US markets slide amid heavy week of economic data

US equity indices retreated as investors positioned ahead of a busy macroeconomic calendar that includes delayed inflation and employment releases. Concerns about elevated valuations in technology stocks added to the caution. Meanwhile, Chinese activity indicators disappointed, underscoring persistent weakness in retail demand and manufacturing momentum.

US markets softened ahead of key data: investors await updated CPI and Nonfarm Payrolls readings that were delayed by the government shutdown.

Tech-sector valuation worries, and scepticism about near-term returns on AI investment, continued to weigh on the Nasdaq.

China’s industrial production and retail sales underperformed consensus, highlighting fragile domestic consumption despite a modest uptick in CPI.

The week’s calendar is dense: major policy decisions and a raft of activity and price data across the US, UK, EU, Japan and Canada will influence market direction.

US markets fall as investors brace for inflation and NFP data

US equity markets declined as the week began, with investors moving to a more cautious stance ahead of several critical releases. Delayed official statistics — notably the consumer-price index and employment reports postponed by recent government disruptions — will be published this week and are expected to shape the Federal Reserve’s policy trajectory.

Concerns about valuation, particularly in technology and AI-exposed companies, added to downside pressure. After a stretch of robust gains, investors have become more selective, rotating out of richly valued growth names when near-term earnings signals look less certain.

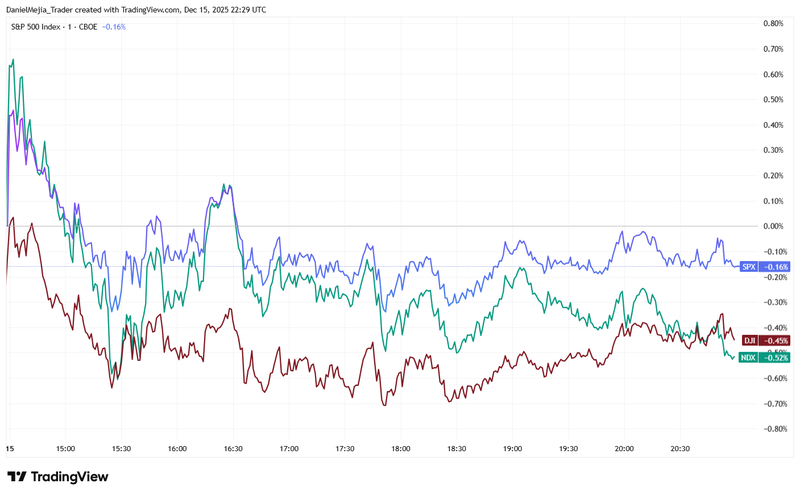

At the close, the major indices recorded modest losses: the S&P 500 fell 0.16 per cent to 6,816, the Dow Jones Industrial Average eased 0.09 per cent to 48,416, and the Nasdaq declined 0.51 per cent to 25,067. Volatility rose modestly as markets awaited the sequence of data releases and central-bank decisions scheduled this week.

Figure 1. S&P 500, Dow Jones and Nasdaq (daily performance). Source: Nasdaq and NYSE; chart via TradingView.

Chinese industrial production and retail sales disappoint

China’s latest activity data signalled ongoing softness. The National Bureau of Statistics reported industrial production slowed marginally to 4.8 per cent year-on-year, below consensus of 5.0 per cent, while retail sales decelerated sharply to +1.3 per cent year-on-year, well under the expected +2.9 per cent and the weakest pace since December 2022.

These readings are notable given that headline CPI recently ticked up to +0.7 per cent year-on-year, prompting some hopes of a nascent consumption recovery. However, the retail-sales detail paints a different picture: several sub-sectors showed pronounced weakness. Trading Economics reports that areas experiencing pronounced declines included household appliances and audio-visual equipment (from -14.6% to -19.4%), materials (-8.3% to -17.0%), and notable softening in categories previously buoyant such as gold, silver and jewellery (from +37.6% to +8.5%).

The data underlines the challenge for policymakers seeking a durable consumption-led recovery. Chinese equity benchmarks reacted negatively: the FTSE China A50 slipped 0.69 per cent to 15,130, while the Hang Seng fell 1.28 per cent to 25,650.

Key economic events this week

Monday

- China: Industrial Production

- China: Retail Sales

- Canada: Inflation Rate

Tuesday

- United Kingdom: Unemployment Rate

- Germany: Manufacturing PMI

- US: Nonfarm Payrolls; Unemployment Rate

- Japan: Balance of Trade

Wednesday

- United Kingdom: Inflation Rate

- US: Retail Sales

Thursday

- United Kingdom: BoE interest-rate decision

- European Union: ECB interest-rate decision

- US: Inflation Rate

- Japan: Inflation Rate

Friday

- Japan: BoJ interest-rate decision

- United Kingdom: Retail Sales

Markets will remain sensitive to the sequencing and composition of these releases; in particular, headline and core inflation metrics, together with payrolls and central-bank commentary, are likely to determine near-term financial-market direction.