Jobless claims add uncertainty to the Fed’s next move

Weekly jobless claims rose above expectations, sharpening the contrast between sticky inflation risks and a softening labor market. Markets now look to Jerome Powell’s remarks at Jackson Hole for policy clues.

Jobless claims were above expectations in their weekly variation.

Markets await Jerome Powell’s press conference for monetary policy clues.

PMI data in the U.S. and Europe were mixed, although they showed strength in most cases.

Walmart showed results above expectations in revenue, but below estimates in profits.

Jobless claims were above expectations, adding uncertainty to the Fed’s next move

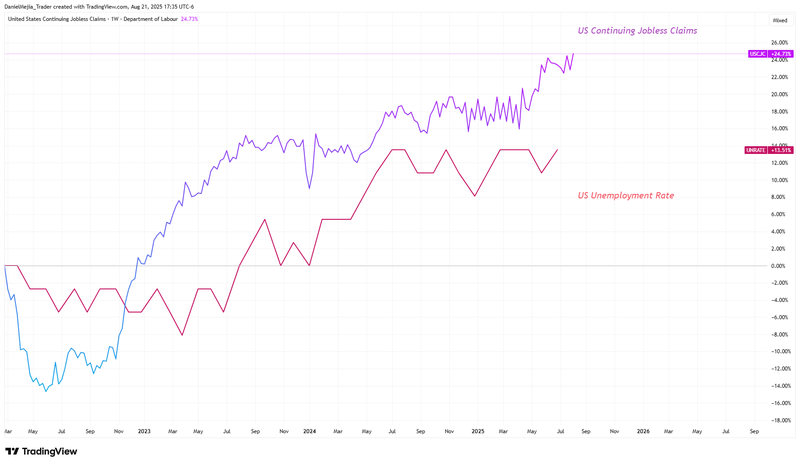

Initial jobless claims exceeded forecasts, printing 235,000 versus the 225,000 analysts expected—slightly above the one-year average. Continuing jobless claims also surprised to the upside at 1,972,000, extending a year-long uptrend that has steepened since April 2025. While weekly benefits data can be noisy, the latest readings matter because they arrive on the eve of the Fed chair’s Jackson Hole press conference. The deterioration in claims will likely imply questions to Jerome Powell about the growth costs of maintaining a still-restrictive stance.

Historically, continuing claims and the U.S. unemployment rate move together. The next figure illustrates a positive correlation and a persistent uptrend in both metrics since April 2023.

Financial markets await Powell’s Jackson Hole remarks

U.S. equities slipped about 0.4% on average after the New York close. The mild pullback reflected risk-management outflows and profit-taking amid concerns that Chair Jerome Powell’s tone will remain hawkish. Powell is scheduled to speak at 10:00 a.m. ET on Friday, August 22, and markets are watching closely for clues on the timing and pace of any policy shifts.

Earlier this week, the Fed minutes showed that most participants favor maintaining a restrictive stance, with only two members supporting a rate cut. At the same time, jobless-claims data surprised to the upside, sharpening the contrast between already-released inflation readings and the increasingly evident softening in labor indicators.

PMI data in Europe and the U.S. show mixed strength

The preliminary July PMIs painted a nuanced picture. In the Eurozone, manufacturing PMI rose to 50.5 (prior 49.8), edging into expansion, while services PMI slipped to 50.7 (prior 51.0). In the U.K., services PMI surprised to the upside at 53.6 (prior 51.8), but manufacturing PMI softened to 47.3 (prior 48.0), remaining in contraction.

In the U.S., both PMIs beat consensus: services eased to 55.4 (prior 55.7) while manufacturing improved to 55.4 (prior 55.1). On a relative basis, the U.S. economy continues to show greater strength and resilience; however, accumulating signs of recovery across Europe have likely supported a gradual return of flows to the region’s equity markets.

Walmart maintains growth guidance; earnings miss weighs on shares

Walmart Inc. reported mixed second-quarter results. Total revenue beat expectations at $177.4 billion, up 4.8% YoY, suggesting U.S. shoppers are maintaining steady spending with the retailer—both in stores and online—despite tariff-related headwinds.

Despite the solid revenue beat, the stock closed down 4.49% as profits missed expectations. EPS came in at $0.68, up 21.51% YoY, but below the $0.74 consensus. Investors were also unsettled by higher inventory costs, likely reflecting the increased tariff-related costs. While tariffs have not materially dampened retail demand so far, the risk of softer consumption would rise if inflation reaccelerates.