation pick-up, though the index remains positive on a year-to-date basis.

Figure 2. China CPI (2023–2025). Source: National Bureau of Statistics of China; chart obtained from Trading Economics.