Gold drops amid US monetary policy uncertainty

Gold prices fell sharply after hawkish commentary from several Federal Reserve officials reduced the market’s confidence in near-term easing. At the same time, oil rallied following damage to Russian energy infrastructure that disrupted exports. Meanwhile, the activity indicators from China surprised to the downside, prompting modest weakness in Chinese equities.

COMEX gold (GCZ5) declined more than 2 per cent as the market trimmed the probability of a December Fed cut amid elevated policy uncertainty.

Brent and WTI climbed over 2 per cent after reported damage at the Novorossiisk export terminal raised concerns about Russian supply disruption.

China’s industrial production and fixed-asset investment underperformed expectations, which dented sentiment in Hong Kong and onshore A-share indices.

Gold prices down amid doubts over Fed easing

The gold futures contract (GCZ5) on COMEX fell by in excess of 2 per cent during today’s session as investors reassessed the likelihood of monetary easing from the Federal Reserve. In the wake of several relatively hawkish remarks from FOMC members, the CME Group’s FedWatch Tool showed a reduction in the implied probability of a 25-basis-point cut for the December meeting, reflecting a more cautious market stance.

The recent government shutdown had delayed the publication of a number of official US economic series, creating a two-month information gap for the Fed. Although government operations have now resumed, the central bank remains exposed to the delayed flow of employment and activity data — a factor that has amplified uncertainty and weighed on interest-rate expectations.

Conventionally, lower interest rates and a weaker US dollar tend to support bullion because the opportunity cost of holding non-yielding assets declines and gold becomes less expensive in other currencies. In the present environment, however, the absence of clarity about rate cuts has suppressed that dynamic and contributed to the price setback.

Figure 1. Gold futures (GCZ5) year-to-date. Source: COMEX; Figure obtained from TradingView.

Oil prices rise after reported attack on Russian export hub

Brent (BRNF6) and WTI (CLZ5) futures both advanced by more than 2 per cent following reports that the Novorossiisk terminal — a key Russian export facility — was struck in a Ukrainian attack, damaging storage infrastructure and interrupting shipments. Novorossiisk handles material flows equivalent to a significant portion of global seaborne exports; market commentary cited an estimated throughput disruption equal to roughly 2 per cent of global supply, prompting a rise in the geopolitical risk premium for energy.

Market participants are also weighing the cumulative effect of forthcoming Western sanctions and the US deadline of 21 November for winding down certain business with Russian entities, which could further reduce available flows. Brent traded near US$64.39 per barrel (+2.19 per cent) and WTI around US$60.00 per barrel (+2.23 per cent) as traders reappraised near-term supply risk.

Chinese activity indicators disappoint

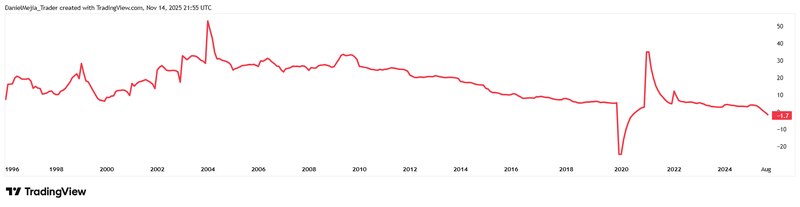

China’s latest official releases signalled a slowdown in momentum. Industrial production slowed to 4.9 per cent year-on-year (consensus c. 5.5 per cent; prior 6.5 per cent), while fixed-asset investment contracted by 1.7 per cent year-on-year, deeper than the expected −0.8 per cent and weaker than the prior −0.5 per cent. These outcomes point to persistent weakness in investment and manufacturing-related demand.

The structural problems in China’s property sector and subdued household consumption have continued to weigh on domestic activity, despite headline GDP growth of c. 4.8 per cent year-on-year — a rate that remains above global average but below China’s historical norm. Market reaction was modestly negative: the Hang Seng eased c. 0.33 per cent to about 26,500, while the FTSE China A50 declined c. 0.16 per cent to c. 15,308.

Figure 2. China fixed-asset investment (YoY). Source: National Bureau of Statistics of China; Figure obtained from TradingView.