JOLTs strength fuels market jitters before Fed meeting

The JOLTs survey showed a recovery in vacancies for September and October, rekindling debate over the Federal Reserve’s path even as market pricing for a December cut remains elevated. The Reserve Bank of Australia held rates at 3.6 per cent and signalled little appetite for further cuts, while German external trade produced mixed readings that underscore broader European stagnation.

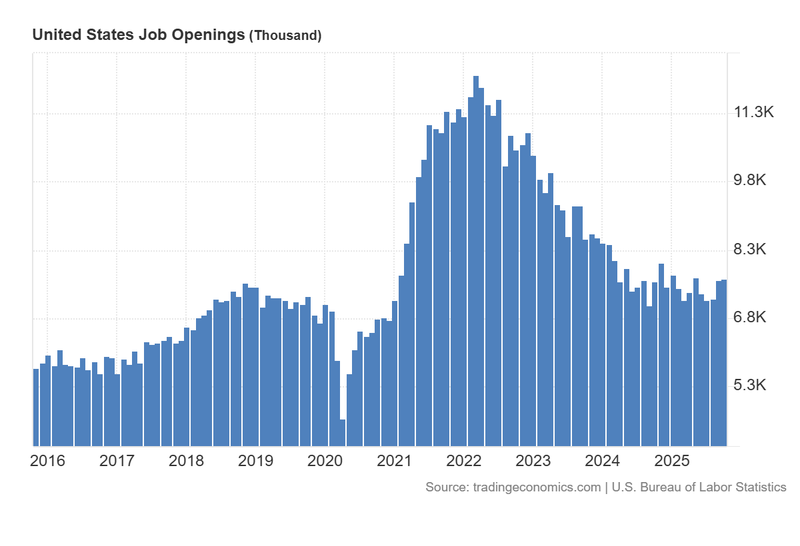

US job openings rose to 7.67 million in October, suggesting some resilience in the labour market despite recent weakness elsewhere.

Market-implied odds of a 25 basis-point Fed cut remain close to 87 per cent, leaving investors uneasy ahead of the FOMC decision.

The RBA left rates unchanged at 3.6 per cent and indicated it is unlikely to pursue additional cuts in the near term.

Germany recorded modest export growth (+0.1% MoM) but a sharp fall in imports (-1.2% MoM), a mixed signal for euro-area momentum.

The JOLTs report shows an improvement in September-October

The US Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey (JOLTS) recorded a rise in vacancies, with the headline series climbing to 7.67 million in October. The uplift—which follows a weaker patch in recent months—was concentrated in trade, transportation and utilities, while professional and business services, the federal government, and leisure & hospitality posted declines.

The JOLTs bounce contrasts with the most recent ADP private-payrolls reading, which registered a contraction, highlighting a mixed employment picture. Despite the improvement in vacancies, market pricing for a 25bp cut at the Fed’s next meeting has not meaningfully altered and remains close to 87 per cent (CME Group FedWatch), reflecting the market’s continued expectation that the Fed will prioritise signs of labour-market softening when setting policy.

Market reaction to the data was mixed: the S&P 500 and Dow Jones slipped modestly (c. 0.09% and 0.38% respectively), while the Nasdaq-100 and the dollar index (DXY) ticked up 0.16% and 0.14%. Ten-year Treasury yields rose by two basis points to 4.19%, indicating slightly firmer rate expectations.

Figure 1. United States job openings (2016–2025). Source: BLS; figure obtained from Trading Economics.

RBA holds rates at 3.6%, signals limited scope for further cuts

The Reserve Bank of Australia elected to maintain its interest rate at 3.6 per cent, in line with consensus. In its statement and subsequent press remarks, Governor Michele Bullock emphasised the bank’s caution about prematurely easing policy and noted the risk that inflation could reassert if conditions soften too rapidly.

The RBA’s tone—effectively ruling out an imminent sequence of rate reductions—supported the Australian dollar, which rose about 0.33 per cent to 0.6640 against the US dollar on the day. The decision underscores a divergence between some major central banks that are contemplating cuts and others that remain vigilant against an inflation rebound.

German external trade prints mixed; balance widens slightly

Germany’s Federal Statistical Office reported exports up 0.1 per cent month-on-month in October (better than consensus of -0.2%) while imports fell 1.2 per cent, leaving the trade surplus at €16.9 billion (up from €15.3 billion).

Trading Economics highlights that exports to the UK, China and the US eased—partly reflecting tariff and demand dynamics—while imports from China, the US, the UK and Russia declined. The readings come against a backdrop of stagnating GDP (Q3 growth at 0.0 per cent) and elevated unemployment (6.3 per cent), pointing to continued headwinds for Europe’s largest economy.

The euro traded slightly softer in response, slipping about 0.10 per cent to 1.1626 against the dollar as markets weighed the mixed trade picture alongside global monetary policy uncertainty.