Fed rate-cut odds climb on softer-than-expected ADP data

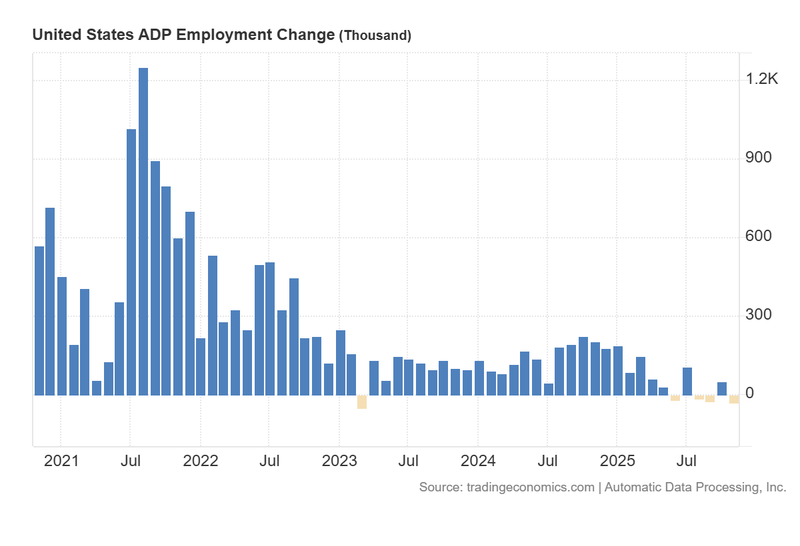

Private payroll data from ADP surprised to the downside in November, registering a contraction that reinforced markets’ expectations of Federal Reserve easing. The ISM services PMI, by contrast, showed continued resilience in the US services sector. Outside the US, Australia’s GDP decelerated in Q3, while US crude inventories recorded a modest build.

The ADP report recorded a contraction of 32,000 private non-farm jobs in November, well below the consensus expectation of +10,000, prompting markets to reassess the Fed’s path.

CME Group’s FedWatch tool priced a markedly higher probability of a 25 basis-point cut for the December FOMC meeting, as investors reacted to the weakened private payrolls reading.

The ISM services PMI surprised to the upside at 52.6, signalling continued expansion in the US services sector and tempering concerns about a broad-based slowdown.

Australia’s Q3 GDP slowed to 0.4 per cent (quarter-on-quarter), and US crude inventories rose by 0.574 million barrels, yet WTI traded higher on a mix of geopolitical and demand-supply considerations.

ADP report: private payrolls contract unexpectedly

The Automatic Data Processing Inc. (ADP) monthly employment report showed a contraction of 32,000 private non-farm payrolls in November, substantially below market expectations of an increase of 10,000. ADP indicated that small firms were the principal source of the decline; ADP’s chief economist attributed weakening hiring to heightened corporate caution amid uncertain consumer demand and macroeconomic conditions.

Market reaction was immediate. Using the CME Group’s FedWatch tool, investors materially increased the likelihood assigned to a 25 basis-point cut at the Federal Reserve’s December meeting — reflecting a view that the Fed may prioritise supporting employment should weakness persist. Equity markets responded positively to the surprise, with the S&P 500, Dow Jones and Nasdaq 100 posting gains on the news.

Figure 1. United States ADP Employment Change (2021-2025). Source: Data from the Automatic Data Processing; Figure obtained from Trading Economics.

ISM services PMI shows resilience

Contrasting with the ADP weakness, the Institute for Supply Management (ISM) services PMI rose to 52.6, above the consensus of 52.1 and marginally higher than the prior month’s 52.4. A reading above 50 denotes expansion; the services sector therefore continues to display underlying resilience, supported by consumer spending on services and activity in professional and business services.

The indicator is important because it highlights the strength and resilience of the services sector, even as the Manufacturing PMI signalled contraction just days earlier. The dollar index (DXY) eased modestly on the day (c. 0.41 per cent), while US equity indices advanced as investors priced a greater probability of policy easing.

Australia: GDP growth slows in Q3

Australia’s Bureau of Statistics reported that third-quarter GDP growth decelerated to 0.4 per cent quarter-on-quarter from 0.7 per cent in the prior quarter, falling short of consensus expectations for an unchanged outcome. Although Australia has avoided outright contraction over the past three years, the longer-term average quarterly growth rate remains modest (around 0.43 per cent), and the economy faces the twin pressures of elevated inflation (currently c. 3.8 per cent) and a gradually softening labour market.

The Reserve Bank of Australia has progressively eased policy from peaks of 4.35 per cent; the current official cash rate stands at 3.6 per cent. Despite the Q3 slowdown, the Australian dollar appreciated by roughly 0.65 per cent to 0.6601, a move that was in part driven by US dollar weakness following the ADP surprise.

US crude inventories and oil market reaction

The US Energy Information Administration (EIA) reported a weekly crude-stock build of 0.574 million barrels, contrary to analysts’ expectations for a draw of 0.8 million barrels. While a build typically exerts downward pressure on prices, WTI futures nevertheless rose by about 0.8 per cent, trading near US$59.11 per barrel.

Oil markets remain sensitive to a complex mix of drivers: geopolitical tensions and episodic supply risks can support prices even in the face of modest inventory builds, while longer-term concerns about OPEC+ production plans and weak demand growth — particularly in China — continue to weigh on sentiment.