US employment data exhibit mixed results; stock markets rise

Non-farm payrolls decelerated in December while the unemployment rate decreased slightly. These mixed results in the US labour market bolster the Federal Reserve’s rationale for maintaining a neutral-to-restrictive stance, as the central bank may seek to exert prolonged downward pressure on prices through unchanged rates. Concurrently, the Chinese inflation rate accelerated marginally, and oil prices closed with gains amid heightened geopolitical uncertainty involving the US and Latin American.

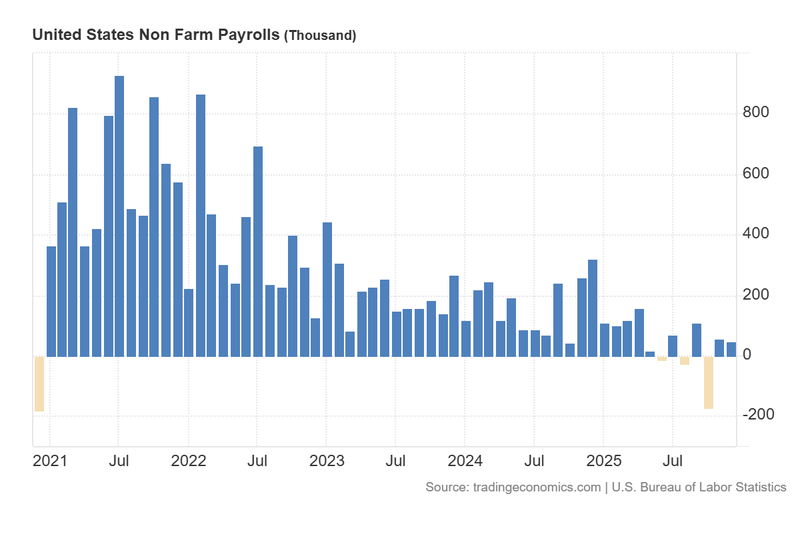

Non-farm payrolls (NFP) added 50,000 new positions in December, while the unemployment rate fell to 4.4%.

CME Group’s FedWatch tool remained unchanged, with market pricing still discounting two 25-basis-point cuts in 2026, beginning in June.

Chinese inflation rose to 0.8%, its highest level since March 2023; however, domestic consumption remains subdued as the government prepares fiscal and financial stimulus.

Oil prices appreciated by over 2% amid geopolitical tensions between the US and Latin American countries—specifically Mexico.

NFP decelerates as unemployment rate falls; US equity markets rise

According to data from the Bureau of Labour Statistics, non-farm payrolls (NFP) slowed from 56,000 new positions in November to 50,000 in December, falling short of analysts' expectations for a 60,000-position increase. Conversely, the national unemployment rate fell slightly from 4.5% to 4.4%. This contraction in unemployment contrasts with the softening NFP data, providing the Federal Reserve with justification to maintain its current restrictive policy.

Consequently, the CME Group's FedWatch remained stable, as the consensus continues to estimate two 25-basis-point cuts for the current year, with the inaugural cut projected for the June meeting. While employment data continues to exhibit underlying weakness when viewed holistically, the December report reflects a nuanced landscape where month-on-month variations remain relatively marginal.

Furthermore, several members of the Federal Open Market Committee (FOMC) have issued statements indicating that inflation remains stubbornly high. The support provided by a lower unemployment rate offers the Fed greater leeway to pursue price cooling while labour market levels remain ostensibly controlled.

Although interest rate forecasts remained largely static, the primary stock indices rose in tandem. The S&P 500 closed up 0.65% at 6,966 points—marking a new all-time high. The Dow Jones Industrial Average rose 0.48% to 49,504, nearing its previous record, while the Nasdaq-100 climbed 1.02% to 25,766 points.

Parallel to these moves, the US Dollar Index (DXY) appreciated 0.30% to 99.13, and 10-year Treasury yields edged higher to close at 4.17%. In both instances, market participants appear to be pricing in a Federal Reserve that will sustain a "higher for longer" stance through at least the first half of 2026.

Figure 1. US Non-Farm Payrolls (2021-2025). Source: Bureau of Labour Statistics; Figure via Trading Economics.

Chinese inflation increases, yet remains below expectations

Data from China's National Bureau of Statistics reveals that year-on-year inflation accelerated slightly from 0.7% in November to 0.8% in December, marginally improving the outlook for domestic consumption. However, this acceleration fell short of the 0.9% forecast anticipated by analysts. Despite missing estimates, the figure represents the highest inflationary level since March 2023.

The result may be interpreted positively for the Chinese economy, as price levels move further away from deflationary territory, thereby boosting domestic demand expectations. According to Trading Economics, the sectors experiencing the most significant price acceleration were food, healthcare, and education.

In addition to the inflation data, state broadcaster CCTV—as reported by Reuters—indicated that the Chinese cabinet convened to discuss the implementation of fiscal and financial incentives aimed at stimulating domestic demand. The government's objectives focus on reinvigorating private capital investment, particularly directed toward small and medium-sized enterprises (SMEs) and domestic consumption.

In response, the FTSE China A50 index appreciated 0.28% to 15,519 points, while the Hang Seng index rose 0.64% to 26,408 points.

Oil prices advance amid tensions between the US and Latin America

The Brent and WTI crude benchmarks rose simultaneously as geopolitical frictions intensified between the United States and Latin American nations. On one hand, US intervention in Venezuelan internal politics has generated global uncertainty regarding adherence to international norms. On the other hand, the President Donald Trump declared that the US could potentially target "narcoterrorism" in Mexico via ground operations. These comments have heightened concerns regarding the sovereignty of Latin American states.

Additionally, diplomatic relations between the US and European nations—specifically Denmark and NATO members—remain strained due to the ongoing dispute over Greenland. Reports indicate that the US President Donald Trump and Danish Prime Minister Mette Frederiksen are scheduled to meet next week to address the issue.

While these frictions do not yet directly impact oil supply chains, the prevailing geopolitical risk sentiment drove energy prices higher at the close. The Brent futures contract (BRNH26) rose by 2.18% to $63.34 per barrel, while the WTI futures contract (CLG26) appreciated by 2.35% to reach $59.12 per barrel.