US markets decline amid weak employment signals

US markets lost ground after fresh employment data underscored persistent weakness in the labour market. Non-farm payrolls recorded a sizable deterioration in October and provided only a modest rebound in November; the unemployment rate rose to its highest level since October 2021. Sterling and oil markets also reacted to regional labour and activity data, while investors await forthcoming inflation releases that will inform central-bank policy expectations.

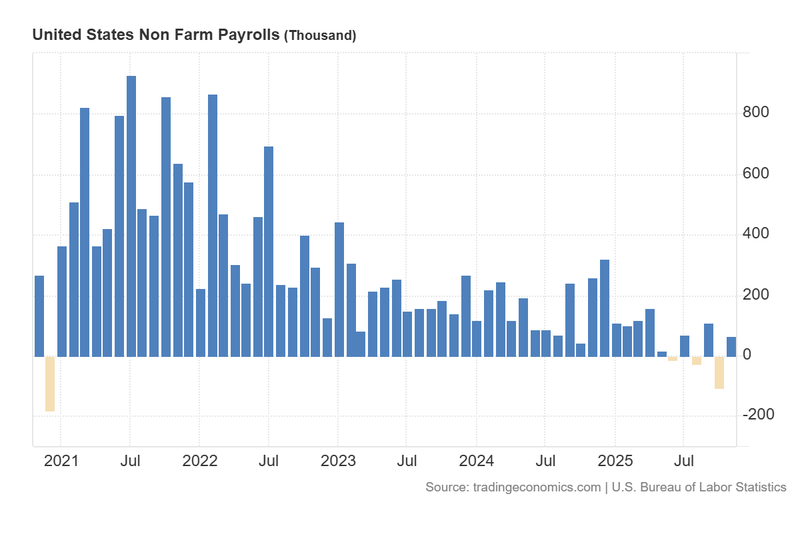

US non-farm payrolls fell by 105,000 in October and then recovered by 64,000 in November; the three-year trend remains negative.

The US unemployment rate climbed to 4.6%, exceeding consensus and above the Fed’s prior outlook for 4.5% in 2025.

UK unemployment edged up to 5.1%, matching analysts’ forecasts and marking the highest reading since April 2021.

Brent and WTI both fell roughly 3%, reaching their lowest levels since March 2021 amid growing concerns about global demand.

Updated US employment data exhibit deeper weakness than expected

The Bureau of Labour Statistics reported a sharp deterioration in US non-farm payrolls (NFP) in October, with a decline of 105,000 positions — the weakest monthly outturn since January 2021. November subsequently showed a modest recovery of 64,000 jobs, marginally ahead of consensus forecasts of 50,000, but the underlying three-year slope in payrolls remains negative.

The unemployment rate rose to 4.6% in November (from 4.4% in September), exceeding analysts’ expectations and surpassing the Federal Reserve’s projection of 4.5% for 2025. This is the highest unemployment rate since October 2021 and signals a notable weakening in the labour market. The October unemployment rate release was delayed and previously unpublished owing to data disruptions from the government shutdown.

Market participants and policymakers attribute the deterioration to several structural and cyclical factors, including tighter immigration policies, increased automation (notably AI-related labour substitution), and fiscal constraints affecting public-sector employment. In response to the softer jobs backdrop, forward-looking measures such as the CME Group’s FedWatch continue to price a higher probability of easing over the coming year, but the Federal Reserve is expected to weigh upcoming inflation reports – scheduled for release on 18 December – before committing to further policy moves.

Market reaction was mixed: the DXY dollar index was essentially unchanged (+0.02% at 98.27), the US 10-year Treasury yield fell by 2 basis points to 4.15%, the S&P 500 declined 0.24% to 6,800, and the Dow Jones eased 0.62% to 48,114. The Nasdaq-100 bucked the trend, rising 0.26% to 25,132, reflecting intra-day rotation between sectors.

Figure 1. United States Non-Farm Payrolls (2021–2025). Source: US Bureau of Labour Statistics; chart via Trading Economics.

UK unemployment edges higher in line with expectations

The Office for National Statistics reported the UK unemployment rate increased slightly to 5.1%, consistent with market expectations. Employment change remained negative, with a marginal improvement from a contraction of 22,000 to 16,000 job losses, but both readings point to ongoing fragility in the labour market.

This deterioration in UK employment complicates the Bank of England’s policy outlook. Although market consensus anticipates a 25 basis-point cut in December (from 4.0% to 3.75%), uncertainty persists: inflation is still materially above target (currently c. 3.6%), while labour-market slack has widened. Sterling strengthened modestly, trading up about 0.37% against the US dollar at 1.3418, as market participants weighed relative macro resilience in UK versus the more impaired US labour picture.

Oil prices retreat to multi-year lows amid demand concerns

Brent and WTI crude fell sharply — approximately 2.7–2.9% — reaching their lowest levels since March 2021. The decline followed the combination of weaker US employment indicators and disappointing Chinese activity data earlier in the week (industrial production and retail sales), raising doubts over near-term global oil demand.

At the close, the Brent futures contract (BRNG26) traded near US$58.90 per barrel (-2.71%) and WTI (CLF26) around US$55.15 per barrel (-2.92%). Given the outsized influence of US and Chinese demand on the oil complex, further downside remains possible should forthcoming macro releases confirm a deeper-than-anticipated slowdown.