Japan react: GDP dip gives Takaishi case for fiscal stimulus

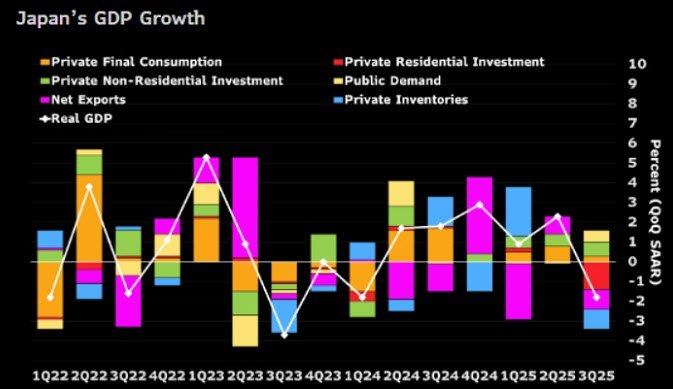

Japan’s third-quarter GDP slipped more than expected, sharpening the new administration’s argument for fresh fiscal stimulus and adding pressure on the Bank of Japan to move cautiously on tightening. The contraction was driven largely by a sharp housing pullback and softer exports, while underlying domestic demand remained resilient.

GDP contracted at a 1.8% annualized pace, milder than feared

Housing investment plunged as new environmental rules kicked in

Consumption and corporate capex remained solid

Weakness strengthens the case for fiscal support and a slower BOJ normalization path

Japan’s economy slips, but underlying demand stays firm

Japan’s third-quarter GDP contraction arrived softer than markets expected, but the headline decline has already sharpened the fiscal and monetary debate in Tokyo. The new administration is expected to use the setback to reinforce its case for additional fiscal support, while the Bank of Japan faces renewed pressure to ease its foot off the normalization pedal.

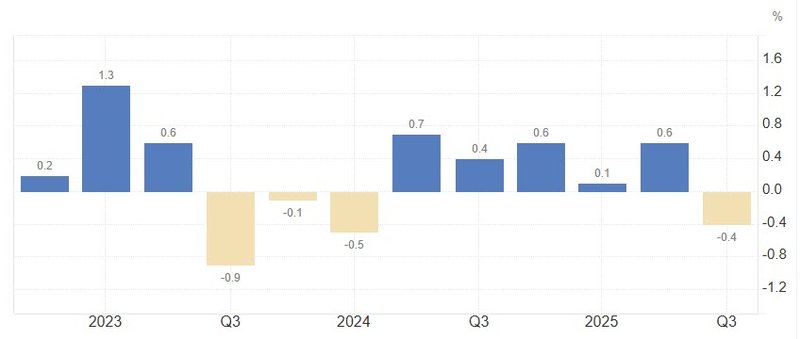

The economy shrank at an annualized pace of 1.8%, a milder slide than consensus forecasts of –2.4%. The downturn was driven overwhelmingly by a collapse in residential investment, which plunged 9.4% quarter-on-quarter as stricter environmental standards slowed housing construction. That alone shaved 1.4 percentage points off headline growth.

Source: Bloomberg

Exports also softened after front-loaded shipments ahead of US tariffs, cutting another 1.0 point from the GDP print. Despite these drags, the decline does not signal a major break in Japan’s post-pandemic recovery—rather, it reflects a cluster of one-off pressures.

Source: tradingeconomics

Consumption holds steady despite external headwinds

Strip away the housing shock, and domestic demand looks surprisingly resilient. Private consumption rose 0.1% for a sixth straight quarter. Behind the stability: a rebound in inbound tourism, better spending on non-durable goods as food-price pressures eased, and firm services demand.

Still, uncertainty looms. Beijing’s recent call urging Chinese citizens to avoid travel to Japan could cool tourist inflows heading into the fourth quarter, potentially trimming one of the strongest pillars of domestic consumption.

Corporate investment strengthens again

Capital expenditure expanded 1.0%, marking a fourth consecutive quarterly rise. Companies continued to invest heavily in software, automation and R&D—sectors tied to productivity upgrades and digital transformation.

This uptick in capex points to confidence among Japan’s largest firms, even as global manufacturing cycles remain uneven. It also suggests that corporate Japan is preparing for medium-term expansion despite headline volatility.

Fiscal stimulus case grows; boj faces renewed scrutiny

The GDP dip effectively hands the administration greater political leverage to push for new stimulus measures—particularly those targeting housing, household purchasing power and corporate investment.

At the same time, pressure is mounting on the Bank of Japan to tread more cautiously. Markets still expect the BOJ to raise rates by 25 basis points in December, but the latest data give policymakers room to delay until January if volatility persists.

Given fragile global demand, geopolitical uncertainty and domestic political tensions, the odds of a slower normalization path have increased.

Japan’s growth stumble looks temporary—but it arrives at a strategically sensitive moment. With fiscal plans being drafted and monetary policy moving into uncharted territory, the balance between stimulus, stability and credibility becomes harder to navigate. The coming weeks will signal whether policymakers respond with caution, conviction, or a blend of both.