Silver falls as China export curbs and Dollar strength weigh on metals

Silver and gold both corrected yesterday after strong rallies, with silver suffering its largest one-day drop in years. China’s new export restrictions added supply concerns for silver, while a firmer U.S. dollar reduced demand for dollar-priced metals. Traders also booked profits ahead of year-end, amplifying volatility. Gold, although less volatile than silver, retraced some of its recent gains as investors reassessed positions across precious metals.

Silver Sharp profit-taking after record highs and technical selling.

Gold Moderate pullback as investors adjusted positions amid broader metals volatility.

Dollar strength pressured metals, while China’s export rules added supply concerns for silver.

Silver profit-taking

Silver surged above $84 per ounce earlier in the week, driven by tight supply expectations and strong industrial demand in the electronics and solar sectors. Yesterday, silver fell by 16% due to speculative positions reaching extreme levels, triggering a massive unwinding of leveraged futures contracts. Exchanges such as CME raised margin requirements on silver contracts, forcing traders to reduce positions, which accelerated the sell-off. China’s new export rules, effective January 1, 2026, require licenses for silver exports, favoring large, certified producers. Although this policy was not the direct cause of yesterday’s decline, it contributed to the earlier optimism that is now unwinding. Export restrictions may further tighten physical supply, keeping medium-term prices elevated even as the market digests a short-term correction. Major silver miners and ETFs also experienced declines. Speculative appetite in China added an additional layer of volatility; high purchase volumes in Shanghai Silver Exchange contracts pushed premiums to record levels, prompting China’s only specialized silver fund to restrict new investor entries after repeated warnings about price risks. Large institutional investors trimmed positions to lock in profits, highlighting how speculative positioning interacts with economic and policy factors to create rapid price swings.

Source: Trading View

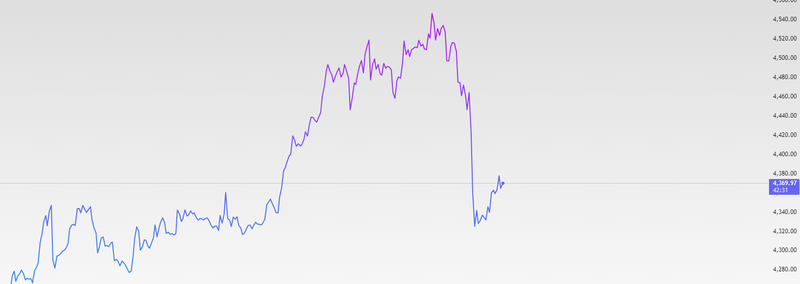

Gold pullback and drivers

Gold retraced 5% from recent high $4,574 per ounce, marking its first notable correction after a sustained rally. The decline was largely driven by institutional repositioning, as large ETFs and fund managers adjusted holdings to lock in profits. Year-end liquidity needs also prompted investors to free up capital, contributing to temporary selling pressure across the market. Rising real yields in the U.S. added another layer of pressure. While nominal interest rates have remained relatively stable, real yields, which account for inflation expectations, moved higher in recent sessions. Higher real yields increase the opportunity cost of holding non-yielding assets like gold, making bonds more attractive to investors in the short term. This dynamic helps explain why gold, despite strong fundamentals, softened alongside silver and other risk-sensitive assets. On the demand side, gold remains structurally supported. Central banks, particularly in Asia and the Middle East, continue to accumulate gold to diversify reserves and hedge against geopolitical and currency risks. In particular, countries such as India, China, and the United Arab Emirates have been increasing official purchases through both bullion and allocated reserves, maintaining underlying demand even during short-term corrections.

Source: Trading View

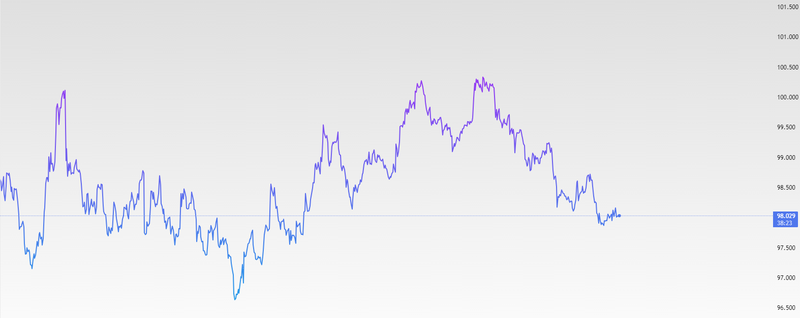

U.S. Dollar strength and its impact

The U.S. dollar has been relatively stable but remains a focal point for markets as the year ends, trading near 98.00 on the dollar index ahead of the release of the Federal Reserve’s December meeting minutes later today. Currency markets are subdued with thin liquidity due to the holiday period, but the dollar’s behaviour continues to influence precious metals and other risk assets. The dollar has had a challenging 2025, facing a nearly 10% annual decline, it’s steepest in eight years, driven by expectations of future Fed rate cuts, shrinking interest rate differentials with other major economies, and broader fiscal and political uncertainty in the U.S. This weakness has supported currencies like the euro and British pound, both reaching multi‑year highs against the greenback. Against this backdrop, the dollar’s modest stability yesterday helped exacerbate selling pressure on dollar‑priced commodities, including silver and gold. A firming or stable dollar increases the cost of these metals for holders of other currencies, reducing demand and encouraging profit‑taking in markets already stretched from recent rallies. Silver, which is more leveraged and industrially sensitive, saw sharper moves, while gold showed slightly more resilience, partly due to safe‑haven demand returning in thin markets. Market attention today is firmly on the Fed minutes from the December policy meeting. Analysts expect these minutes to reveal a split among policymakers on the outlook for 2026, with some members cautious about the pace of future rate cuts and others open to further easing amid slowing inflation and growth data. This internal debate matters because it shapes expectations for the Fed’s next moves and in turn affects the dollar’s direction.

Source: Trading View