Risk-on tone builds in Asia as December Fed cut bets firm

Dovish Fed pricing kept risk assets bid in Asia, powering NZD and AUD while the yen stayed soft despite chatter of a near-term BoJ move. Focus now swings to the UK Autumn Budget.

Kiwi jumps after a hawkishly framed RBNZ cut

Aussie firms as inflation tops forecasts, pushing RBA easing into 2026

Yen underperforms despite talk of a December–January BoJ hike window

UK Budget risk looms; gilts are the confidence barometer

Asia session: Risk appetite extends, dollar soft at the margins

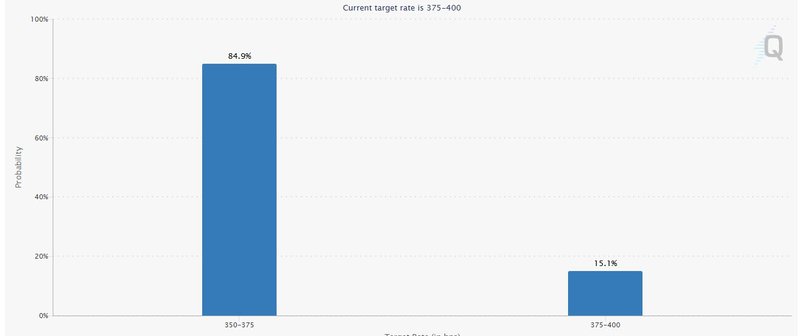

A constructive tone from intensifying bets on a December Fed cut pushed U.S. equities higher overnight and briefly knocked the 10-year Treasury yield below 4%. In Asia, NZD and AUD outperformed; JPY stayed heavy. Index moves were broadly positive (Nikkei, Hang Seng, and Shanghai all higher), with U.S. futures steady after a solid close. Markets are pricing roughly an 85% chance of a December Fed rate cut, implying a move from the 3.75%–4.00% range down to 3.50%–3.75%.

Source: CME Group

New Zealand: RBNZ trims 25 bps but shuts the door on a deeper easing cycle

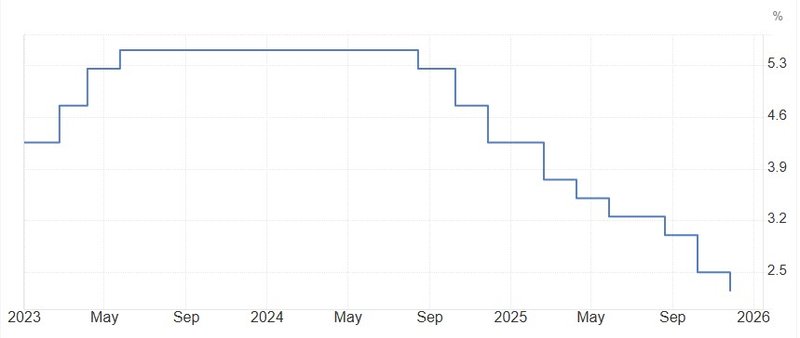

The RBNZ lowered the OCR by 25 bps to 2.25% but paired it with firm guidance. The decision (5–1, one hold dissent) signaled limited appetite for further cuts: projections show the OCR troughing near 2.2% through 2026 and edging to ~2.7% by end-2027. The statement noted activity is stabilizing, weaker NZD is supporting exporters, and inflation risks look more balanced—language that effectively frames yesterday’s move as the cycle’s endpoint absent a negative shock. NZD rallied on the “cut-and-done” message.

Source: TradingEconomics

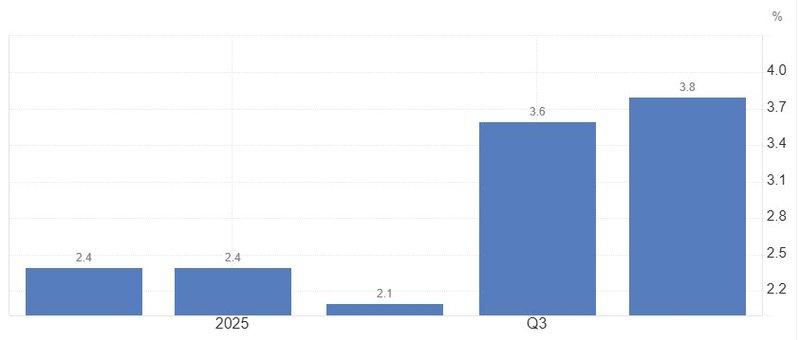

Australia: Inflation re-accelerates, extending RBA patience

Australia’s monthly CPI quickened to 3.8% y/y in October (trimmed mean 3.3%), with both goods and services prices firming. Housing led gains (5.9%), followed by food/non-alcoholic beverages and recreation/culture. The upside surprise nudges markets to push any RBA rate cut further into 2026 and offered AUD a tailwind.

Source: TradingEconomics

Japan: Yen stays soggy despite BoJ chatter

Reports that officials are preparing markets for a possible December move—after high-level political consultations—left traders unconvinced. A close call between a December hike and a January delay keeps timing uncertain; sensitivity to the Fed’s decision one week earlier adds another layer. For now, JPY softness reflects skepticism that near-term policy traction will materialize.

Source: TradingView

UK Autumn Budget: Credibility test ahead

Conflicting pre-briefing on tax settings leaves an unusually wide distribution of outcomes. Gilts will be the cleanest read on confidence in the fiscal stance; sterling is likely to move inversely with gilt yields—this is a trust test, not yield-seeking.