Palantir at record high as US markets show mixed performance

The Nasdaq outperformed other US indices after Palantir Technologies reported stronger-than-expected third-quarter results and raised guidance for Q4 2025 on robust AI demand. By contrast, the Dow underperformed amid a soft ISM manufacturing PMI, which extended the sector’s run of contraction to eight months.

Palantir rose to a record close after beating Q3 revenue and EPS forecasts and upgrading Q4 2025 guidance on AI-related strength.

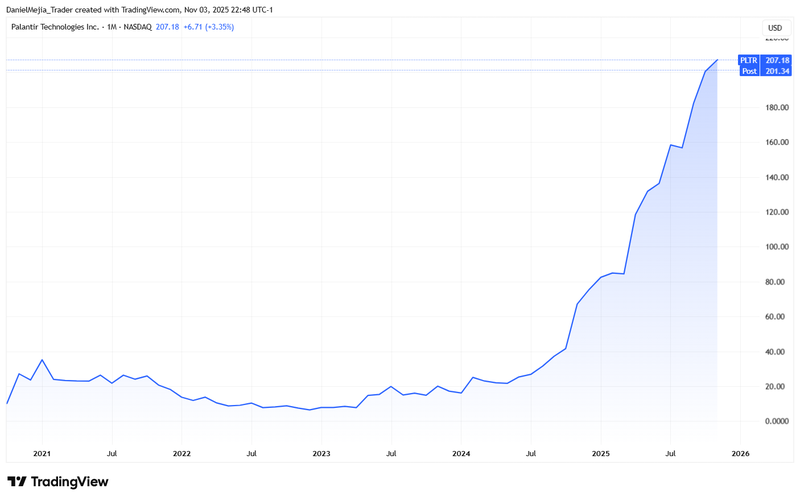

Palantir’s shares are up c. 163 per cent year-to-date; the company’s valuation metrics remain elevated.

The ISM manufacturing PMI printed 48.7, below expectations and signalling continued contraction in US manufacturing.

Major US indices finished mixed: the S&P 500 and Nasdaq-100 advanced modestly while the Dow Jones closed lower.

Ether declined c. 7.6 per cent following reports of a c. $100 million hack, and Bitcoin fell c. 3.5 per cent on correlated selling.

Palantir posts an upside surprise; valuation questions persist

Palantir Technologies closed at a record US$207.18, up c. 3.35 per cent, after reporting third-quarter revenue of US$1.18 billion versus consensus of US$1.09 billion — roughly a 63 per cent year-on-year increase. Adjusted earnings per share were US$0.21, ahead of an expected US$0.17, representing a year-on-year rise of about 110 per cent. The company also raised its Q4 2025 revenue guidance to US$1.33 billion, above analysts’ forecasts of US$1.19 billion, citing continued strength in its AI business and ongoing contract wins, including government programmes despite the current federal funding lapse.

Palantir’s rapid growth has supported a substantial re-rating: the company’s market capitalisation stands around US$491.50 billion and year-to-date share performance is approximately +163 per cent. Nevertheless, valuation multiples remain aggressive — in Q2 2025 the price-to-earnings ratio was c. 453x and the price-to-book ratio c. 54x — inviting scrutiny from sceptical market participants concerned about long-term sustainability if free cash flow does not scale commensurately with revenue.

Equity-market breadth was uneven: the S&P 500 closed up 0.17 per cent at 6,851, the Nasdaq-100 gained 0.44 per cent to 25,972, while the Dow Jones fell 0.48 per cent to 47,336.

Figure 1. Palantir stock prices: historical overview (2021-2025). Source: data from the Nasdaq Exchange. Figure obtained from TradingView.

ISM manufacturing PMI signals persistent contraction

The Institute for Supply Management reported a manufacturing PMI reading of 48.7, missing expectations of 49.5 and falling from the prior month’s 49.1. The print indicates continued contraction in the sector (sub-50), driven by declines in production and inventories; employment and supplier-delivery measures also softened. The manufacturing PMI has now been below 50 for eight consecutive months since March 2025, a stretch that market observers have linked to tariff measures and broader trade frictions that have weighed on industrial demand and supply-chain dynamics.

The sector’s weakness was reflected in the underperformance of industrial-heavy indices, contributing to the Dow’s relative decline versus the tech-led gains in the Nasdaq.

Crypto markets retreat after reported multimillion-dollar hack

CNBC reported a suspected hack affecting a protocol on the Ethereum network that may have resulted in losses of roughly US$100 million. Ether fell c. 7.6 per cent to close near US$3,600. Given the high correlation across major cryptocurrencies, Bitcoin also traded lower, down c. 3.47 per cent to approximately US$106,500. The episode highlights persistent operational and security risks in decentralised finance infrastructure and contributed to a c. 27 per cent decline in Ether from recent peaks, while Bitcoin has retraced c. 15 per cent over the same period.

Wall Street's third-quarter reporting (week overview)

This week is particularly significant due to the large number of U.S. companies reporting their third-quarter financial results. Some of the most notable firms, both in terms of market capitalization and public interest, include the following:

Monday

- Palantir (PLTR)

Tuesday

- Advanced Micro Devices (AMD)

- Shopify (SHOP)

- Amgen (AMGN)

- Pfizer (PFE)

Wednesday

- McDonald’s (MCD)

- Qualcomm (QCOM)

Thursday

- AztraZeneca (AZN)

- Airbnb (ABNB)

Key economic events this week

Monday

- US: ISM Manufacturing PMI

Tuesday

- Australia: RBA Interest Rate Decision

- US: JOLTs Job Openings

Wednesday

- US: ISM Services PMI

- US: ADP Employment Change

- Australia: Balance of Trade

Thursday

- United Kingdom: BoE Interest Rate Decision

- Canada: Ivey PMI

- Mexico: Banxico Interest Rate Decision

Friday

- China: Balance of Trade

- China: Exports

- China: Imports

- Germany: Balance of Trade

- US: Non Farm Payrolls

- US: Unemployment Rate

- US: Michigan Consumer Sentiment

If you're interested in trading indices, foreign exchange, shares, or commodities, consider exploring the CFD contracts offered by Equiti Group. Please note that trading leveraged derivatives involves a high level of risk and may not be suitable for all investors.