Supply fears lift oil; US, China PMIs decline

Brent and WTI futures rose modestly as supply concerns stemming from geopolitical incidents in Russia and Venezuela offset OPEC+’s decision to maintain its first-quarter 2026 production target. At the same time, recent purchasing-managers’ indices signalled cooling manufacturing activity in both China and the United States, adding to the sense of a fragile global demand backdrop.

Brent and WTI rose c. 1.4–1.5 per cent as market participants weighed potential disruptions to Russian and Venezuelan flows against OPEC+’s decision to keep output targets steady into Q1-2026.

A Ukrainian drone attack on a Russian fleet and the US closure of Venezuelan airspace heightened short-term supply risk, supporting near-term crude prices.

China’s manufacturing PMI (S&P Global) slipped below the 50 threshold to 49.9, while the official NBS manufacturing PMI stood at c. 49.2, both consistent with contractionary conditions.

The ISM manufacturing PMI for the United States fell to 48.2, below expectations, and helped to drag US equities and the dollar modestly lower.

Oil: supply disruptions versus OPEC+ policy

Brent and WTI futures climbed after a combination of supply-related headlines and policy developments. Brent (BRNG6) rallied by about 1.44 per cent to US$63.27 per barrel, while WTI (CLF6) gained roughly 1.52 per cent to US$59.44 per barrel.

Two immediate supply concerns supported the move. First, Ukrainian forces reportedly struck a Russian fleet with drones, disrupting elements of Russia’s export infrastructure. Second, the United States’ temporary closure of Venezuelan airspace has complicated logistics for a country that remains a material exporter despite sanctions. Taken together, these incidents increased the perceived short-term geopolitical risk premium.

Counterbalancing those upside pressures, OPEC+ elected to maintain its production target for Q1-2026 at its most recent meeting. The group’s intent to avoid abrupt changes to output was designed to smooth expectations and limit price volatility, but market participants are nevertheless balancing the risk of intermittent supply shocks against the possibility of rising OPEC+ production.

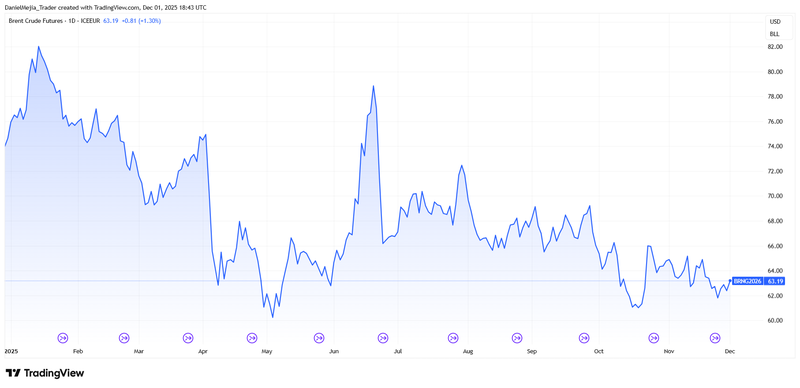

Despite the intraday gains, the year-to-date picture for Brent remains weak: the contract is down materially since the start of the year (c. 17 per cent YTD), reflecting a mix of demand concerns — notably for China and the United States — and recurring debate about potential OPEC+ supply increases.

Figure 1. Brent futures contract (year-to-date). Source: ICE-EUR; analysis via TradingView.

China: manufacturing PMI slips below 50

S&P Global’s China general manufacturing PMI edged down to 49.9 from 50.6, below the neutral 50.0 threshold and under consensus forecasts. The official National Bureau of Statistics (NBS) manufacturing PMI also signalled contraction, at c. 49.2 in the most recent print. These surveys point to weakness in new orders and export demand, while employment and supplier-delivery subcomponents also showed strain.

Although there have been occasional signs of stabilisation — for example, headline CPI returned to modest positive territory in October (around +0.2 per cent year-on-year) — domestic consumption remains subdued and trade tensions have weighed on external demand. The PMI readings therefore reinforce concerns that China’s near-term industrial recovery remains fragile.

United States: ISM manufacturing disappoints

The Institute for Supply Management’s manufacturing PMI for the United States fell from 48.7 to 48.2, missing the consensus of c. 48.6 and representing continued contraction (any reading below 50 denotes contraction). The components that contributed most to the decline included new orders, supplier deliveries and employment, while production registered a modest increase.

The soft ISM print had a measurable impact on asset prices: the US dollar index eased slightly (c. 0.07 per cent) and major US equities — the S&P 500, Nasdaq-100 and Dow Jones — collectively fell by roughly 0.6 per cent on average as investors digested the weaker activity signal.

Key economic events this week

Monday

- China: Manufacturing PMI

- US: ISM Manufacturing PMI

Tuesday

- Japan: Consumer Confidence

- European Union: Inflation Rate

Wednesday

- Australia: GDP Growth Rate

- US: ISM Services PMI

- US: EIA Crude Oil Inventories

Thursday

- Australia: Balance of Trade

- Canada: Ivey PMI

- US: Initial Jobless Claims

Friday

- Canada: Unemployment Rate

- US: Core PCE Price Index

- US: Michigan Consumer Sentiment

- US: Personal Spending