Gold, silver set new highs on economic and geopolitical fears

Gold and silver surged to record levels as investors sought safe havens amid renewed economic uncertainty and escalating geopolitical tensions between the United States and Venezuela. Concurrently, UK inflation softened materially, increasing the likelihood of Bank of England easing, while oil prices recovered on supply-risk considerations.

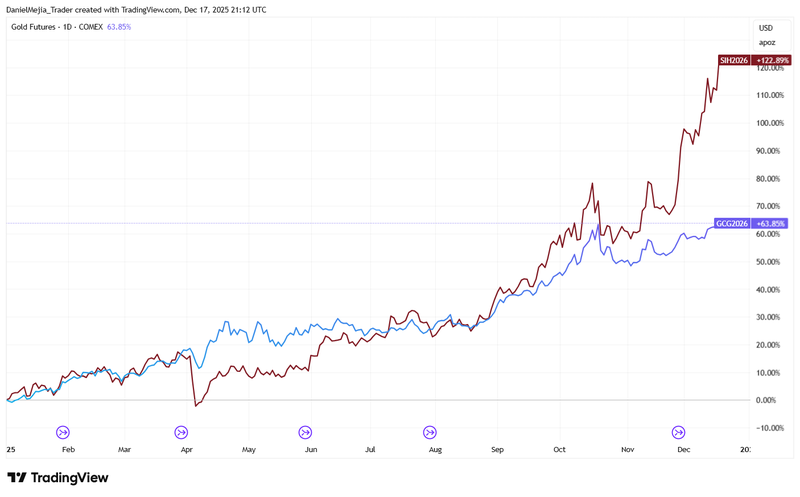

Gold futures (GCG26) hit a fresh record, supported by safe-haven flows amid weaker US and Chinese activity data, and a scaling on geopolitical tensions.

Silver (SIH26) outperformed, posting a sharp daily advance and extending a strong year-to-date gain as industrial and investment demand pick up.

UK inflation decelerated more than expected, raising market expectations of a 25-basis-point Bank of England cut on 18 December and further easing in 2026.

Brent and WTI rose as the prospect of US actions against Venezuelan oil exports and an inventory draw in the US increased short-term supply concerns.

Gold and silver reach historic highs amid economic and geopolitical uncertainty

The COMEX gold futures contract (GCG26) rose by about 0.94 per cent, reaching a new intraday high near $4,373 per ounce. Silver futures (SIH26) advanced strongly — roughly 5.25 per cent on the session — to $66.64 per ounce, also marking a record high.

Precious metals have been bid as investors weigh several factors. On the economic front, weakness in Chinese industrial production and retail sales and soft US employment data have raised concerns about global demand and boosted safe-haven demand. On the geopolitical front, according to Reuters, tensions between the US and Venezuela intensified after the US president Donald Trump ordered a blockade of all sanctioned oil tankers from Venezuela, a development that could disrupt regional energy flows and elevate risk premia.

The combination of heightened geopolitical risk and a weakening macroeconomic backdrop typically favours non-yielding assets such as gold and silver: lower expected real yields reduce the opportunity cost of holding bullion, while safe-haven demand rises during episodes of political and economic stress.

Figure 1. Gold future contract GCG26 and Silver future contract SIH26 (year-to-date). Source: COMEX Exchange; analysis via TradingView.

UK inflation decelerates, boosting expectations of BoE easing

The Office for National Statistics reported that UK headline inflation slowed to 3.2 per cent year-on-year in November (from 3.6 per cent), below consensus expectations of 3.5 per cent. Core inflation — which excludes energy and food — also eased to 3.2 per cent (from 3.4 per cent), undershooting forecasts.

The softer print has materially altered market pricing for Bank of England policy. The probability of a 25-basis-point rate reduction at the BoE meeting on 18 December has increased, and investors are now more receptive to the possibility of additional cuts in 2026, contingent on further evidence of disinflation.

Market response was immediate: sterling weakened modestly to 1.3375 USD, while the FTSE 100 rose 0.92 per cent to 9,774, reflecting the rally in interest-sensitive equities when monetary policy is expected to ease.

Oil edges higher as supply risks re-emerge

Brent and WTI each recorded gains after reports of a potential US interdiction of sanctioned Venezuelan tankers and an EIA inventory draw. At the close, Brent traded near $59.68 per barrel (+1.29 per cent) and WTI near $55.81 (+0.98 per cent).

Although the legal and operational feasibility of a full blockade remains uncertain, market participants priced in the prospect of interrupted Venezuelan exports — a non-trivial source of barrels historically — together with a US crude decrease of 1.274 million barrels versus forecasts for a 1.1 million-barrel fell (according to the US Energy Information Administration). These developments increased short-term supply concerns and supported oil prices.

Oil analysts note that absent a broader demand recovery, any sustained upside in oil will depend on the magnitude and duration of supply disruptions; in the near term, the path of prices will be sensitive to further geopolitical announcements and forthcoming inventory releases.