US jobless claims fall, but easing outlook stays unchanged

Initial US jobless claims fell to a three-year low, signalling intermittent strength in the labour market, yet the market’s priced outlook for Federal Reserve easing remains effectively unchanged. Oil and gas markets responded to geopolitical developments and demand expectations. Investors are awaiting upcoming Fed guidance before materially altering policy expectations.

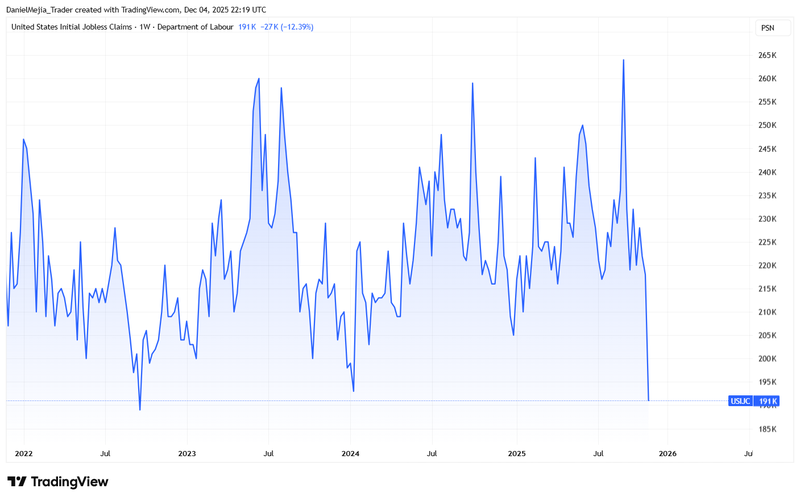

Initial jobless claims fell to 191,000, the lowest weekly reading in three years and well below consensus.

Continuing claims declined to 1.939 million, signalling some stabilisation in ongoing unemployment flows.

Despite the labour-market surprise, the CME Group’s FedWatch probability for a 25 basis-point cut in December remains close to 87 per cent, reflecting continued expectations of eventual easing.

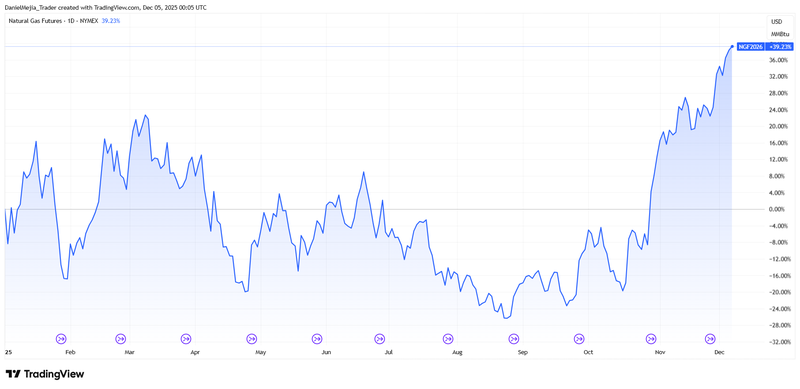

Brent and WTI ticked higher amid renewed supply-risk concerns linked to Russia–Ukraine and rising tensions with Venezuela; natural gas has surged strongly year-to-date and over the last quarter.

Initial jobless claims drop to a three-year low

According to the US Department of Labor, weekly initial jobless claims fell to 191,000, down from 218,000 and below the consensus of 220,000. Continuing claims—those receiving ongoing benefits—also edged down to 1.939 million from 1.943 million.

The print offers a tentative sign of resilience in the labour market, notwithstanding broader structural strains. Reduced immigration flows and job displacement linked to automation and AI — especially in certain technology subsectors — continue to be cited as medium-term headwinds, while smaller firms appear particularly cautious about hiring amid macroeconomic uncertainty.

Crucially, market participants remain cautious about over-interpreting a single weekly datapoint. The CME Group’s FedWatch Tool still prices a high probability (around 87 per cent) of a 25 basis-point Fed cut in December, suggesting investors expect the Fed to place greater weight on evolving employment weakness against persistent inflation.

Figure 1. United States initial jobless claims (2022–2025). Source: US Department of Labor; chart via TradingView.

Oil rises on supply concerns and geopolitical friction

Brent and WTI futures rose modestly, by roughly 0.94 per cent and 1.30 per cent respectively, closing near US$63.26 and US$59.68 per barrel. Traders cited renewed supply concerns following renewed tensions in the Russia–Ukraine theatre and an escalation in US–Venezuela relations, both of which could disrupt shipments from sanctioned producers.

Market participants continue to juggle conflicting forces: episodic supply risks that push prices higher versus longer-term oversupply concerns related to OPEC+ production plans and softer global demand, notably from China. In the near term, any tangible disruption to Russian flows or Venezuelan exports is likely to prompt further price sensitivity in oil markets.

Turkey extends Russian gas imports while planning US investment

Reuters reported that Turkey has extended its gas procurement arrangements with Russia while simultaneously exploring infrastructure investments in the United States to diversify energy sources over the medium term. Turkish officials indicated plans for sustained purchases over the next 15 years to US, but signalling continued reliance on Russian supply in the near term even as strategic diversification is pursued.

The natural-gas futures contract (NGF26) on NYMEX closed higher, gaining about 0.61 per cent, and remains a notably strong performer: natural gas prices have risen by approximately 39 per cent year-to-date and by about 65 per cent over the past three months, reflecting tightness in regional markets, weather-driven demand and supply-side concerns.

Figure 2. Natural gas futures (YTD performance). Source: NYMEX; chart via TradingView.