Silver and gold reach record prices simultaneously

Silver and gold futures reached new all-time highs as investors sought safe havens amid geopolitical and economic uncertainty and in anticipation of monetary easing by the Federal Reserve.

Gold and silver contracts hit new all-time highs as investors seek refuge and anticipate Federal Reserve easing. Year-to-date returns: gold ~57%, silver ~70%.

Q3 reporting season began strongly; several major banks reported revenue and earnings per share above estimates.

UK unemployment rose to 4.8%, exceeding forecasts and marking the highest rate since July 2021.

Fed Chair indicated that quantitative tightening could come to an end in the coming months, subject to economic and financial conditions.

Silver and gold contracts hit new all-time highs

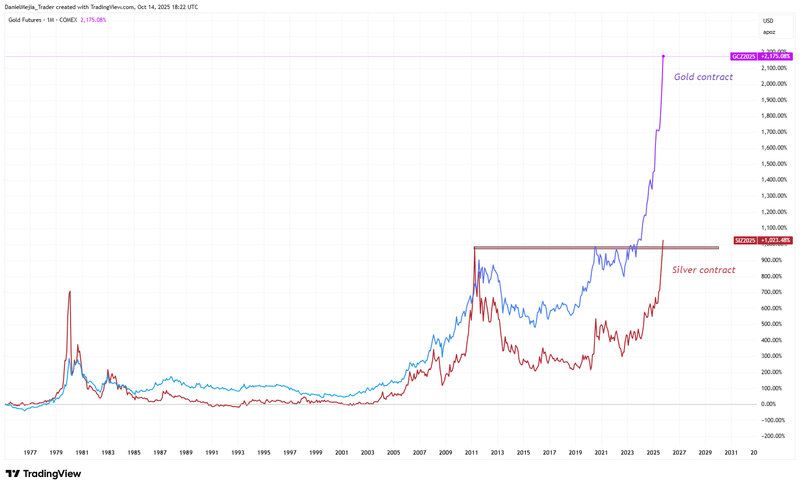

Silver and gold futures reached record levels as investors continued to seek safe assets in response to heightened economic, geopolitical and trade uncertainty. COMEX’s gold contract (GCZ5) reached $4,150 per ounce, representing a year-to-date return of approximately 57%. COMEX’s silver contract (SIZ5) surpassed $50 per ounce, a level not seen since the price surge in May 2011. The price of silver accumulates a year-to-date gain of roughly 70%.

The principal drivers behind the rise in precious-metal prices include the ongoing demand for safe havens, expectations of monetary easing by the Federal Reserve, and steady purchases by central banks and gold-linked ETFs. In his address to the National Association for Business Economics annual meeting, Fed Chair Jerome Powell said that the outlook for inflation and employment “does not seem to have changed since its last meeting”; subsequently, the implied probability of a 25-basis-point interest-rate cut rose to 96% according to CME Group’s FedWatch tool.

Figure 1. Price of gold and silver contracts, historical behavior (1977-2025). Source: data from COMEX Exchange. Own analysis conducted via TradingView.

Equity markets mixed after strong bank results

The US third-quarter reporting season opened on a positive note, with several large banks reporting results above analysts’ expectations. JPMorgan, Wells Fargo, Goldman Sachs, BlackRock and Citigroup all reported revenues and earnings per share that exceeded consensus estimates. JPMorgan Chase also raised its full-year forecast for net interest revenue.

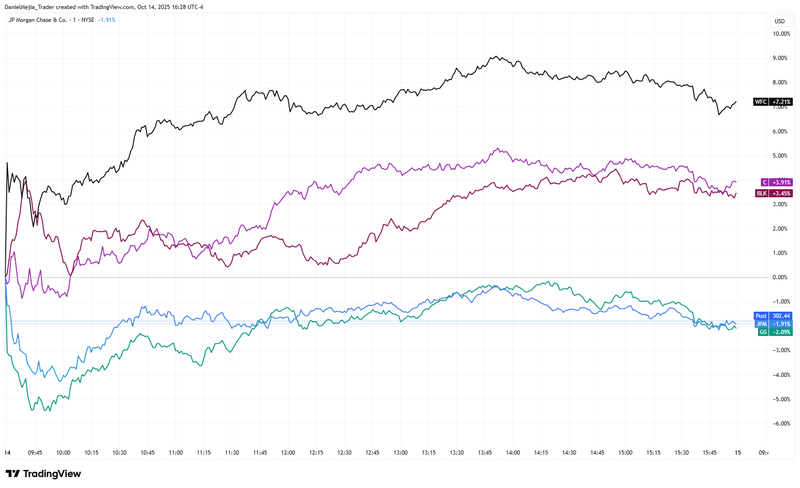

Market responses at the close were mixed. Wells Fargo closed up 7.21% at $84.56 per share, Citigroup rose 3.91% to $99.84, and BlackRock gained about 3.45% to $1,194.26. By contrast, JPMorgan fell 1.91% to $302.14, while Goldman Sachs declined 2.09% to $770.74 per share.

Figure 2. Today’s market performance of JPMorgan, Wells Fargo, Goldman Sachs, BlackRock and Citigroup. Source: data from NYSE Exchange. Own analysis conducted via TradingView.

Broader US indices registered mixed returns as strong corporate results were counterbalanced by geopolitical and trade concerns. Remarks by former President Donald Trump indicating that the White House is considering ending certain trade ties with China contributed to risk-off sentiment. The Dow Jones closed up 0.44%, while the S&P 500 and Nasdaq-100 fell 0.16% and 0.69%, respectively.

UK unemployment rate continues to rise

Data from the United Kingdom’s Office for National Statistics showed the unemployment rate unexpectedly rose to 4.8%, above forecasts and the highest level since July 2021. The reading represents an increase from the prior figure of 4.7% and continues an upward trend in unemployment that began after the low of 3.6% recorded in August 2022.

In response, sterling depreciated by approximately 0.13% against the US dollar.

Figure 3. United Kingdom Unemployment Rate (2022-2025). Source: data from the Office for National Statistics. Figure obtained from Trading Economics.

Jerome Powell signals potential end to balance-sheet reduction

According to information from Reuters, at the National Association for Business Economics annual meeting, Fed Chair Jerome Powell indicated that the Federal Reserve could cease reducing the size of its securities holdings—commonly referred to as quantitative tightening—in the coming months, although he did not provide a detailed timetable.

He emphasised the Fed’s objective of preserving financial stability in the Treasury and broader fixed-income markets. FOMC members will continue to evaluate incoming economic and financial data to determine the appropriate course of action that supports market stability; Powell’s remarks were deliberately cautious and omitted precise operational details.