Silver tops $100 amid global geopolitical turmoil; oil prices rise

Silver futures have breached the historic $100 threshold, while gold nears the significant $5,000 psychological milestone. These unprecedented levels reflect an accelerating flight to safety as investors navigate escalating global geopolitical tensions. Simultaneously, the primary crude oil benchmarks, Brent and WTI, advanced following heightening friction between the United States and Iran.

The silver futures contract climbed 5.40%, surpassing $100 per ounce, as gold appreciated by 1.25% to approach the $5,000 mark, driven by robust safe-haven demand.

Brent and WTI rose by approximately 2.47% and 2.46% respectively, following US President Trump’s announcement of new sanctions on Iranian oil vessels and potential military maneuvers.

The BoJ held interest rates steady at 0.75%, since a significant deceleration in domestic inflation during December.

UK retail sales volumes increased by 0.4% month-on-month (MoM), while S&P Global PMIs outperformed consensus forecasts, bolstering the British pound.

Silver futures surpass $100 as gold approaches $5,000 amid flight to safety

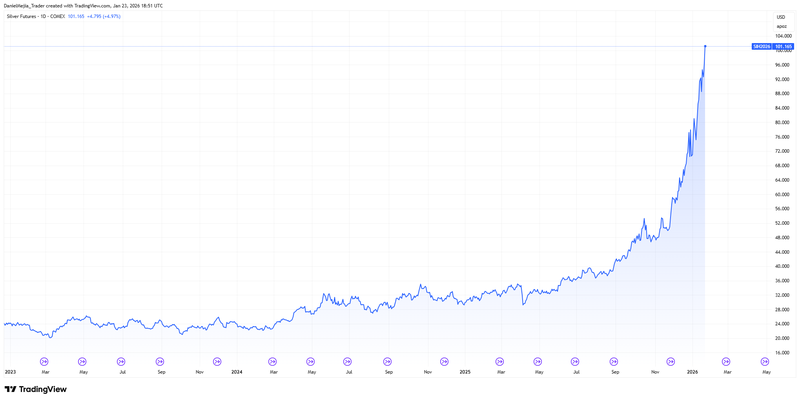

For the first time in history, the silver futures contract (SIH26) has exceeded $100 per ounce. Prices surged by 5.40% during the session to reach $101.60. Concurrently, the gold futures contract (GCG26) appreciated by 1.25%, trading at $4,974 per ounce—perilously close to the $5,000 psychological barrier. These historic milestones are the result of sustained capital allocation toward defensive assets by market participants seeking refuge from systemic uncertainty.

The rally in silver is underpinned by a confluence of factors, including its dual role as a safe-haven asset and a critical industrial component in the jewellery, electronics, and solar energy sectors. Additionally, the metal’s high correlation with gold has intensified its upward trajectory.

However, market analysts have noted that speculative activity may be exacerbating these price movements, raising concerns regarding potential short-term volatility. According to reports from Reuters, industry specialists suggest that current valuations appear overextended relative to global inventory capacity. They argue that a significant portion of the price appreciation stems from substantial inflows into physical exchange-traded funds (ETFs), largely driven by heightened retail investor interest.

Figure 1. Silver futures contract SIH26 (2023-2026). Source: Data from the COMEX Exchange; Figure obtained from TradingView.

Oil prices rebound sharply following US geopolitical pressures on Iran

The primary oil benchmarks, Brent and WTI, recorded significant gains amid deteriorating diplomatic relations between Washington and Tehran. Reuters reports that the US President Donald Trump has introduced fresh sanctions targeting vessels involved in the transport of Iranian crude. Furthermore, the President Trump indicated that a naval “armada” has been deployed to the region, heightening fears of a potential military confrontation.

Supporting these remarks, US officials declared that warships are expected to arrive in the Middle East in the coming days. Consequently, energy traders are pricing in a higher risk premium due to the potential for supply chain disruptions. The Brent futures contract rose by 2.47% to approximately $65.98 per barrel—its highest level in three months—while WTI increased by 2.46% to $61.15 per barrel.

Japanese inflation decelerates as BoJ maintains interest rates unchanged

Data from Japan’s Ministry of Internal Affairs and Communications reveals that the year-on-year (YoY) inflation rate slowed significantly, falling from 2.9% in November to 2.1% in December—the lowest level recorded since April 2022. Core inflation, which strips out volatile food and energy costs, also decelerated from 3.0% to 2.4%. Although these figures remain above the Bank of Japan’s (BoJ) 2% target, the prominent downward trend prompted the central bank to maintain its interest rates at 0.75%, in line with market expectations.

The Japanese yen responded with a notable appreciation of 1.65% against the US dollar, reaching 155.78. Investors are increasingly speculating on a potential BoJ intervention to support the currency, which has depreciated by roughly 9% since May 2025. Meanwhile, the Nikkei 225 equity index closed 0.29% higher at 53,846 points.

UK economic data exceeds forecasts; sterling gains momentum

According to the Office for National Statistics (ONS), UK retail sales volumes rose by 0.4% in December, contrasting sharply with the previous month’s decline of 0.1% and defying analyst expectations of a further 0.1% contraction. On a YoY basis, sales growth accelerated to 2.5%, representing the strongest performance since May 2025.

Complementing this data, the S&P Global UK Services PMI rose from 51.4 to 54.3 points, significantly outstripping the forecast of 51.7. The manufacturing PMI also improved, climbing from 50.6 to 51.6 points. Driven by this sequence of positive economic indicators, the British pound appreciated by 1.06% against the US dollar, trading at 1.3638.